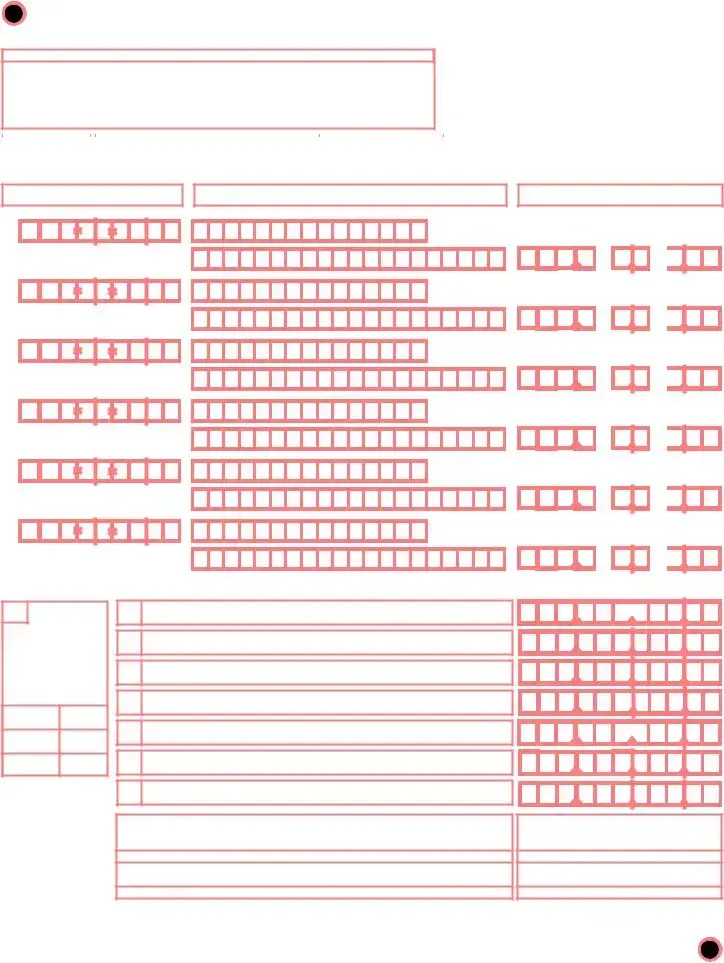

Free Louisiana Wage Report Template

The Louisiana Wage Report form is a document essential for employers in the state, designed to streamline the process of reporting wages and certain tax liabilities. As of January 31, 2012, the transition to electronic filing became mandatory for employers with a workforce of 100 or more, reflecting a broader move towards digital submissions accessible via www.laworks.net. This shift underscores the importance of accuracy in submitting preprinted information, including details such as the employer account number and the reporting year/quarter, without any alterations unless executed through the designated Employer's Report of Change Form. The form meticulously guides the employer through recording individual employee wages, rounded to the nearest dollar, and mandates the inclusion of social security numbers to ensure credit is accurately attributed to the employees for their wages. It further requires the calculation of the total number of covered workers per pay period and a summation of wages, not excluding the directive to report any periods of zero employment. Notably, the form also outlines the procedure for calculating excess wages, with a clear example provided for ease of understanding. Employers are reminded of the implications of late filings, which could result in interest and penalties assessed on overdue amounts. Additionally, the form serves as a resource for managing overpayments or underpayments, with specific instructions for applying credits or calculating additional amounts due for late submissions. This holistic approach encapsulates not only the reporting requirements but also offers guidance on managing potential financial adjustments, ensuring employers are well-equipped to comply with state regulations.

Form Example

,>$$$

5,, |

|

6""& |

|

7!; |

|

8$#,& |

|

|

|

|

|

|

|

:#1#)!:)'

? "0 02/ %)>(78 >!47@8

'

9<= |

+ |

|

|

4 |

|

|

|

|

0 |

|

|

|

|

2 |

|

|

|

|

|

5

6

7

8

9

IMPORTANT: Reports on disks will no longer be accepted after Jan. 31, 2012. Employers reporting 100 or more employees MUST file electronically at www.laworks.net.

