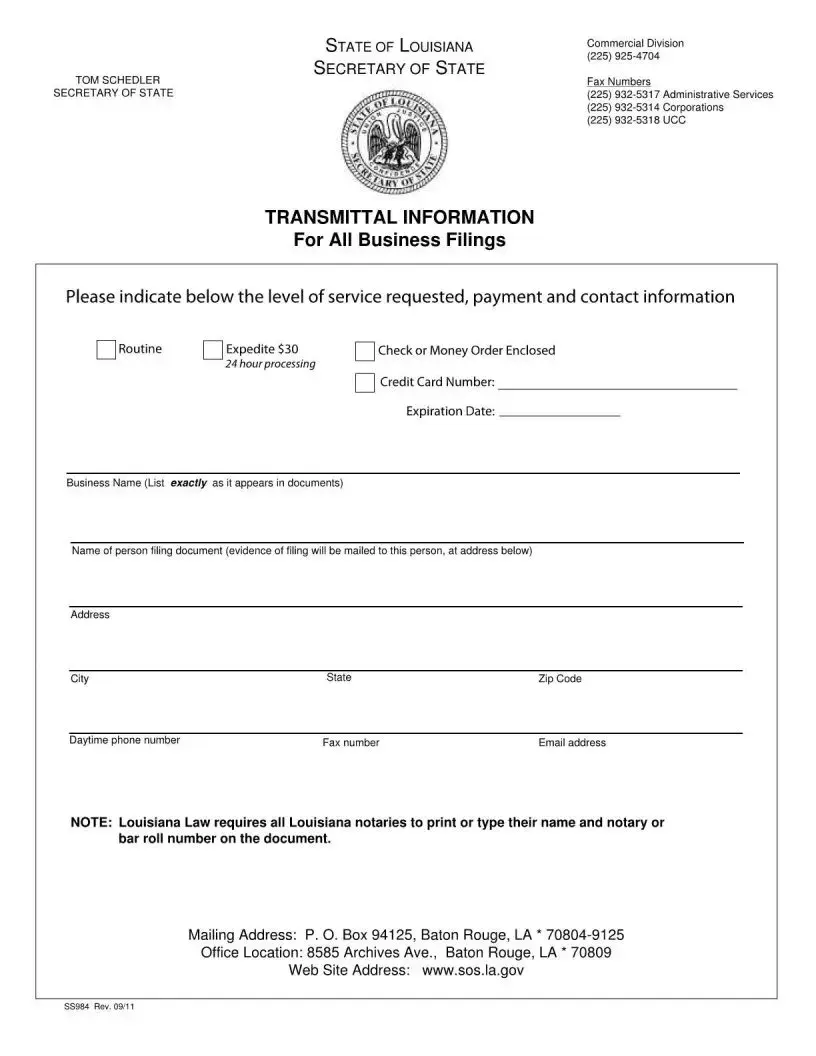

Free Ss984 Template

Navigating government paperwork often seems like a daunting task, but understanding the specifics can make the process much smoother. One such document that may come into play, especially for individuals dealing with certain federal government services, is the SS984 form. This form serves a crucial role in facilitating a wide range of processes, from those related to social services to more specialized governmental functions. It encompasses various fields designed to collect pertinent information that assists government officials in making informed decisions regarding the services an individual is eligible for or the type of assistance they require. The form's comprehensiveness ensures that all relevant data is captured, streamlining the administrative process. Moreover, properly completing the SS984 can significantly expedite the handling of one's case, reducing wait times and improving the overall efficiency of government service delivery. Despite its importance, many individuals may not be familiar with the SS984 form, its purposes, or the specific scenarios in which filling it out is requisite. Consequently, a deeper dive into the form's structure, the information it seeks to gather, and tips for accurate completion can empower those requiring to engage with it, lending clarity to a potentially complex procedure.

