Free R 540Ins Louisiana Template

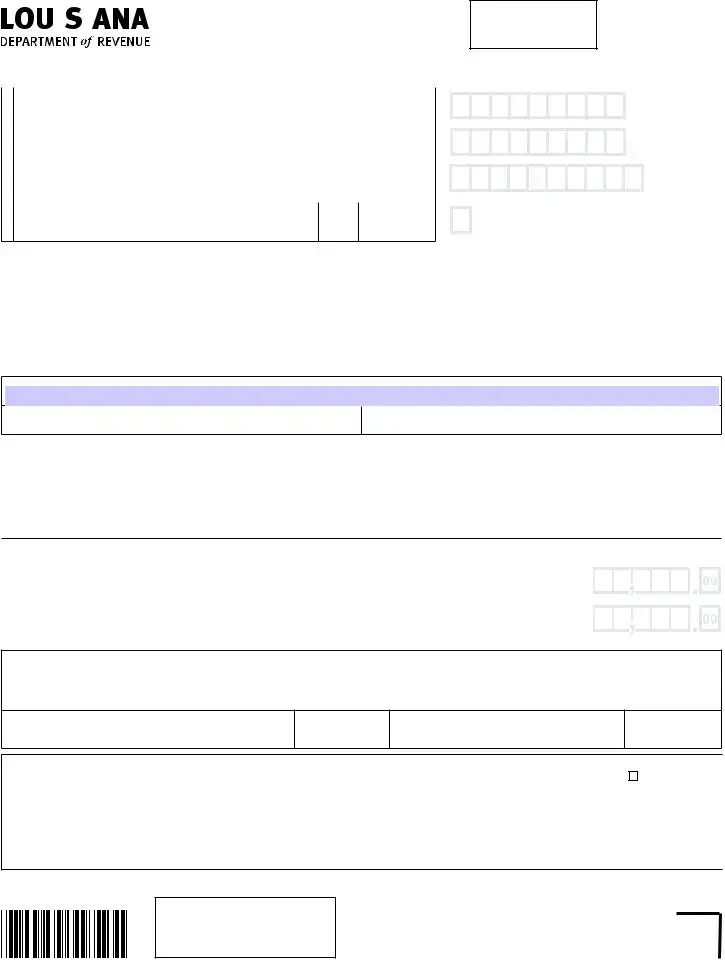

In an effort to ensure Louisiana residents are well-informed and able to reclaim funds rightfully owed to them, the R-540INS form serves as a crucial document for homeowners who have paid assessments to the Louisiana Citizens Property Insurance Corporation. This form, specific to the 2019 filing period, provides a pathway for individuals to request a refund of 25 percent of the Citizens Insurance assessment paid within that calendar year as part of their homeowner's insurance premium. The structure of the form accommodates both single-property owners and those with multiple properties, requiring detailed information about the properties insured, including the address, insurance company name, and policy number. Essential to the refund process is the submission of the insurance declaration page(s) for all properties, which delineate the assessment amounts. Furthermore, the form presents an option for those filing an amended return to indicate their specific need, thereby tailoring the submission process to diverse taxpayer circumstances. The meticulous completion of this form, aligned with the guidelines provided, facilitates the efficient processing of refunds while reducing the chances of delay due to errors or omissions. Importantly, the form stipulates the necessity of a paid preparer's signature and identification number if the return was prepared by a professional, reinforcing the accountability and accuracy of the information provided.

Form Example

|

|

|

|

|

Request for Refund of Louisiana |

|

|||

|

|

|

|

|

|

||||

|

|

|

|

|

Citizens Property Insurance |

|

|

||

|

|

|

|

|

|

|

|||

|

|

|

|

|

Corporation Assessment |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your first name |

|

MI |

Last name |

|

Suffix |

||||

➜ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s name |

|

MI |

Last name |

|

Suffix |

||||

➜ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

Current home address (number and street including apartment number or rural route) |

|||||||||

➜ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

City, town, or APO |

|

|

State |

ZIP |

|||||

Individual

Income Tax

FILING PERIOD

2019

Your Social

Security Number

Spouse’s Social

Security Number

Area code and daytime telephone number

➜ |

For amended return, mark this box.

