Free Ucc 1 Louisiana Template

In Louisiana, navigating financial and legal landscapes requires understanding tools like the UCC-1 Financing Statement, a crucial document for delineating the rights and responsibilities concerning secured transactions. This form, integral to the Uniform Commercial Code (UCC) practices within the state, is meticulously designed to record and publicize the interest a creditor holds against a debtor's personal property, which serves as collateral for a loan or obligation. The UCC-1 form in Louisiana demands precise information, including the debtor's full legal name, contact details, tax identification number, and specifics about the organization if applicable, ensuring that only one debtor's name is registered per form to avoid confusion. It also requires details about the secured party or assignee and a comprehensive description of the collateral involved. Options on the form allow for indicating if the filing relates to real property, a transmitting utility, a trust, or even a decedent's estate, among others, including alternative designations like lessee/lessor and bailee/bailor relationships. Moreover, the form facilitates the inclusion of additional debtors and secured parties, accommodating complex transactions. Filing the UCC-1 form correctly is foundational for maintaining a secured party's priority in the event of debtor default or bankruptcy, making it a critical step for creditors in protecting their interests.

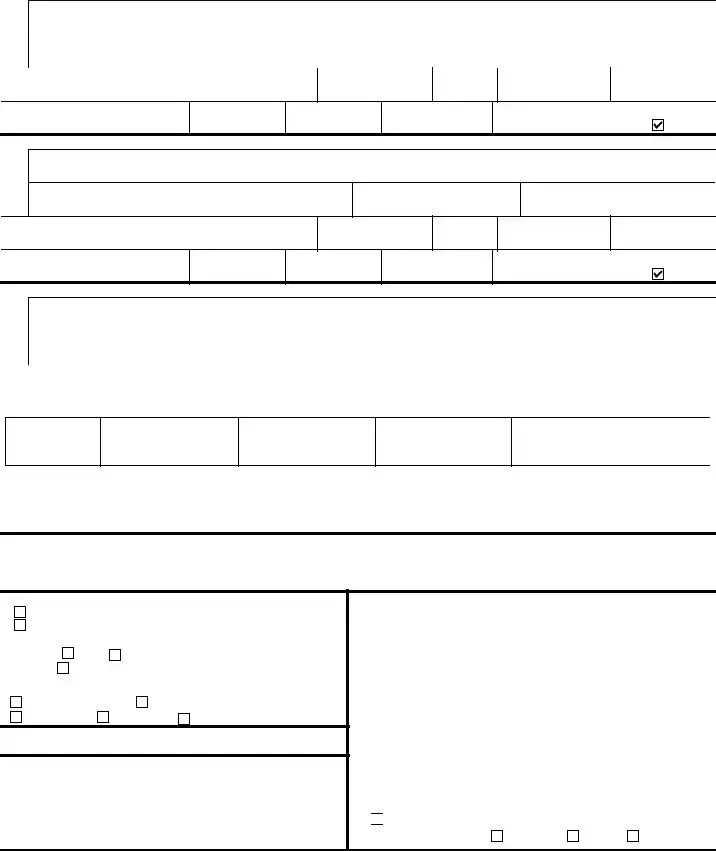

Form Example

STATE OF LOUISIANA

UNIFORM COMMERCIAL CODE - FINANCING STATEMENT -

IMPORTANT - Read Instructions on back before filling out form

1.DEBTOR'S EXACT FULL LEGAL NAME - insert only one debtor name (1a or 1b) - do not abbreviate or combine names 1a. ORGANIZATION'S NAME

OR |

1b, INDIVIDUAL'S LAST NAME (AND TITLE OF LINEAGE [e.g. Jr., Sr., III], if applicabl |

FIRST NAME |

MIDDLE NAME |

|

|||

|

JONES |

RON |

W |

|

|

|

|

|

|

|

|

1c. MAILING ADDRESS

1015 EAST BOBBY COURT

CITY

MILLERSVILLE

STATE

POSTAL CODE

37072-

COUNTRY

USA

1d. TAX ID #: SSN OR EIN

ADD'L INFO RE ORGANIZATION DEBTOR:

1e. TYPE OF ORGANIZATION

1f. JURISDICTION OF ORGANIZATION

1g. ORGANIZATIONAL ID #, if any

None

2.ADDITIONAL DEBTOR'S EXACT FULL LEGAL NAME - insert only one debtor name (2a or 1b) - do not abbreviate or combine names 2a. ORGANIZATION'S NAME

OR

2b, INDIVIDUAL'S LAST NAME (AND TITLE OF LINEAGE [e.g. Jr., Sr., III], if applicabl

FIRST NAME

MIDDLE NAME

2c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

USA

2d. TAX ID #: SSN OR EIN

ADD'L INFO RE ORGANIZATION DEBTOR:

2e. TYPE OF ORGANIZATION

2f. JURISDICTION OF ORGANIZATION

2g. ORGANIZATIONAL ID #, if any

None

3.SECURED PARTY'S NAME ( or NAME OF TOTAL ASSIGNEE OF ASSIGNOR S/P) - insert only one secured party name (3a or 3b) 3a. ORGANIZATION'S NAME

|

Alpha Omega Consulting Group, Inc. |

Fed ID# |

|

|

|

|

||

OR |

|

|

|

|

|

|

|

|

3b, INDIVIDUAL'S LAST NAME (AND TITLE OF LINEAGE [e.g. Jr., Sr., III], if applicabl |

FIRST NAME |

|

|

MIDDLE NAME |

|

|||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

3c. MAILING ADDRESS |

|

CITY |

STATE |

POSTAL CODE |

COUNTRY |

|||

716 Vauxhall Drive |

|

Nashville |

TN |

37221 |

USA |

|||

|

|

|

|

|

|

|

|

|

4. This FINANCING STATEMENT covers the following collateral:

Year

1992

Color

blue

Make

buick

Model

century

Body Style |

VIN |

2d |

32132132132132112 |

|

|

5a. Check if applicable and attach legal description of real property: |

|

Fixture filing |

|

|

Standing tmbe |

|||

|

|

|

|

|

|

|

|

|

constituting goods |

|

The debtor(s) do not have an interest of record in the real property (Enter name of an owner of recor |

|

|

||||

|

|

|

|

|

|

|

|

|

5b. Owner of the property (if other than named debtor)

6a. Check only if applicabel and check only one box.

Debtor is a Transmitting Utility. Filing is Effective Until Terminat

Filed in connection with a public finance transaction. Filing is Effective for 30

6b. Check only if applicabel and check only one box. |

|

||||

Debtor is a |

Trust or |

Trustee acting with respect to property h |

|||

|

|

||||

in trust or |

Decedent's Estat |

|

|

|

|

|

|

||||

7. ALTERNATIVE DESIGNATION (if applicable): |

|

LESSEE/LESSOR |

|||

CONSIGNEE/CONSIGNOR |

BAILEE/BAILOR |

||||

SELLER/BUYER |

AG. LIEN |

|

|

||

|

|

|

|

|

|

8.Name Phone Number to contact filer

9.Send Acknowledgement To: (Name Address)

Alpha Omega Consulting Group, Inc.

Mike Burch

716 Vauxhall Drive

Nashville, TN 37221

(615)

10. The below space is for filing Office Use Only

11.

CHECK TO REQUEST SEARCH REPORTS ON DEBTOR(S

CHECK TO REQUEST SEARCH REPORTS ON DEBTOR(S

(ADDITIONAL FEE REQUIRED) |

ALL DEBTORS |

DEBTOR 1 |

DEBTOR 2 |

LOUISIANA APPROVED FORM

Document Breakdown

| Fact | Detail |

|---|---|

| Form type | Uniform Commercial Code - Financing Statement (UCC-1) |

| Application | Used in the State of Louisiana |

| Purpose | To document a secured transaction |

| Requirement | Debtor and secured party must provide full legal names |

| Debtor Information | Includes name(s), mailing address, tax identification, and type/jurisdiction of organization |

| Secured Party Information | Includes organization or individual name, mailing address, and Tax ID |

| Collateral Description | Details of collateral securing the loan, including property related to the transaction |