& 0*$

?A2A?$

"*$

2$ A2"2"$2

52 "22

# B

:2

5$ :2

6$ :2

#" 22

2

$ ""

7>0!*=

5 2%'

6 2+#"$02'

7 #(" 344$*$'

8 (&2+'

9 .,/,))!)/,,)01)!0)#

4

!"#"$#$% "&'

(=%$%

|

|

|

|||

|

|

|

|

||

|

|||||

|

|

||||

|

|

||||

|

|

||||

|

|||||

|

|||||

,

%2&

*004BC1101* *999999920101*

7>0 |

5 |

YEAR/QUARTER |

(PREPRINT) |

EMPLOYER ACCOUNT NUMBER |

(PREPRINT) |

!"#

/'. 0#1,)&*2)**3

+.' .

►Items 1, 2, 3, 4, 5 and 6 have been pre)printed on the report. IMPORTANT: Do not alter the preprinted information on this document. Changes must be reported on the Employer’s Report of Change Form, found at www.laworks.net.

►In Item 7, enter number of continuation sheets.

►In Items 8, 9 and 10, enter on lines 1 thru 6 the employee's social security number, the total wages paid (including tips), and the first and last name of each employee. Round to the nearest dollar amount. (up or down; I.E. $1081.49 shall be rounded to $1081.00 and $1081.50 shall be rounded to $1082.00). If you are reporting more than 6 employees, you will need a continuation sheet. If continuation sheets are needed go to www.laworks.net to download the Employer's Wage Report)Continuation Sheet.

Wage totals must be entered on each sheet; total wages this quarter, including continuation sheets, should be entered on line 13.

NOTE: In order to receive proper credit for the wages paid to your employees the social security numbers must be listed.

►In Item 11, enter the number of covered workers in each pay period including the 12th of each month (Do not include workers on strike).

►Total the wages entered for the employees on the front of this form and enter this amount in Item 12.

►In item 13, enter the total from Item 12 and the totals from each continuation sheet you have attached.

SIGNATURE: Each report must be signed and dated by the proprietor, officer of the corporation, partner or duly authorized individual. Please provide title and telephone number.

IF YOU HAD NO EMPLOYMENT IN ANY PAY PERIOD YOU MUST FILE THIS REPORT ENTERING ZERO ()0)) WAGES.

NOTE: THE WAGE BASE WAS $7000 PRIOR TO THE YEAR 2010.

►In Item 14, enter the total of all reported employees’ excess wages for the quarter.

The following is an example of an excess wage calculation based on a wage base of $7700.00. Jan Doe earned $3500 in the 1st quarter (Jan., Feb., Mar.). You will have )0) excess wages. Jan Doe earned $3000 in the 2nd quarter (Apr., May, June). You will have )0) excess wages. Jan Doe earned $3000 in the 3rd quarter (July, Aug., Sept.). You will have $1800 excess wages. Jan Doe earned $2500 in the 4th quarter (Oct., Nov., Dec.). You will have $2500 excess wages.

NOTE: EXCESS WAGES NEVER EXCEED TOTAL WAGES IN A QUARTER.

IMPORTANT: For your information only...(Effective Jan. 1, 1998)

To compute the total amount of the contributions you paid which may be reported on your FUTA 940 tax form.

Multiply this factor |

(REPRINT) |

times the tax due ___________ |

If you received a Notice of Tax Overpayment (Form T287ES) you may use any part of this credit toward your contributions due. Enter the amount of the overpayment you wish to use on line 17 of the Employer’s Quarterly Wage and Tax Report.

(NOTE : Overpayments equal to or less than $500 will be preprinted in this field. Underpayments equal to or less than $5 will be preprinted in this field.)

If you are filing after the due date for this quarter a portion of the interest and penalty due will be subtracted from the remittance. To calculate interest and penalty see the example below.

EXAMPLE: Assume the report is 15 days past the due date for the 1st quarter of 2000 (04/30/00).

