Free T 1B Louisiana Template

The State of Louisiana, through its Department of Revenue, mandates the reporting and payment of severance taxes for timber severed within its jurisdiction, a regulation encapsulated in the Form Sev. T-1B R-9030-L. Designed to streamline the process of taxation for timber severed or purchased, this document underscores Louisiana's commitment to managing its natural resources while providing a structured framework for tax collection. With specific fields for the reporting company’s details, including the revenue account number and the address, as well as the particulars of the timber's destination, the form serves as a critical tool in the administration of timber severance taxes. Essential for ensuring compliance, the form must be submitted by the stipulated deadline — the last day of the month following the timber's severance, with provisions for weekends and holidays. Moreover, it addresses the situations where the tax obligations fall on parties other than the direct severer, through Schedule B, which details transactions where severance tax liability transfers, indicating a comprehensive approach to the taxation process. This mechanism not only aids in the accurate levying of taxes but also in the fair distribution of fiscal responsibilities among stakeholders in the timber industry.

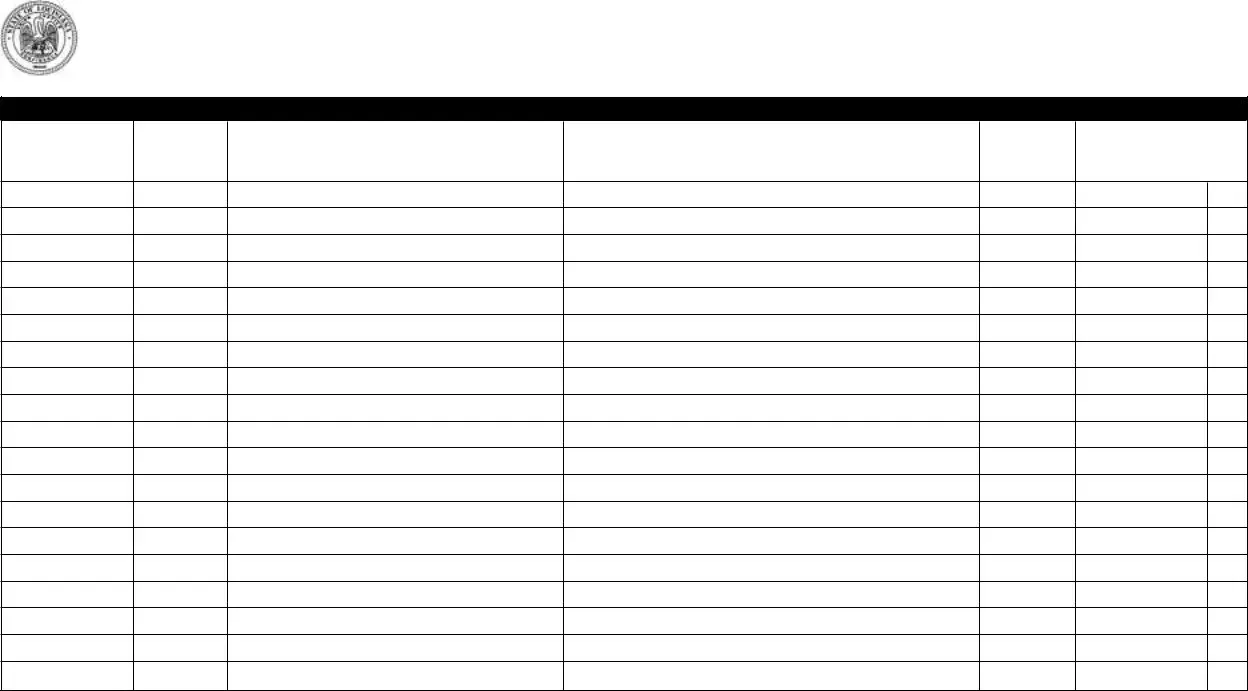

Form Example

Form Sev. |

|

State of Louisiana |

|

|

Department of Revenue |

|

Timber Severance Tax |

|

P.O. Box 201, Baton Rouge, LA |

|

File original of this return only. |

Type or print complete name of reporting company |

Revenue Account Number |

|

|

Street address or rural route, city, state, ZIP |

Taxable Period |

|

|

Name of plant or mill for which this report is filed |

|

|

|

This form is to be completed when severance taxes are due by others on timber severed or purchased. In order to avoid penalties, this form must be filed on or before the last day of the month following the month in which the timber was severed. If the due date falls on a weekend or holiday, the return is due the next business day.