Louisiana Revised Statute 47:6025 allows a refundable tax credit equal to 25 percent of the Louisiana Citizens Property Insurance assessment that you paid between January 1, 2019, and December 31, 2019, as a part of your homeowner’s insurance premium. You may claim the Louisiana Citizens Property Insurance Corporation assessment refund on this form or on your individual income tax return, but not on both forms. Claiming the refund on both forms will delay your individual income tax return for review.

One Property

If you paid the Louisiana Citizens Property Insurance Corporation assessment for only one property, list the property’s address, the insurance company’s name, and the insurance policy number in the boxes below. Enter the amount of your paid assessment below on Line 1.

Address of Property

Insurance Company

Policy Number

More Than One Property

If you paid the Louisiana Citizens Property Insurance Corporation assessment for more than one property, complete the Supplement Schedule for Refund of Louisiana Citizens Property Assessment, Form

YOU MUST ATTACH A COPY OF YOUR INSURANCE DECLARATION PAGE FOR ALL PROPERTIES.

REFUND

1. Enter the amount of the total assessment paid. . . . . . . . . . . . . . . . . . 對 . . . .

2. REFUND - Multiply Line 1 by 25 percent (.25). . . . . . . . . . . . . . . . . . 對 . . . .

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. I also consent that the Louisiana Department of Revenue may contact my insurance company/companies to verify the amount of the Louisiana Citizens Property Insurance Corporation assessment paid, and I further direct my insurance company/ companies to provide the Citizens Insurance Assessment information to the Louisiana Department of Revenue upon request.

Your Signature

Date (mm/dd/yyyy)

Spouse’s Signature (If filing jointly, both must sign)

Date (mm/dd/yyyy)

PAID

PREPARER USE ONLY

Print Preparer’s Name |

Preparer’s Signature |

Date (mm/dd/yyyy) |

|

|

|

|

|

|

Check ■ if |

|

|

|

|

|

Firm’s Name ➤ |

|

|

Firm’s FEIN ➤ |

|

|

|

|

|

|

Firm’s Address ➤ |

|

|

Telephone ➤ |

|

|

|

|

|

|

MAIL TO:

Louisiana Department of Revenue

P. O. Box 3576

Baton Rouge, LA

For Office |

|

PTIN, FEIN, or LDR Account Number |

||||||||||

Use Only. |

|

|

|

of Paid Preparer |

||||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6977

Instructions for Preparing your 2019 Louisiana Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment

Mail return to:

Louisiana Department of Revenue

P. O. Box 3576

Baton Rouge, LA

About this Form

The return has been designed for electronic scanning, which permits faster processing with fewer errors. In order to avoid unnecessary delays caused by manual processing, taxpayers should follow the guidelines listed below:

1.An individual may file this form to claim the refund of the Louisiana Citizens Property Insurance Corporation assessment(s) that was paid during calendar year 2019.

2.Enter the amount only on the line that is applicable.

3.Complete the form by using a pen with black ink.

4. Because this form is read by a machine, please enter your numbers inside the boxes like this: 1 2 3 4 5

5.All numbers should be rounded to the nearest dollar.

6.Numbers should NOT be entered over the

7. If you are filing an amended return, mark an “X” in the “Amended Return” box.

8.Failure to attach the Insurance Declaration Page(s) will result in this form being returned to you.

Name(s), address, and Social Security Number(s) – Enter your name(s), address, and Social Security Number(s) in the space provided. If married, please enter Social Security Numbers for both you and your spouse.

Information concerning the assessment amounts and Insurance Declaration Page – The amount of this assessment may appear as separate line items on what is referred to as the “Declaration Page” of your property insurance premium notice. The Declaration Page names the policyholder, describes the property or liability to be insured, type of coverage, and policy limits. Depending on the location of the insured property, these line item charges may be listed as: Louisiana Citizens FAIR Plan REGULAR Assessment, Louisiana Citizens FAIR Plan EMERGENCY Assessment, Louisiana Citizens Coastal Plan REGULAR Assessment, and/or Louisiana Citizens Coastal Plan EMERGENCY Assessment. Your total assessment paid is the total of these amounts, if they are shown on the Declaration Page.

Important note: If you are a customer of the Louisiana Citizens Insurance Corporation and you paid the Tax Exempt Surcharge, this surcharge may not be claimed.

•Enter the address of the property, the insurance company’s name, and the policy number in the spaces provided.

•Do you own more than one property that incurred an assessment?