The tax due = $350.00 and an underpayment of $2.50 is on the account. This brings the total due to $352.50. The interest calculation at 1% per month is 0.50% times the $352.50 tax due totaling $1.74.

The penalty calculation at 5% per month is of tax due + interest due , totals $17.71. The total payment equals $352.50 + 1.74 + 17.71 = $371.95.

Add the interest and penalty calculated to the tax due and enter on line 18 as total remittance.

QUESTIONS CAN BE DIRECTED TO: (PREPRINT) |

.___________________________________________ |

%1#4%556##%##56##4#78%9%6#%11

Document Breakdown

| # | Fact | Detail |

|---|---|---|

| 1 | Electronic Filing Requirement | Employers with 100 or more employees must file electronically via www.laworks.net. |

| 2 | Discontinued Disk Reports | Reports submitted on disks were no longer accepted after January 31, 2012. |

| 3 | Preprinted Information | Items 1 to 6 are preprinted on the form and should not be altered; changes must be reported on the Employer’s Report of Change Form. |

| 4 | Wage Rounding | Wages, including tips, should be rounded to the nearest dollar. |

| 5 | Continuation Sheets | If reporting more than 6 employees, continuation sheets are required which are available at www.laworks.net. |

| 6 | Reporting Covered Workers | Number of covered workers in each pay period including the 12th of each month must be reported, excluding workers on strike. |

| 7 | Wage Base Change | Before the year 2010, the wage base was $7000, impacting excess wage calculations. |

| 8 | FUTA Contribution Calculation | For FUTA 940 tax form reporting, a specific calculation factor effective from January 1, 1998, can be used for determining the total amount of contributions paid. |

Instructions on Filling in Louisiana Wage Report

Filling out the Louisiana Wage Report form is a critical process for employers to ensure accurate payroll reporting and compliance with state regulations. This document helps to track wages paid to employees, which is essential for state unemployment insurance purposes. Employers should approach this task with care, making sure all information is correct to avoid any potential issues.

- Review the preprinted sections (Items 1 through 6), which include details such as YEAR/QUARTER and EMPLOYER ACCOUNT NUMBER. It's crucial not to alter these sections. Any necessary changes must be submitted using the Employer’s Report of Change Form available at www.laworks.net.

- In Item 7, write the number of continuation sheets attached, if any are needed beyond the initial page to report all employees.

- For Items 8, 9, and 10, on lines 1 through 6, enter each employee’s social security number, the total wages paid (including tips), and the employee's first and last name, respectively. Ensure wages are rounded to the nearest dollar.

- If you have more than six employees to report, use the Employer's Wage Report-Continuation Sheet, which can be downloaded from www.laworks.net. Remember to include the total wages for the quarter on line 13, summing up this page and any continuation sheets.

- In Item 11, count the number of covered workers in each pay period, specifically including the 12th of each month. Do not count workers on strike.

- Calculate the total wages from the front of this form and any continuation sheets, then enter this amount in Item 12.

- Add the totals from Item 12 and from each continuation sheet to reach a grand total, which should be entered in Item 13.

- The form requires a signature at the bottom. It must be signed and dated by the business proprietor, an officer of the corporation, a partner, or another duly authorized individual. Include the signer's title and telephone number.

- If no wages were paid during any pay period within the quarter, it's essential to still file this report by entering zero wages.

- For Item 14, enter the total of all reported employees' excess wages for the quarter, calculated based on the guidelines provided within the form.

Upon completion, if any taxes are due, refer to the section detailing how to calculate interest and penalties for late submission, if applicable. This includes adding any applicable interest and penalty to the amount due and writing this in Item 18 as the total remittance. Remember, accurate reporting and timely filing are key to compliance and avoiding unnecessary fees. For questions, contact details are preprinted on the form for assistance.

Listed Questions and Answers

What is the Louisiana Wage Report Form?

The Louisiana Wage Report Form is a document that employers must complete to report wages paid to employees, including tips. It is essential for calculating employer contributions to the state and for compliance with Louisiana employment laws.