Schedule

Purchaser/ Seller

Revenue Account

Number

Seller=S

Purchaser=P

Name of seller/purchaser

Complete address of seller/purchaser

Parish |

Product |

code |

code |

|

|

Total Timber

tons

Document Breakdown

| # | Fact |

|---|---|

| 1 | The T-1B Form is issued by the Louisiana Department of Revenue for Timber Severance Tax purposes. |

| 2 | This form is designated for use within the State of Louisiana as per state-specific regulations concerning timber severance. |

| 3 | It is identified with the specific code: Sev. T-1B R-9030-L (9/03), indicating its form version and relevance. |

| 4 | The primary purpose of this form is for reporting and paying taxes on timber that has been severed or purchased by parties other than the landowner. |

| 5 | Filers must submit the original return to the indicated P.O. Box in Baton Rouge, LA, emphasizing the filing procedure's formal nature. |

| 6 | Entities must include comprehensive identification details like Revenue Account Number, street address, and name of the plant or mill for the report. |

| 7 | It mandates completion upon the due severance taxes by individuals other than the direct severer, highlighting a broader tax collection scope. |

| 8 | The form's filing is time-sensitive, requiring submission by the last day of the month following the timber's severance date to avoid penalties. |

| 9 | In cases where the due date falls on a weekend or holiday, the form is due the following business day, offering a slight flexibility in terms of timing. |

| 10 | Schedule B of the form addresses Timber products purchased or sold, marking a differentiation basis on whom the severance tax is imposed. |

Instructions on Filling in T 1B Louisiana

Filling out the T 1B Louisiana form is a straightforward process, but it's important to pay attention to detail. The form is used to report severance taxes on timber, which are due by other parties on timber that was purchased or severed. Completing this form accurately and submitting it on time helps ensure compliance with state tax regulations and avoids potential penalties. Filing by the deadline, which is the last day of the month following the month in which the timber was severed, prevents any unnecessary delays or fines. Now, let's walk through the steps to fill out the form correctly.

- Begin by typing or printing the complete name of the reporting company in the provided space.

- Enter the Revenue Account Number of the reporting company.

- Fill in the street address or rural route, city, state, and ZIP code of the reporting company.

- Indicate the Taxable Period for which this report is being filed.

- Write the name of the plant or mill for which the report is filed.

- In Schedule B, identify whether the transaction is for a purchaser or a seller by marking the appropriate code: Seller=S, Purchaser=P.

- Enter the Revenue Account Number of the seller or purchaser involved in the transaction.

- Provide the complete name of the seller or purchaser.

- Fill in the complete address of the seller or purchaser, including the parish.

- Specify the Product code for the timber products purchased or sold.

- Record the Total Timber tons involved in the transaction.

After filling out the form, review all the information to ensure accuracy. Once you're confident that all details are correct and complete, submit the original form to the address mentioned at the top: P.O. Box 201, Baton Rouge, LA 70821-0201. Remember, it's crucial to file this form on time, ideally before the deadline, to comply with state regulations and avoid any potential penalties or interest for late submissions. Filing the T 1B Louisiana form accurately and on time is an important responsibility that helps maintain compliance with the state's tax obligations on timber severance.

Listed Questions and Answers

What is the purpose of the T-1B Louisiana form?

The T-1B Louisiana form serves a crucial role in the reporting and payment process for severance taxes on timber in the State of Louisiana. This specific form is required when severance taxes are due on timber that has been severed or purchased. It ensures that the appropriate severance taxes are reported and paid to the Department of Revenue, thereby aiding in the proper management and conservation of the state's timber resources. By completing this form, reporting companies provide essential information regarding the amount of timber severed or purchased and the corresponding tax obligations.

How and when should the T-1B Louisiana form be filed?

Filing the T-1B Louisiana form correctly and on time is important to comply with state requirements and avoid penalties. The form must be typed or printed clearly and should include all required details such as the reporting company's name, revenue account number, and the specific details of the timber transactions. Importantly, the completed form must be filed with the Department of Revenue by no later than the last day of the month following the month in which the timber was severed. If the due date falls on a weekend or holiday, the form is due the next business day. This timeline ensures a systematic reporting process and helps in maintaining accurate records for both the reporting entities and the state.

What information is required on the T-1B Louisiana form?