Form Example

Document Breakdown

| Fact | Description |

|---|---|

| Purpose | The SS984 form is used to document important information related to a specific, often state-regulated, matter. |

| Applicability | This form is typically relevant in jurisdictions that require detailed records for certain proceedings or transactions. |

| Sections | It includes various sections designed to collect comprehensive data pertinent to the issue it addresses, ensuring all necessary details are duly recorded. |

| Governing Law | The form is governed by the specific state laws applicable to the matter it pertains to, which can vary significantly from one state to another. |

| Filing Process | Filing requires submission to the appropriate state department or agency, often within a designated timeframe, and may involve a filing fee. |

Instructions on Filling in Ss984

After you've gathered all the necessary information, completing the SS984 form will be a straightforward task. This document, vital for certain processes, requires accurate and detailed information. Below is a step-by-manual to assist you in filling it out correctly, ensuring that your submission is processed efficiently without unnecessary delays.

- Start by entering your full name, including any middle initials, at the top of the form where indicated.

- Next, provide your Social Security Number (SSN) in the designated space. Ensure that this is accurate, as it's crucial for identification purposes.

- Fill in your date of birth using the format MM/DD/YYYY to avoid any confusion.

- Input your current address, including the street name and number, city, state, and zip code. If your mailing address is different, ensure you provide that as well.

- Specify your employment status by checking the appropriate box. If you are employed, you'll need to supply your employer's name and address.

- Answer any questions related to your eligibility for the process this form is associated with. This may require checking boxes or providing brief explanations.

- Review the form to ensure all the information provided is correct and complete. Mistakes or omissions can delay processing.

- Sign and date the form in the designated area at the bottom. Your signature validates the information and authorizes the process to go forward.

Once your SS984 form is complete, it's essential to follow the specific submission guidelines provided. This may involve mailing it to a certain address or submitting it online, depending on the context. Taking care to submit it correctly will help ensure that your information is processed in a timely manner, advancing you to the next steps of your required process.

Listed Questions and Answers

What is the SS984 form used for?

The SS984 form is a crucial document utilized for reporting specific types of transactions or changes to the relevant government entity. It serves various purposes, including but not limited to updating personal information, submitting required notifications, and complying with legal obligations in certain scenarios.

Who needs to fill out the SS984 form?

Individuals or entities that are involved in activities or circumstances as specified by the regulations or laws that require reporting or notification to the government must complete the SS984 form. This can range from private individuals to companies, depending on the nature of the transaction or change being reported.

What information is needed to complete the SS984 form?

To accurately complete the SS984 form, the following information is typically required:

- Personal or entity identification details, including name and contact information.

- Specific details about the transaction or change being reported.

- Any other relevant information as dictated by the form's instructions or the particular requirements of the situation.

How can someone obtain and submit the SS984 form?

Obtaining and submitting the SS984 form involves a few steps:

- To obtain the form, individuals or entities should visit the official website of the government agency that oversees the specific area of reporting. The form can typically be downloaded in a PDF format.

- After carefully filling out the form with all the required information, it can usually be submitted electronically through the agency's website or, in some cases, may need to be printed and mailed to the specified address.

- It's important to keep a copy of the form and any correspondence for personal records.

Common mistakes

Not double-checking personal information. A common misstep is entering incorrect details such as the Social Security number, name spelling, or date of birth. Such errors can lead to processing delays or even the rejection of the application.

Ignoring accompanying instructions. The SS-984 form comes with specific guidelines that should be thoroughly reviewed before completing the form. Skipping these instructions may result in incomplete or incorrect submissions.

Leaving sections blank. Even if a particular question or section may not seem applicable, it's important to fill in "N/A" (not applicable) rather than leaving it blank. This indicates to reviewers that the question was not overlooked.

Using incorrect or unclear handwriting. If the form is filled out by hand, illegible handwriting can cause significant issues in processing the form. It's advisable to complete the form electronically if possible or ensure neat, legible handwriting if not.

Failing to provide necessary documentation. Often, the SS-984 form requires additional documents for verification purposes. Neglecting to attach these documents can result in an incomplete application.

Forgetting to sign and date the form. An unsigned form is considered incomplete and not legally binding. Always check that the signature and date fields at the end of the form are completed.