| Special conditions | Options for additional debtor, choices for specific filing conditions such as public finance transactions |

| Governing Law | Louisiana Revised Statutes, applicable Uniform Commercial Code sections |

| Additional Options | Alternative designation of parties, request for search reports on debtor(s) |

| Filing Office | Secretary of State, Louisiana |

Instructions on Filling in Ucc 1 Louisiana

Completing the UCC-1 Louisiana form is a crucial step for parties involved in secured transactions. This document serves as a public declaration of interest, securing the rights of the filer against the debtor's collateral. Properly filling out this form ensures that these rights are recognized and protected under the Uniform Commercial Code as adopted in Louisiana. Follow these steps carefully to complete the form accurately.

- Start by entering the Debtor's exact full legal name in section 1. Choose either 1a for an organization or 1b for an individual, including any titles of lineage if applicable. For an organization, additional information regarding type, jurisdiction, and organizational ID number (if any) needs to be filled in sections 1e to 1g.

- In section 1c, provide the debtor's mailing address, including city, state, postal code, and country. Ensure the address is complete and accurate.

- Enter the debtor's Tax ID number (SSN or EIN) in section 1d.

- If there is an additional debtor, repeat the steps (1 to 3) for sections 2a to 2g, making sure only to include one additional debtor's name and related details.

- In section 3, enter the Secured Party's name and contact information in the respective fields (3a or 3b for an organization or an individual, and 3c for the mailing address).

- Detail the collateral covered by this financing statement in section 4. Include all relevant details such as year, make, model, and VIN for vehicles, or describe other types of collateral.

- If applicable, check the appropriate box in section 5a for a fixture filing, as-extracted collateral, or standing timber, and provide the legal description of the related real property. If the owner of the property is different from the named debtor, list the owner's name in section 5b.

- In section 6a and 6b, check the appropriate box if special conditions apply, such as the debtor being a transmitting utility, the filing being effective until termination, or related to a public finance transaction.

- For alternative designations like lessee/lessor or seller/buyer, fill out section 7 if applicable.

- Provide the contact information of the person to reach in case of questions in section 8, including name and phone number.

- Section 9 requests the acknowledgment to be sent to a specified address. Fill in the name and address of the recipient.

- If you require search reports on the debtor(s), check the appropriate box in section 11. Remember that requesting search reports will require an additional fee.

Once the form is carefully reviewed for accuracy and completeness, submit it to the appropriate Louisiana filing office. Keep a copy for your records and await confirmation or acknowledgment from the filing office. Timely and accurate filing of the UCC-1 form is essential to protect your interests in the collateral described.

Listed Questions and Answers

What is a UCC-1 Financing Statement?

A UCC-1 Financing Statement is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (i.e., collateral). This form is essential in securing the creditor's interest, making the claim public information, and giving the creditor priority over other creditors in case of debtor default. In Louisiana, as in other states, the form is governed by the Uniform Commercial Code (UCC) and serves as a critical step in the process of secured transactions.

Who needs to file a UCC-1 Financing Statement in Louisiana?

Any creditor who wants to ensure its interest in a debtor's personal property is protected should file a UCC-1 Financing Statement. This includes lenders in secured loans, sellers on credit, or any party with a transaction that creates a security interest in personal property or fixtures. Businesses and individuals offering financing for goods such as machinery, equipment, or vehicles, or taking these goods as collateral, also need to file. It’s important that such filings are made correctly and timely to maintain the secured status of the collateral.

What information is required on the UCC-1 Louisiana form?

The UCC-1 Louisiana form requires comprehensive information to accurately identify the involved parties and the collateral. Key pieces of information include:

- Debtor's exact full legal name: This must be accurate and should reflect the name on official documents.

- Mailing address of the debtor: Current contact information for communication purposes.

- Tax ID #: Social Security Number (SSN) or Employer Identification Number (EIN) for individuals or organizations, respectively.

- Type and jurisdiction of organization, if applicable: For business entities, the type of organization and the state of incorporation or organization must be provided.

- Secured Party's name and contact information: Indicates the creditor or assignee holding the security interest in the collateral.