The T-1B Louisiana form requires specific information to ensure a comprehensive report on the timber severed or purchased. Information required includes:

- Complete name of the reporting company.

- Revenue Account Number.

- Street address or rural route, city, state, ZIP of the reporting company.

- Taxable Period for which the report is being filed.

- Name of the plant or mill for which the report is filed.

- Details under Schedule B for timber products purchased or sold, indicating whether the taxes are to be paid by the purchaser or the seller, including:

- Purchaser/Seller Revenue Account Number.

- Indication of Seller (S) or Purchaser (P).

- Name and complete address of the seller/purchaser.

- Parish where the transaction took place.

- Product code.

- Total Timber tons involved in the transaction.

This comprehensive collection of data assists the Department of Revenue in accurately assessing severance taxes due and ensuring compliance with state regulations.

What happens if the T-1B Louisiana form is filed late?

Filing the T-1B Louisiana form after the due date can lead to penalties. The State of Louisiana mandates that this form must be filed on or before the last day of the month following the month in which the timber was severed to avoid these penalties. If filed late, the reporting entity may be subject to fines and interest on the unpaid tax amount. It is imperative to adhere to the filing deadline to ensure compliance with state tax obligations and avoid unnecessary financial charges. Entities experiencing difficulties in meeting the deadline should contact the Department of Revenue for guidance on possible extensions or resolution strategies.

Common mistakes

Completing the T-1B Louisiana form, essential for reporting timber severance taxes, involves meticulous attention to detail. The form serves as a crucial document for companies undergoing timber severance operations in Louisiana, helping ensure compliance with state tax regulations. However, individuals often encounter pitfalls that can lead to inaccuracies or omissions, potentially causing delays or financial penalties. Here, we discuss four common mistakes to avoid when filling out this document.

Failing to Confirm the Due Date: One of the most straightforward but frequently overlooked details is the due date for submitting the form. It is due the last day of the month following the month in which the timber was severed. Should this date fall on a weekend or holiday, the form must be submitted by the next business day. Overlooking this detail can result in late filings and unnecessary penalties.

Incorrectly Reporting Timber Tons: Accuracy in reporting the total timber tons is critical. Mistakes in documentation can arise from a range of issues, from simple mathematical errors to misunderstandings about which transactions require reporting. Ensuring the correct and precise quantity of timber severed or purchased is reported prevents discrepancies that could lead to audits or penalties.

Omitting Seller or Purchaser Information: The form requires detailed information about both sellers and purchasers, including their complete names, addresses, and revenue account numbers. An often-made mistake is omitting or inaccurately recording this data. Incomplete or incorrect information can hinder the processing of the form, leading to delays or the need for resubmission.

Not Specifying the Correct Product Code: Each timber product has a designated product code that must be accurately recorded on the form. The failure to use the correct code can misrepresent the nature of the transaction, affecting tax assessments and potentially leading to compliance issues. It's crucial to review the list of product codes and ensure the accurate code is applied to each timber product reported.

Avoiding these mistakes requires careful review and understanding of the form's requirements. The best practices include double-checking due dates, verifying the accuracy of reported quantities and details, and thoroughly reviewing all provided information for completeness and accuracy. By doing so, filers can ensure their T-1B Louisiana form is filled out correctly, promoting timely and compliant tax reporting.

Documents used along the form

When dealing with the intricate processes enshrined in the timber industry of Louisiana, particularly concerning severance taxes, numerous forms and documents complement the T 1B Louisiana form to ensure compliance and streamline fiscal responsibilities. These forms collectively facilitate a coherent system, aiding entities in maintaining accurate records, abiding by tax regulations, and making informed decisions regarding timber-related activities.

- Form R-1046: Louisiana Timber Severance Tax Return Summary – This document summarises the total timber severed and taxes due. It provides a comprehensive overview for entities to report their severance tax liability.

- Form R-1064: Application for Timber Tax Refund – Entities that believe they have overpaid on their timber severance taxes can file this form to request a refund.

- Form R-1029: Sales Tax Return – Although primarily used for sales tax, this form may be required if certain timber products are involved in transactions that could implicate sales tax considerations.

- Form R-1082: Severance Tax Exemption Certificate – For qualifying transactions or entities, this certificate provides evidence of an exemption from severance tax.

- LAT 5: Parish E-File – Local parishes may have specific filing requirements for timber severed within their jurisdictions. This electronic filing system facilitates compliance with local tax authorities.