Misinterpreting the purpose of a section. Certain sections may ask for detailed information that can be misunderstood. It's critical to read each question carefully and research or ask for clarification if the purpose isn't clear.

Assuming all sections apply. Some parts of the SS-984 form might be applicable only under specific conditions or for certain individuals. One should carefully assess whether each section must be completed based on their unique circumstances.

In sum, attention to detail, careful review of the instructions, and understanding the specific requirements of every section are paramount when completing the SS-984 form. Avoiding these common mistakes can greatly increase the likelihood of a smooth and timely processing experience.

Documents used along the form

When individuals or entities need to submit the SS-984 form, often required for various transactions or regulatory compliance, this process may involve several additional forms and documents. Each of these documents serves a unique purpose, ensuring comprehensive and compliant submissions. The sum of these documents contributes to a thorough record, assisting in a multitude of scenarios where specific, detailed information is essential for verification, assessment, or procedural purposes. Here, we present five commonly associated forms and documents, elucidating their distinct roles in conjunction with the SS-984 form.

- Form SS-5: Application for a Social Security Card. This form is instrumental in requesting a new, replacement, or revised Social Security card. For individuals needing to update or obtain their Social Security number (SSN) in relation to the SS-984 form, the SS-5 is a primary requirement.

- W-9 Form: Request for Taxpayer Identification Number and Certification. Frequently used in conjunction with the SS-984 form for tax-related matters, the W-9 is essential for providing one’s taxpayer identification number (TIN), which could be an SSN or an Employer Identification Number (EIN), to entities that are required to file information returns to the IRS.

- Form I-9: Employment Eligibility Verification. Employers use this form to verify the identity and employment authorization of individuals hired for employment in the United States. This process may involve the SS-984 form when addressing the SSN aspect of employment eligibility documentation.

- W-4 Form: Employee's Withholding Certificate. This document is vital for determining the amount of federal income tax to withhold from an employee's wages. When an individual's SSN is required for tax purposes in employment settings, it may complement the information provided on the SS-984 form.

- 1099-MISC Form: Miscellaneous Income. For individuals or entities that are required to report payments made during the course of their trade or business to others, the 1099-MISC form serves this purpose and may require SSN information for which the SS-984 form is relevant, particularly in contractor or freelance situations.

Together, these documents create a framework that supports a variety of administrative, legal, and financial processes, demonstrating the interconnectedness of various forms and the thorough documentation often required by entities and individuals alike. Understanding the specific purpose and information required by each form can significantly streamline any related procedures, ensuring both compliance and accuracy in one's endeavors.

Similar forms

The Ss984 form is similar to several other documents in various aspects, including purpose, structure, and the type of information they collect.

Firstly, the Ss984 form shares similarities with the IRS W-9 Form. Both forms are used to collect taxpayer identification information for reporting purposes. While the Ss984 form focuses on the identification of individuals for state-level transactions, the IRS W-9 Form is utilized primarily for federal tax reporting by freelancers, independent contractors, and other non-employees. They likewise require the provision of a Social Security Number (SSN) or Employer Identification Number (EIN), making them critical for financial and employment-related procedures.

Another document similar to the Ss984 form is the I-9 Employment Eligibility Verification form. This resemblance lies in their mutual requirement for identity and employment authorization verification. The I-9 form is used by employers to verify the legal work status of newly hired employees, ensuring they are eligible to work in the United States. Both the Ss984 and the I-9 forms necessitate individuals to present specific documents that establish both identity and employment eligibility, albeit for different purposes and under different legal frameworks.

Last, the similarity between the Ss984 form and the DMV Driver’s License Application form can be observed. Both forms are essential for identity verification and require personal information that includes full legal name, date of birth, and address. However, the DMV Driver’s License Application is specifically designed for the issuance or renewal of a driver's license, indicating its more focused use in comparison to the broader application of the Ss984 form in state-level identity verification and processing.

Dos and Don'ts

When you're filling out the form SS-984, it's crucial to take each step with care to ensure the process is completed correctly. Below are the actions you should take and avoid to help guide you through this essential process.