- Collateral description: Detailed information about the collateral securing the loan must be recorded to identify it clearly.

Additional details might be required based on the specific nature of the collateral or parties involved.

How do you file a UCC-1 Financing Statement in Louisiana?

To file a UCC-1 Financing Statement in Louisiana:

- Complete the UCC-1 form in full, ensuring all information is accurate and matches legal documents.

- Include any attachments if applicable, such as detailed descriptions of real property to which the filing relates (fixture filings) or additional debtor information.

- Submit the form and any attachments, along with the appropriate fee, to the Louisiana Secretary of State's office. The form can be filed online, by mail, or in person, depending on the filer's preference and the specific requirements at the time of filing.

- After filing, the filer will receive a confirmation and a filing number, which should be kept for records and future reference.

In Louisiana, staying compliant with the filing procedures and timing is crucial to ensuring the security interest is properly perfected, making the creditor’s claim against the collateral enforceable against other parties.

Common mistakes

Not providing the debtor's exact full legal name is a common mistake. The form requires that you choose either an organization's name (field 1a) or an individual's last name followed by their first and middle names, including titles of lineage if applicable (field 1b). Failing to use the exact legal name as it appears in official documents can lead to rejection of the form or issues in enforcing the security interest. It's crucial not to abbreviate or combine names.

Another error is improperly listing the secured party's information. Just like with the debtor’s details, the secured party’s name must be entered accurately in field 3a for organizations or 3b for individuals, including titles of lineage if applicable. An incorrect or incomplete name can create confusion or legal complications down the line.

Overlooking the need to check applicable boxes in sections 5a, 6a, and 6b is also a frequent oversight. These sections deal with specific circumstances of the filing, such as fixture filings, debtor status (e.g., Transmitting Utility or cases involving a Trust or Decedent’s Estate), and any alternative designations. Neglecting these checkboxes may result in an incomplete filing, potentially affecting the legal standing of the financing statement.

Last but not least, failing to provide adequate descriptions of the collateral covered by the financing statement in section 4 is a common error. A vague or incomplete description can lead to disputes over what assets are actually covered under the agreement. It's important to be as detailed and precise as possible, including specific characteristics like year, make, model, and VIN for vehicles, to avoid ambiguity.

Documents used along the form

Filing a Uniform Commercial Code Form 1 (UCC-1) in Louisiana is a critical step in securing interests in collateral tied to a financial agreement. It's not uncommon for additional documents to be necessary for comprehensive protection and legal compliance. Understanding these documents can streamline the process and ensure that all legal bases are covered.

- UCC-3 Amendment Form: Used for making amendments to the UCC-1 filing, including address changes, name changes, or to add or release collateral.

- UCC-5 Correction Statement: Allows for clarifications or corrections to a previously filed UCC-1 document, ensuring accuracy in the public record.

- Security Agreement: Outlines the terms and conditions under which the collateral is pledged to secure the debt. This agreement provides the legal basis for the UCC-1 filing.

- Loan Agreement: Details the terms of the loan, including interest rate, payment schedule, and default terms, often referenced in the UCC-1 filing.

- Promissory Note: A written promise to pay a specific sum of money to a specific person under specified terms, often secured by the collateral listed in the UCC-1.

- Subordination Agreement: Adjusts the priority of security interests, potentially allowing a new creditor to take a higher priority over existing creditors mentioned in a UCC-1.

- Release of Lien: Used when the debt has been satisfied, to remove the lien from the public record, effectively terminating the UCC-1 filing's effectiveness.

- Assignment of Security Interest: Transfers the interest of a secured party under the UCC-1 to another party, requiring a new filing to reflect this change.

- Financing Statement Cover Sheet: While not always required, some jurisdictions or specific types of transactions may require a cover sheet for organizational or clerical purposes.

Each document serves a unique purpose in the context of secured transactions and their legal recording. Be it amending, clarifying, or terminating a security interest, the proper use of these forms ensures the secured party maintains the expected level of protection against the debtor's default. Business professionals engaging in transactions requiring a UCC-1 filing should familiarize themselves with these documents to safeguard their interests effectively.