Who is required to file the Louisiana Wage Report Form electronically?

Employers with 100 or more employees are mandated to file their Wage Report Forms electronically through the Louisiana Workforce Commission website at www.laworks.net.

Can I alter preprinted information on the Louisiana Wage Report Form?

No, changes to the preprinted information cannot be made directly on the form. Instead, employers must report any changes using the Employer’s Report of Change Form available at www.laworks.net.

What should I do if I need to report more than 6 employees?

If reporting for more than 6 employees, you need to use a continuation sheet. The Employer's Wage Report Continuation Sheet is available for download at www.laworks.net. Make sure to enter wage totals on each sheet and combine them for the total wages this quarter.

How do I calculate and report excess wages?

Excess wages refer to the portion of an employee's earnings that exceed the state's wage base in a quarter. For each quarter, summarize the wages that surpass the wage base for all reported employees and enter this total in Item 14 of the form.

What if I had no employment during a pay period?

Even if no wages were paid during a pay period, you must file the report stating zero wages to maintain compliance.

How can I figure out the interest and penalty if my report is late?

If filing after the due date, calculate interest at a rate of 1% per month on the tax due, and penalties at 5% per month. Add these amounts to the tax due to find the total amount of remittance required.

Where can I get help if I have questions about the form?

For assistance with the Louisiana Wage Report Form, employers can contact the Louisiana Workforce Commission through the contact information preprinted on the form.

Common mistakes

When filling out the Louisiana Wage Report form, it's essential to avoid common mistakes to ensure accurate and timely processing. Here are eight mistakes often made:

Not using the preprinted information correctly. The form comes with certain fields preprinted, such as items 1 through 6, which should not be altered. Any changes need to be reported on a separate Employer’s Report of Change Form.

Incorrectly rounding the total wages paid. Wages, including tips, should be rounded to the nearest dollar, meaning if it's $1081.49, it should be rounded to $1081.00, and $1081.50 should be rounded to $1082.00.

Failing to use continuation sheets when reporting more than six employees. If there are more wages to report, one must download the continuation sheet from the website.

Forgetting to enter the total wages on each continuation sheet. It's crucial to include the total wages for this quarter on line 13, which combines the initial page and any additional sheets.

Omitting social security numbers. Proper credit for wages paid can only be received if the social security numbers are listed for all employees.

Not accurately reporting the number of covered workers in each pay period. This includes those working on the 12th of each month but excludes workers on strike.

Error in calculating excess wages. It's necessary to understand and accurately calculate the excess wages for each quarter, keeping in mind that excess wages never exceed total wages.

Incorrectly calculating interest and penalties if filing late. This requires understanding the example provided and accurately applying it to the situation if the report is submitted after the due date.

Ensuring these details are correctly handled can simplify the process and prevent delays or issues with the Louisiana Wage Report submission.

Documents used along the form

When completing the Louisiana Wage Report form, businesses may need to prepare and submit additional documents to ensure accurate and comprehensive compliance with state employment regulations. Understanding each document and its purpose can streamline the reporting process, making it more efficient for employers.

- Employer’s Report of Change Form: This form is necessary when there are changes to the preprinted information on the Louisiana Wage Report form. It’s used to update the state's records on the employer's address, business name, ownership, or other relevant details.

- Employer's Wage Report Continuation Sheet: Employers with more than six employees need this continuation sheet to report additional employee wages. It ensures that every employee's wages are accounted for and properly reported.

- Notice of Tax Overpayment (Form T287ES): This document is used when an employer has a credit due to overpaying taxes in previous periods. Employers can apply this credit towards current contributions due.

- Employer’s Quarterly Wage and Tax Report: A comprehensive form that details the total wages paid, taxes owed, and any adjustments for overpayments or underpayments. It includes the total amount of contributions to be reported on the FUTA 940 tax form.