If you had more than one property during 2019 that incurred an assessment, prepare and attach Form

9.Sign and date the return. Mail the return to the address at the top of this form.

Paid Preparer Instructions

If your return was prepared by a paid preparer, that person must also sign in the appropriate space, complete the information in the “Paid Preparer Use Only” box and enter his or her identification number in the space provided under the box. If the paid preparer has a Preparer Tax Identification Number (PTIN), the PTIN must be entered in the space provided under the box, otherwise enter the Federal Employer Identification Number (FEIN) or LDR account number. If the paid preparer represents a firm, the firm’s FEIN must be entered in the “Paid Preparer Use Only” box. The failure of a paid preparer to sign or provide an identification number will result in the assessment of the unidentified preparer penalty on the preparer. The penalty of $50 is for each occurrence of failing to sign or failing to provide an identification number.

Document Breakdown

| Fact | Detail |

|---|---|

| Form Title | Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment |

| Form Number | R-540INS |

| Revision Date | January 2019 (1/19) |

| Purpose | To claim a refundable tax credit for Louisiana Citizens Property Insurance Corporation assessment paid in 2019 |

| Eligibility | Individuals who paid Louisiana Citizens Property Insurance Corporation assessment in 2019 |

| Refund Calculation | 25 percent of the paid Louisiana Citizens Property Insurance Corporation assessment |

| Document Requirement | Attachment of the Insurance Declaration Page for all listed properties is mandatory |

| Filing Options | Refund claim can be made on this form or on individual income tax return, but not on both |

| Amended Return Option | Mark “Amended Return” box for filing an amended return |

| Governing Law | Louisiana Revised Statute 47:6025 |

| Mailing Address | Louisiana Department of Revenue P. O. Box 3576 Baton Rouge, LA 70821-3576 |

Instructions on Filling in R 540Ins Louisiana

Filing the R-540INS form is an important step for Louisiana residents seeking a refund for the Louisiana Citizens Property Insurance Corporation assessment. This process involves providing detailed information about your insurance and the assessments paid, so it's crucial to approach this with careful attention to detail. Here's how to correctly fill out the form to ensure your submission is processed efficiently and accurately.

- Begin with your personal information, including your first name, middle initial (MI), last name, and any suffix. If you are filing a joint return, include your spouse's name, MI, last name, and suffix.

- Enter your current home address, including the number, street, apartment number or rural route, city, town, or APO, state, and ZIP code.

- State the filing period by writing "2019" in the designated space.

- Provide your Social Security Number in the given box. If filing jointly, make sure to also include your spouse's Social Security Number.

- Add your area code and daytime telephone number in the specified area.

- Check the box if you are filing an amended return.

- For those with one property, list the property’s address, the insurance company’s name, and the insurance policy number. Then, enter the total assessment paid on Line 1.

- If you paid assessments for more than one property, prepare and attach the Supplement Schedule for Refund of Louisiana Citizens Property Assessment (Form R-INS Supplement). Enter the sum of these assessments on Line 1.

- Calculate your refund by multiplying the total assessment paid (from Line 1) by 25 percent and enter this amount on Line 2.

- Ensure all information on the form is true to your knowledge, then sign and date the form. If filing jointly, both you and your spouse must sign and date.

- If a paid preparer completed the form on your behalf, they must also sign and date in the "PAID PREPARER USE ONLY" section, including their PTIN, FEIN, or LDR account number.

- Attach a copy of the Insurance Declaration Page(s) for all properties listed.

- Finally, mail the completed form and any required attachments to the Louisiana Department of Revenue at P. O. Box 3576, Baton Rouge, LA 70821-3576.

Completing the R-540INS form accurately is essential for processing your request for a refund. Carefully review your information and double-check that all required documents are included before mailing your submission. This ensures a smoother process and helps avoid potential delays in receiving your refund.

Listed Questions and Answers

What is the R-540INS Louisiana Form?

The R-540INS Louisiana Form, also known as the Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment, is a document used by individuals to claim a refundable tax credit. This credit is equal to 25 percent of the Louisiana Citizens Property Insurance assessment paid as part of the homeowner's insurance premium between January 1, 2019, and December 31, 2019.

Who can file the R-540INS Louisiana Form?

Any individual who has paid the Louisiana Citizens Property Insurance Corporation assessment during the calendar year 2019 is eligible to file the form. It is important to ensure that you haven't claimed this refund on both the R-540INS form and your individual income tax return, as this could delay the review and processing of your tax return.