Similar forms

The UCC-1 Louisiana form is similar to several other documents involved in securing transactions or interests in various types of property. These documents play a crucial role in the legal process of establishing and publicizing the rights of creditors over the debts or obligations owed by debtors. Here, we explore a few documents to which the UCC-1 Louisiana form is comparable and explain the aspects of their similarity.

Financing Statement Amendment (UCC-3)

The UCC-1 Louisiana form shares significant similarities with the Financing Statement Amendment (UCC-3). Like the UCC-1, the UCC-3 is used in the context of the Uniform Commercial Code to modify a previously filed financing statement. Both forms require detailed information about the debtor, the secured party, and the collateral involved in the transaction. However, the UCC-3 specifically deals with amendments, which can include changes to the information provided in the original UCC-1 filing, continuation statements to extend the period of effectiveness of the original filing, termination statements to end the effectiveness, or assigning a secured party's interest. Essentially, the UCC-3 builds upon the original filing created by the UCC-1, modifying or updating its terms as necessary.

Security Agreement

Another document similar to the UCC-1 Louisiana form is the Security Agreement. While the UCC-1 form is a public filing that notifies third parties of the security interest a creditor holds in the debtor's collateral, a security agreement is a private contract between the debtor and the secured party that actually creates or provides for this security interest. The security agreement details the terms of the security interest, such as the rights and obligations of the debtor and the secured party, and a description of the collateral. Although the UCC-1 form itself does not create the security interest (this is the role of the security agreement), it is an essential component in perfecting the security interest by making it effective against third parties. The two documents work hand in hand; the UCC-1 serves as an essential step in the process established by the security agreement.

Real Estate Mortgage

While primarily associated with real property transactions, a Real Estate Mortgage shares foundational similarities with the UCC-1 Louisiana form in terms of securing a creditor's interest. In a real estate mortgage, the debtor (or mortgagor) grants a legal interest in real property to the creditor (or mortgagee) as security for a loan or other obligation. Similar to the UCC-1 form, which is filed to give public notice of a security interest in personal property, a mortgage is recorded in public records to give notice of the security interest in real property. The key similarity lies in the function of both documents to notify third parties about existing security interests, thereby protecting the secured party's rights in the collateral or property. However, they differ in the types of property they cover, with the UCC-1 focusing on personal property and the real estate mortgage covering real property.

Dos and Don'ts

When preparing the UCC-1 Financing Statement for Louisiana, careful attention to detail is paramount. Both actions to take and to avoid can significantly impact the form's validity and the security interest's enforceability. Here’s a guide to help ensure accuracy:

- Do use the debtor's exact full legal name as it appears on official documents to prevent any ambiguity regarding their identity.

- Do not abbreviate or combine names. This includes avoiding nicknames or shortened versions of names, which can lead to errors in identification.

- Do ensure that the address provided is complete and accurate, including the city, state, postal code, and country, to facilitate any necessary contact or legal actions in the future.

- Do not overlook the tax ID number. For individuals, this will be their SSN, and for organizations, their EIN. This information is critical for distinguishing the debtor from others with a similar name.

- Do specify the type of organization accurately if the debtor is not an individual. This detail, along with the jurisdiction of the organization, is essential for correctly establishing the legal context.

- Do not leave the jurisdiction of organization blank for corporate entities. This information affects the application of laws and can impact the enforcement of the security interest.

- Do include a detailed description of the collateral. Clarity about what is being secured ensures all parties understand the scope of the agreement.

- Do not check boxes regarding debtor status (e.g., Transmitting Utility, Trust or Trustee) without verifying the applicable legal definitions. Incorrectly categorizing the debtor can affect the filing's legal standing.

Filling out the UCC-1 form with accuracy not only facilitates a smoother process but also lays the groundwork for a secure and enforceable financial agreement. Careful adherence to these dos and don'ts can save parties from future legal complications and disputes.

Misconceptions

When dealing with the Uniform Commercial Code (UCC-1) financing statement in Louisiana, there are several common misconceptions that need to be addressed to ensure that individuals and organizations are fully informed about how these forms function and their implications. Understanding these misconceptions is crucial for proper compliance and to utilize the form effectively.