- Timber Harvest Notice: A notification required by some local jurisdictions, indicating the intent to harvest timber. This form helps in planning and monitoring timber activities within the region.

- Timber Sale Contract: While not a form per se, this documented agreement between seller and buyer outlines specifics of the timber sale, including the severance tax responsibilities.

- Form 1099-S: Proceeds From Real Estate Transactions – For transactions involving the sale of timberland, this federal tax form reports the proceeds to the IRS, impacting both income and severance tax considerations.

Together, these documents build a framework that individuals and businesses engaged in the timber industry must navigate diligently. Their roles range from operational permissions to tax liabilities, covering the gamut of legal and financial landscape surrounding timber severance in Louisiana. By familiarizing and complying with these additional requirements, stakeholders can ensure a seamless concordance with state and local tax laws, thereby upholding the sustainability and economic integrity of Louisiana's timber resources.

Similar forms

The T-1B Louisiana form is similar to other tax documents that are designed for specific tax reporting purposes within various sectors. While it serves a unique function for timber severance tax filings in Louisiana, its structure and requirements mirror those of similar documents used in different states or for different types of taxes. These similarities often include the requirement for detailed information about transactions, parties involved, and specific identification numbers or codes to facilitate tax collection and enforcement.

One such document is the Form 1099-MISC used at the federal level for reporting miscellaneous income. Like the T-1B Louisiana form, the 1099-MISC requires detailed information about the payer and the payee, including addresses and identification numbers, which is somewhat similar to the T-1B’s need for a revenue account number and addresses of the reporting company. Both forms are used to report specific types of transactions to taxation authorities—severance of timber for the T-1B and miscellaneous income for the 1099-MISC. They both play critical roles in ensuring compliance with tax laws and aiding in accurate tax collection.

Another document bearing resemblance is the Sales and Use Tax Return forms that many states require businesses to file. These forms, much like the T-1B, are concerned with the taxation of specific goods; however, they are broader, focusing on general sales and purchases against the specialized nature of timber products in the T-1B form. Both sets of forms require the reporting entity to provide detailed transactional information, such as the sale or purchase amounts, the transaction dates, and relevant identification numbers. This parallel structure reflects a broad approach to taxation documentation, tailored to specific sectors or activities.

The Heavy Highway Vehicle Use Tax Return (Form 2290) similarly shares characteristics with the T-1B form, particularly in its focus on a specific sector—commercial highway vehicle operation. Like the T-1B form, which is dedicated to the timber sector in Louisiana, Form 2290 is targeted towards a distinct category of taxpayer, those owning heavy vehicles. Each requires specialized reporting related to the operation within their respective industries, including detailed information about assets or activities subject to taxation (vehicles or timber, respectively). This specificity underscores the adaptability of tax forms to various industry needs while adhering to a common framework of taxation reporting.

Dos and Don'ts

When approaching the completion of the T 1B Louisiana form, a crucial document related to timber severance tax, there are several best practices and pitfalls to avoid. These practices are designed to ensure compliance with the State of Louisiana's Department of Revenue requirements, thus avoiding penalties and ensuring a smooth processing of the form. Here are six dos and don'ts to help guide you through this process:

Do:- File on Time: Ensure the form is submitted on or before the last day of the month following the month in which the timber was severed. Remember, if this date falls on a weekend or holiday, you're required to submit by the next business day.

- Type or Print Clearly: Whether you are typing or handwriting the form, clarity is key. This helps prevent any misunderstandings or processing delays.

- Verify All Information: Double-check the revenue account number, the address of the reporting company, and all other details for accuracy before submission.

- Overlook Detail: Every field in the form, especially the Schedule B–Timber products section, requires your attention. Missing or incorrect information can lead to discrepancies and potential penalties.

- Forget to Specify the Role: Clearly indicate whether the entity is a Purchaser (P) or Seller (S) in the relevant section to avoid any confusion regarding the transaction.

- Ignore the Taxable Period: The period for which you are filing must be clearly stated and should align with when the timber was actually severed. This ensures that your return is applied to the correct period.

By adhering to these guidelines, companies can navigate the complexities of the T 1B Louisiana form more efficiently, leading to a more streamlined process and reducing the likelihood of encountering issues with the Department of Revenue.

Misconceptions

There are several misconceptions about the T-1B Louisiana form related to the Timber Severance Tax. Clarifying these misconceptions can help ensure compliance and reduce potential errors when completing and submitting the form.