What information do I need to provide on the R-540INS Form?

To complete the R-540INS Form, you will need to provide several pieces of information, including:

- Your full name and if applicable, your spouse's full name.

- Current home address, including apartment number or rural route, city, town, or APO, state, and ZIP code.

- Your Social Security Number and, if filing jointly, your spouse’s Social Security Number.

- Area code and daytime telephone number.

- The address of the insured property, the insurance company's name, and the insurance policy number. For multiple properties, a Supplement Schedule for Refund of Louisiana Citizens Property Assessment (Form R-INS Supplement) must be completed and attached.

How do I calculate the refund amount on the R-540INS Form?

The refund is calculated by multiplying the total assessment paid during the eligible period by 25 percent (.25). You need to enter the total assessment paid in the space provided on Line 1 of the form, then multiply this number by .25 and enter the result on Line 2 as your refund amount.

What documents must I attach with the R-540INS Form?

When filing the R-540INS Form, it's mandatory to attach a copy of your Insurance Declaration Page for all properties you are claiming an assessment refund. The failure to include these documents will result in the form being returned to you for completion.

Where and how do I submit the R-540INS Louisiana Form?

The completed form, along with all required attachments, should be mailed to the Louisiana Department of Revenue at:

P. O. Box 3576 Baton Rouge, LA 70821-3576

Ensure that all information is accurate and complete to avoid processing delays. If you're filing an amended return, remember to mark the 'Amended Return' box on the form.

Common mistakes

Filling out forms can sometimes be tricky, and making mistakes is common, especially with specific forms like the R-540INS for Louisiana. Here are nine mistakes people often make when completing this form:

- Not attaching the Insurance Declaration Page(s) for each property, which is a must for the form to be processed.

- Entering incorrect or incomplete property addresses or policy numbers, causing delays or issues with the claim.

- Failing to list the insurance company's name accurately, which is crucial for verification purposes.

- Incorrectly calculating the refund amount, by either not multiplying the total assessment paid by 25 percent or making math errors.

- Using ink colors other than black, which can cause issues with electronic scanning and processing.

- Rounding errors or entering cents instead of rounding to the nearest dollar as instructed.

- Claiming the refund on both the R-540INS form and the individual income tax return, which leads to processing delays.

- Missing signatures, especially if filing jointly. Both parties must sign the form for it to be valid.

- Using incorrect or incomplete Social Security Numbers, which is critical for identity verification.

By carefully avoiding these common errors, individuals can help ensure their request for a refund is processed smoothly and efficiently. Always double-check entries and attachments before mailing the form to avoid unnecessary delays.

Documents used along the form

When handling property insurance matters in Louisiana, particularly with regard to claiming refunds for the Louisiana Citizens Property Insurance Corporation assessment, individuals often need to supplement their R-540INS form with various other documents. These additional forms ensure a comprehensive approach, providing all necessary details and fulfilling the requirements set by the Louisiana Department of Revenue. Here's a brief overview of these supplementary documents.

- Form R-INS Supplement: Used when an individual has paid assessments on more than one property. This form gathers detailed information on each property, including the address, the insurance company name, and the policy number, ensuring that refunds are accurately calculated for each assessed property.

- Insurance Declaration Page(s): This is a critical document that must be attached to the R-540INS form or its supplement. It details the coverage specifics of the insured property, listing the policyholder, descriptions, type of coverage, policy limits, and, importantly, the assessment amounts. These page(s) serve as proof of the assessments paid.

- Louisiana Individual Income Tax Return: For those choosing to claim their refund directly on their tax return, the state's individual income tax return form is essential. It may serve as an alternative to the R-540INS, offering a streamlined process for claiming the tax credit.

- Amended Louisiana Individual Income Tax Return: If there are errors or omissions on the original tax return related to the Louisiana Citizens Property Insurance Corporation assessment refund, an amended return may be necessary. This ensures accuracy and compliance, correcting any previous mistakes.

- Power of Attorney and Declaration of Representative (Form R-7004): For individuals who decide to have a representative handle their tax matters, especially concerning refunds, this form authorizes another person to receive confidential information and make decisions on their behalf. It establishes a legal representation for tax purposes.