Things You Should Do

- Read all the instructions provided with the form carefully before you start filling it out. This can prevent mistakes that might delay the process.

- Use black ink or type your responses if the form allows it, ensuring all information is legible and permanent.

- Double-check your personal information, such as your social security number and date of birth, for accuracy. Mistakes in these details can be significant.

- Sign and date the form in the designated areas to verify that the information provided is true and accurate to the best of your knowledge.

- Keep a copy of the completed form for your records. This can be vital for reference or in case the form needs to be resubmitted.

Things You Shouldn't Do

- Do not leave any required fields blank. If a particular question does not apply, write "N/A" to indicate this. Incomplete forms may be returned or rejected.

- Do not use white-out or make corrections on the form. If you make a mistake, it's advisable to start over with a new form to ensure that all information is clear and correct.

- Avoid providing false information. Falsifying government documents can result in penalties, including fines or imprisonment.

- Do not ignore instructions about attaching necessary documents. These documents are usually required to process your form correctly.

- Do not send the form without reviewing it for mistakes. A second review can catch errors that were initially overlooked.

Misconceptions

Understanding forms related to legal or governmental processes can often be daunting. One such example is the commonly referenced but frequently misunderstood SS-984 form. Several misconceptions surround this document, impacting how individuals interact with or perceive the requirements associated with it. Let's clarify a few of those:

It's Only Needed for Employment Purposes: A common misconception is that the SS-984 form is solely required for employment-related activities. While it's true that employers do need this form to verify an employee's eligibility to work in the United States, it also serves broader purposes. For instance, it's used within various government agencies to verify an individual's identity in conjunction with other official purposes.

Personal Information Is at High Risk of Exposure: Given the digital era's privacy concerns, many worry about the level of personal information required on the SS-984 form. It's important to understand that stringent measures are in place to protect this sensitive data. The form has been designed with privacy in mind, ensuring that personal information is safeguarded against unauthorized access.

It's Complicated to Fill Out: The thought of completing government paperwork can be overwhelming, leading to the assumption that the SS-984 form is complicated. However, the form has been structured to be user-friendly, with clear instructions to guide individuals through the process. Assistance is also readily available for those who may have questions or need help with the form.

It Can Be Submitted Online by Anyone: The increasing move towards digital submissions for many forms might suggest that the SS-984 can also be submitted online by anyone. However, this is not the case. Submission protocols for the SS-984 form are specific, requiring certain criteria to be met. Moreover, not all individuals or entities are authorized to submit the form digitally, emphasizing the need for clarification on submission guidelines.

Clearing up misconceptions about the SS-984 form is essential for ensuring proper use and compliance with relevant laws and regulations. By demystifying these common misunderstandings, individuals and employers alike can navigate the requirements with greater confidence and accuracy.

Key takeaways

Filling out government paperwork can often feel like a daunting task, especially when it comes to forms with unclear purposes or complex instructions. The SS984 form is no exception. Here are key takeaways that should help simplify the process and ensure that you use the form correctly and to your advantage.

Understand the purpose: Before diving into any form, especially the SS984, it's crucial to understand what it's used for. This form is typically associated with government procedures, possibly related to social security or other federal programs. Knowing the exact purpose will guide you in providing the correct information.

Gather necessary information beforehand: To make the process smoother, collect all the required documents and information before starting to fill out the form. This might include personal identification, social security numbers, and any relevant financial information.

Read instructions carefully: Government forms come with detailed instructions. Take the time to read these thoroughly to avoid common mistakes. Sometimes, the instructions are more helpful than you might expect, offering clarification on seemingly confusing questions.

Use black ink: If the form requires manual completion, use black ink to fill it out. This ensures legibility and complies with scanning requirements.

Write legibly: Whether filling out the form by hand or typing, ensure that all information is clear and easy to read. Poor handwriting can lead to processing delays or incorrect data entry.

Accuracy is key: Provide accurate and truthful information. Errors or false information can lead to processing delays, form rejection, or legal issues.