Only companies that cut down trees need to file: It's a common misconception that only those who physically sever the timber are required to file the T-1B form. However, the responsibility also extends to individuals or entities that purchase timber where the severance taxes are due by others. This broader applicability helps ensure the tax is properly assessed and collected, even in transactions where the buyer, rather than the seller, is responsible for the tax.

It can be submitted anytime before the tax payment is due: The form must be filed on or before the last day of the month following the month in which the timber was severed. Filing after this deadline can result in penalties, regardless of when the taxes are paid. This strict deadline underscores the importance of timely compliance to avoid additional costs.

Penalties are negotiable: Many believe that if they miss the filing due date, they can easily have penalties waived or reduced through negotiation. While there may be provisions for penalty abatement under certain conditions, it is not a guaranteed outcome and should not be relied upon as a fallback plan.

Weekends and holidays extend the filing deadline: If the due date falls on a weekend or holiday, the misconception is that the form cannot be submitted until the next business day, extending the filing deadline. In reality, the form is due the next business day, ensuring that no additional time is granted beyond the standard filing period.

Digital submission is available: As of the most current information, there is a misconception that the T-1B form can be submitted electronically. Submission requirements can change, but traditionally, Louisiana's Department of Revenue had specific guidelines on how tax forms should be submitted, and for many, only paper submissions through mail are accepted.

Every type of timber transaction must be reported on Schedule B: Schedule B asks for details about timber products purchased or sold on which others are to pay severance tax. However, not all timber transactions may need to be reported here, only those fitting the criteria of purchases or sales involving other parties responsible for the severance tax.

The form is only for corporations: Though the form asks for the “complete name of reporting company,” this may lead to the misunderstanding that only corporations need to file. In reality, any entity, including individuals, partnerships, and more, responsible for the timber severance tax must file if they meet the criteria outlined in the form instructions.

Address details are optional: Another misconception is that providing a complete address for the seller/purchaser in Schedule B is optional. Accuracy in these details is crucial for the Department of Revenue to ensure the correct party is assessed and can follow up on the tax obligations related to the timber transactions reported.

Understanding these misconceptions is vital for anyone involved in the timber industry in Louisiana. By ensuring accurate and timely completion and submission of the T-1BA form, stakeholders can avoid penalties, contribute to the state's revenue correctly, and maintain compliance with local tax laws.

Key takeaways

Filling out and using the T1B Louisiana form is an essential process for operations involved in the forestry sector within Louisiana. This document, specifically required by the State of Louisiana Department of Revenue, outlines several key elements and deadlines that are crucial for compliance. Here are four important takeaways to ensure proper handling and submission of this form:

- Identification and Documentation: Complete all sections of the T1B Louisiana form with accurate information. This includes the full name of the reporting company, its Revenue Account Number, street address or rural route, city, state, ZIP, and the name of the plant or mill for which the report is filed. Proper identification and documentation prevent processing delays and ensure accurate record-keeping.

- Severance Taxes: This form is designed for entities that are responsible for severance taxes on timber that has been severed or purchased. It's crucial to understand whether your operation is directly responsible for these taxes to comply with state laws and avoid penalties.

- Filing Deadline: The form must be submitted on or before the last day of the month following the month in which the timber was severed. This strict deadline aims to keep records up to date and allows for timely processing by the Department of Revenue. If the due date falls on a weekend or holiday, the return is due the next business day, providing a slight extension under certain circumstances.

- Understanding Schedule B: Schedule B of the T1B form specifics the timber products purchased or sold on which others are to pay the severance tax. This part requires detailed information about the purchaser or seller, including their revenue account number, name, complete address, parish, product code, and the total timber tons. Accurately completing Schedule B ensures that taxes are properly allocated and that responsible parties are accurately billed.

Adhering to these guidelines and filling out the T1B Louisiana form meticulously can help entities avoid unnecessary penalties and maintain a good standing with the State of Louisiana Department of Revenue. It is always advisable to review the form for accuracy before submission and to keep a copy for your records.

Popular PDF Templates

Louisiana 2022 Tax Forms - This document facilitates communication between Louisiana citizens and state departments for various requests.

Louisiana Pilot Car Permit - The application process conveyed through the form underscores the Louisiana Department of Transportation and Development's effort to regulate transport activities for agricultural products effectively.

Dcfs Louisiana Login - Its comprehensive nature allows for better-informed decisions regarding staffing and volunteer participation.