Successfully navigating the process of claiming a refund for the Louisiana Citizens Property Insurance Corporation assessment involves careful attention to detail and the correct assembly of necessary documentation. By understanding and utilizing these complementary forms effectively, individuals can ensure accuracy in their submissions, facilitating a smoother review process by the Louisiana Department of Revenue. This approach not only adheres to procedural requirements but also accelerates the refund process, ensuring that taxpayers receive their entitled benefits in a timely manner.

Similar forms

The R-540INS Louisiana form is similar to other state-specific insurance reimbursement forms, each tailored to address particular state-level insurance assessments and tax credits related to property insurance. These forms, though uniquely designed for their respective states, share a common purpose with the R-540INS, aiming to simplify the process for taxpayers to claim refunds or credits for certain insurance-related expenses.

Similar to the R-540INS: One such form is the New Jersey Homestead Benefit Application. Like the R-540INS, this application allows homeowners in New Jersey to apply for a rebate or credit on their property taxes, reflecting a state-specific relief effort similar to Louisiana's insurance assessment refund. Both forms require detailed property and homeowner information and documentation to support the claim, emphasizing the importance of accurate record-keeping. The significant difference, however, hinges on the nature of the benefit – Louisiana focuses on insurance assessment refunds, while New Jersey emphasizes property tax relief.

Another document sharing similarities with the R-540INS is the California Insurance Premium Tax Return. While this form caters to insurers operating within California, necessitating they report premiums and pay respective taxes, it underscores the broader relationship between property insurance and state fiscal mechanisms, akin to the intent behind Louisiana's form. Both the California tax return and the R-540INS engage with insurance premiums from different perspectives – one from the insurer's obligation to the state and the other from the homeowner's right to a refund – yet, they collectively illustrate the intricate ties between insurance operations and state financial policies.

Lastly, the Florida Application for Refund of Sales Taxes Paid on Building Materials highlights a different yet relevant aspect of state-specific incentives aimed at property owners. Although this form is dedicated to obtaining refunds for sales taxes on materials used in property construction or renovation, it resonates with the purpose behind the R-540INS by providing financial benefits to property owners. Both forms emphasize the state's role in offering financial relievers to its residents, albeit targeting different expense categories associated with property ownership and maintenance.

Dos and Don'ts

Filling out the R-540INS Louisiana form, a Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment, requires attention to detail and accuracy. To ensure that the process goes smoothly, here are five things you should do and five things you shouldnithen't do:

Do:

- Ensure you're eligible for the refund by confirming you paid the Louisiana Citizens Property Insurance Corporation assessment between January 1, 2019, and December 31, 2019.

- Use black ink when completing the form to ensure the information is readable for electronic scanning, which helps avoid delays.

- Round all numbers to the nearest dollar and avoid entering numbers over the pre-printed zeros designated for cents.

- Attach a copy of your Insurance Declaration Page for all properties you're claiming an assessment for. This document is necessary for verification.

- If filing for more than one property, make sure to fill out and attach the Supplement Schedule for Refund of Louisiana Citizens Property Assessment (Form R-INS Supplement) in addition to the main form.

Don't:

- Claim the refund twice by filling out this form and also claiming it on your individual income tax return. Doing so will delay the processing of your return.

- Forget to sign and date the form. If filing jointly, both you and your spouse must sign the form for it to be processed.

- Use any other color ink besides black, as it may not be recognized properly by the scanning equipment.

- Leave any required fields blank, especially your social security number, the property address(es), the insurance company’s name(s), and the policy number(s). Missing information can lead to processing delays or even rejection of your refund request.

- Ignore the instruction to not claim the Tax Exempt Surcharge if you're a customer of the Louisiana Citizens Insurance Corporation and paid it. This surcharge is not eligible for the refund.

Misconceptions

Understanding the nuances of tax forms and their related misconceptions is crucial, especially when dealing with specific state provisions like the Louisiana R-540INS form. This form, designed to request a refund for the Louisiana Citizens Property Insurance Corporation Assessment, is a vital tool for eligible residents. Let’s clarify some common misconceptions about this form.

Misconception 1: You can only file the R-540INS form if you have a single property.

This is not accurate. While the form allows for direct listing of assessment information for one property, those with multiple properties must also complete the Supplement Schedule (Form R-INS Supplement) and attach it, ensuring all their eligible properties are considered for the tax credit.