One widespread misconception is that the UCC-1 filing applies only to business loans. In reality, while it's commonly used in commercial transactions, the UCC-1 can also apply to personal loans where personal property is used as collateral. This inclusion ensures a broad applicability, covering various types of loans beyond just business-related financing.

Another misunderstanding is that filing a UCC-1 form automatically makes a secured party's claim valid against all others. The truth is that the validity and priority of a security interest depend on several factors, including compliance with state laws and whether other parties have filed conflicting claims. Timeliness and accuracy in filing are critical components to establishing priority.

Many believe that once filed, a UCC-1 is permanent. However, a UCC-1 financing statement typically expires after five years unless a continuation statement is filed. This duration is designed to balance the interests of the secured party and the debtor, while also keeping public records up to date.

There is a misconception that filing a UCC-1 form is complex and requires legal expertise. Although accuracy and attention to detail are imperative, the form itself is structured to be straightforward. The instructions are designed to guide filers through the process, making it accessible to those without a legal background.

Some assume that any error or typo in the UCC-1 form will invalidate the filing. While accuracy is essential, minor mistakes do not automatically render the filing ineffective. Critical errors, particularly those affecting the debtor's identity or the collateral description, can be problematic. However, many mistakes are correctable without impacting the effectiveness of the security interest.

A common misconception is that UCC-1 filings are only for tangible goods. In reality, these filings can cover both tangible and intangible assets, including inventory, equipment, accounts receivable, and even intellectual property. This wide range of applicability makes the UCC-1 a versatile tool in securing interests across various types of collateral.

Finally, there's a misunderstanding that UCC-1 forms are only filed with the state government. While the form is typically filed with a state's secretary of state or a similar entity, depending on the collateral's nature and location, other filings, such as local or even federal, may be necessary. Understanding the specific filing requirements is essential to ensure proper protection of one's security interest.

Dispelling these misconceptions about the UCC-1 financing statement in Louisiana is vital for all parties engaged in secured transactions. By providing accurate information and clarifying common misunderstandings, individuals and businesses can navigate these legal processes more effectively, ensuring proper compliance and the safeguarding of their interests.

Key takeaways

Filling out the UCC-1 form accurately is crucial for ensuring the enforceability of a security interest in the state of Louisiana. Here are some key takeaways to keep in mind when working with this document:

- Enter all debtor names clearly and accurately. Only one debtor name should be entered (either an organization's name or an individual's full legal name), including any relevant titles of lineage (e.g., Jr., Sr., III) if applicable. This step is vital for correctly identifying the debtor in the public record.

- Provide detailed debtor and secured party information. The form requires not just names but also mailing addresses, tax identification numbers (SSN or EIN), and, for organizations, the type and jurisdiction of organization plus an organizational ID number if available. This information helps further ensure the correct parties are identified and notified if necessary.

- Describe the collateral accurately. Specifying the collateral that the security interest covers, including its description and any identifying information (like VIN for vehicles), is imperative. This clarity helps in the enforceability of the security interest against the specified assets.

- Understand the implications of check boxes and special designations. Certain sections of the form include options to check boxes that can significantly affect the filing, such as indicating whether the debtor is a transmitting utility or if the filing is in connection with a public finance transaction. Each option has specific legal implications and durations of effectiveness.

- Request a search report if needed. A box at the end of the form allows filers to request search reports on the debtor(s) for an additional fee. This can be beneficial for due diligence, ensuring that the filer is aware of any existing claims or interests against the debtor.

It's essential to read the instructions carefully and seek legal advice if needed, as errors in filling out the form can affect the priority or enforceability of a security interest under Louisiana's Uniform Commercial Code (UCC) regulations.

Popular PDF Templates

Louisiana Pilot Car Permit - The permit's effective date must be specified in the application, allowing for planned logistics and transportation strategies by the applying entity.

R-1048 Louisiana 2023 - Ensures that government workers are afforded the tax exemptions entitled to them during official hotel stays.

La Tax Forms - Empowers Louisiana vehicle lessors to transact without sales tax, under specific operational criteria.