Don’t leave blanks: If a question does not apply to you, it's better to write "N/A" (not applicable) instead of leaving it blank. This shows that you didn’t overlook the question.

Sign and date: Your signature and the date are often required to validate the form. Missing signatures are a common reason forms get returned.

Make copies: Before submitting the form, make a copy for your records. This is useful for tracking and future reference.

Seek help if needed: If you're unsure about any aspect of the form, don't hesitate to ask for assistance. This could be from a legal expert, government official, or a trusted individual familiar with the process.

Submit before the deadline: Pay attention to submission deadlines to ensure your form is considered. Late submissions can lead to missed benefits or opportunities.

Filling out the SS984 form, like any government document, requires attention to detail. These key points should help you navigate the process more confidently, ensuring the information you provide is accurate and complete. Remember, taking the time to fill out the form correctly the first time can save a lot of time and hassle down the line.

Popular PDF Templates

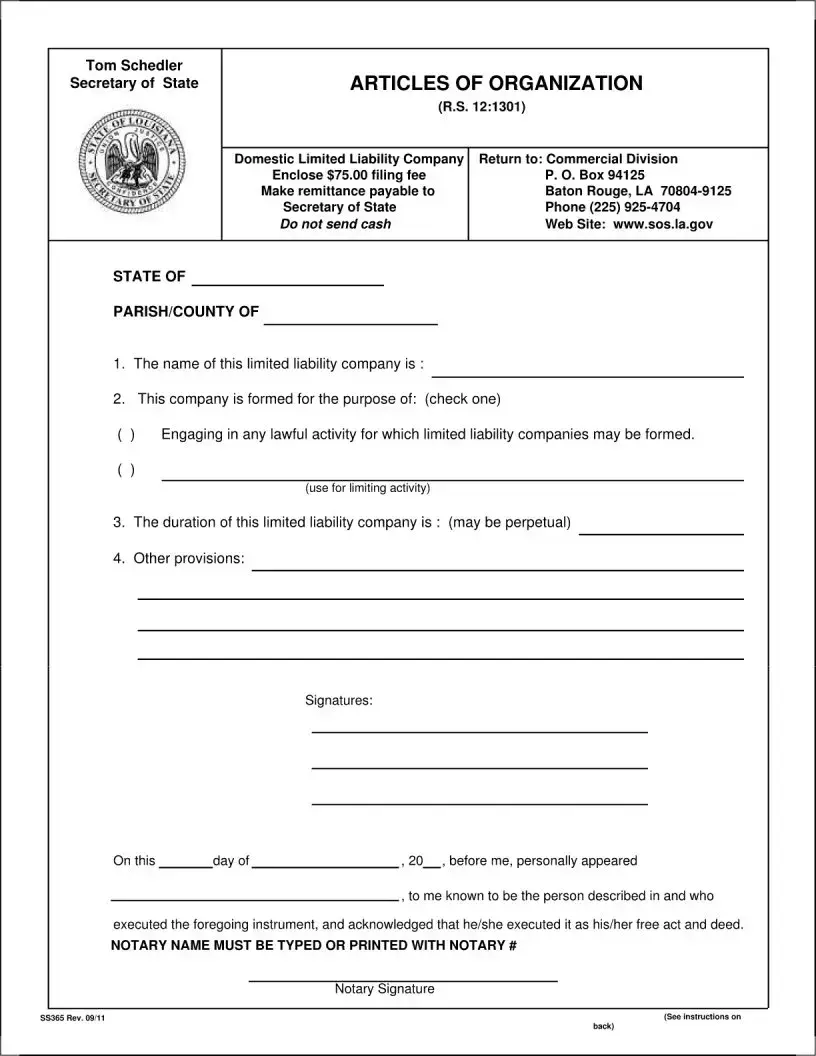

Louisiana State Income Tax Forms - Provides clear instructions for completing the tax form, including explanations of each section and required documentation.

Louisiana Pilot Car Certification - A prompt for the date and signature of the applicant concludes the form, emphasizing the importance of acknowledgement.