Misconception 2: The form is complicated and requires professional assistance.

The form design and instructions aim to be clear and user-friendly, enabling taxpayers to file without necessarily requiring paid professional help. Nevertheless, seeking assistance might be beneficial for clarity or correctness.

Misconception 3: You can file the R-540INS form or claim the assessment refund on your individual return, whichever is convenient.

While it appears to offer flexibility, claiming the refund on both this form and your individual income tax return will delay processing. It’s an either/or scenario, intended to streamline the refund process and eliminate duplication.

Misconception 4: Any assessment you pay can be claimed for a refund.

Not all assessments are eligible for the tax credit. Specifically, the Tax Exempt Surcharge paid to the Louisiana Citizens Insurance Corporation cannot be claimed. It’s essential to understand which assessments qualify for the refund to avoid mistakes.

Misconception 5: Filing an amended return is discouraged and might lead to an audit.

Filing an amended return by marking the designated box on the form is a legitimate process for correcting errors or omissions. It’s not inherently a red flag for audits but rather a taxpayer right for accuracy.

Misconception 6: Electronic submission is an option for the R-540INS form.

As of the form’s last revision, it requires mailing to the Louisiana Department of Revenue. This paper submission requirement ensures that all necessary documents, such as the Insurance Declaration Page(s), are appropriately attached and verifiable.

Misconception 7: The refund amount is negotiable or varies.

The refund is calculated as a straight 25 percent of the paid eligible assessment, as clearly dictated by the form. There’s no ambiguity in the amount, provided the taxpayer accurately reports the total assessment paid.

Misconception 8: You need to submit separate forms for each property assessed.

This misunderstanding can complicate the process unnecessarily. For those with more than one property, the R-INS Supplement is specifically designed to consolidate all properties onto a single additional form, streamlining the submission.

Misconception 9: The paid preparer’s signature is optional.

If a professional prepares the form, their signature and identification information are mandatory. This requirement ensures accountability and compliance with tax preparation standards, with specific penalties applied for non-compliance.

Clearing up these misconceptions ensures that taxpayers can confidently approach filing the R-540INS form, understand its importance, and accurately claim the tax credits they are entitled to. It underscores the importance of careful reading of instructions and, when in doubt, seeking clarification to abide by the tax laws effectively.

Key takeaways

Understanding the R-540INS Louisiana form is crucial for residents looking to claim a refund on the Louisiana Citizens Property Insurance Corporation assessment. This form is specifically designed for individuals who paid this assessment as part of their homeowner's insurance premium during the calendar year 2019. Below are key takeaways to ensure the process is both efficient and compliant.

- The R-540INS form is intended for individuals seeking a refund of the Louisiana Citizens Property Insurance Corporation assessment(s) paid within the specified period (January 1, 2019, to December 31, 2019).

- A refundable tax credit equal to 25 percent of the paid assessment can be claimed using this form. However, it's important to note that this claim can be made either on the R-540INS form or on the individual income tax return, but not on both.

- For homeowners who paid assessments for more than one property, a Supplement Schedule (Form R-INS Supplement) must be completed and attached.

- Submission of the Insurance Declaration Page for all listed properties is mandatory. Failing to attach these documents will result in the form being returned.

- The form requires basic identification details, including your first and last name, current home address, Social Security Number(s), and a contact telephone number.

- Accuracy is key when filling out this form. Use black ink and ensure numbers are neatly entered inside the boxes to facilitate electronic scanning and prevent processing delays.

- Round all numbers to the nearest dollar, and do not enter cents. Also, avoid overriding pre-printed zeros in the boxes designated for cents.

- If filing an amended return, there is a specific box that must be marked to indicate this. This is crucial for the processing of your claim.

- Finally, both the form and any accompanying schedules or statements must be signed and dated, affirming that all information provided is accurate. If a paid preparer was used, their signature and identification information are also required.

Following these guidelines closely will help streamline the process of claiming your refund. Remember, the Louisiana Department of Revenue requires detailed verification, including the possibility of contacting your insurance company to confirm the assessments paid. Proper documentation and adherence to the specified instructions are essential for a smooth submission.

Popular PDF Templates

Ss984N - Structured to capture essential details like the notary's name and specific allegations of misconduct.

Louisiana 2022 Tax Forms - Centralizes the process of making requests to the Louisiana government, simplifying access to various state services.