- FUTA 940 Tax Form: Federal Unemployment Tax Act (FUTA) form where employers report their annual federal unemployment taxes. The Louisiana Wage Report assists in gathering some of the necessary information to complete this form.

- Request for Employment Information Form: Employers may need to submit this form to verify employment and wage information for specific purposes, such as unemployment claims or verification for social services.

Acknowledging and preparing these documents in conjunction with the Louisiana Wage Report form can significantly aid businesses in maintaining compliance with reporting requirements. Doing so not only adheres to legal standards but also benefits the overall management of employee records and payroll processing.

Similar forms

The Louisiana Wage Report form is similar to other essential documents used in the realm of employment and taxation. These include the Federal Unemployment Tax Act (FUTA) Tax Form 940, the Quarterly Federal Tax Return Form 941, and the Employer's Quarterly Wage Report and Unemployment Tax Return Form used in various states. Each of these documents plays a pivotal role in ensuring that employers report their payroll expenses and taxes accurately, albeit serving slightly different purposes within the tax reporting process.

Federal Unemployment Tax Act (FUTA) Tax Form 940: The Louisiana Wage Report Form and the FUTA Tax Form 940 share similarities in that both are crucial for reporting wages paid to employees and calculating unemployment taxes. Form 940 specifically is used by employers to report annual federal unemployment taxes. Similar to the Louisiana Wage Report, employers must detail the total wages paid, but Form 940 emphasizes the federal unemployment contributions. Both forms contribute to the administrative funding of state unemployment insurance and job service programs.

Quarterly Federal Tax Return Form 941: Form 941, however, is filed quarterly and focuses on reporting wages, tips, and other compensation paid to employees. It also includes calculations for withholding income tax, social security, and Medicare taxes. Like the Louisiana Wage Report Form, Form 941 requires detailed employee wage information and total payroll taxes deducted for the period. This form is vital for reconciling the taxes withheld from employees’ paychecks with the employer's tax liability.

Employer's Quarterly Wage Report and Unemployment Tax Return: State-specific versions of the Employer's Quarterly Wage Report and Unemployment Tax Return closely resemble the Louisiana Wage Report form in function and purpose. They require employers to submit detailed wage data for each employee, including total quarterly wages and social security numbers. The aim is to accurately calculate and report state unemployment insurance taxes due. Despite the variations in name and slight differences in format, these forms collectively ensure proper funding for unemployment benefits, relying on accurate employer reporting as does the Louisiana Wage Report.

Dos and Don'ts

When filling out the Louisiana Wage Report form, there are certain practices to observe to ensure accuracy and compliance with state requirements. Below is a list of recommended do's and don'ts:

- Do report electronically if you are employing 100 or more employees, as mandated.

- Do not alter the preprinted information on the form. Instead, use the Employer’s Report of Change Form for any updates.

- Do round the wages paid to the nearest dollar when completing items 8, 9, and 10.

- Do ensure you list the social security numbers of your employees to receive proper credit for the wages paid.

- Do not include workers on strike when entering the number of covered workers for each pay period in item 11.

- Do sign and date the report, providing the title and telephone number of the authorized individual.

- Do file this report even if you had no employment in any pay period by entering zero wages.

- Do calculate the total of all reported employees’ excess wages for the quarter and enter this in item 14.

- Do not overlook the calculation of interest and penalty if filing after the due date. Add these amounts to your total remittance as shown in item 18.

Following these guidelines will help ensure that the Louisiana Wage Report is correctly and promptly filled out, minimizing errors and potential compliance issues.

Misconceptions

Many employers and employees in Louisiana have misconceptions about the Louisiana Wage Report form, which can lead to errors in compliance and reporting. Here are ten common misconceptions explained:

- Electronic filing is optional for all employers. This is not correct. Employers with 100 or more employees are required to file electronically at www.laworks.net, ensuring a more efficient and secure submission process.

- The form accepts reports on disks. As of January 31, 2012, reports submitted on disks are no longer accepted. This change signifies a move towards digital and more environmentally friendly reporting methods.

- Preprinted information can be altered if incorrect. Preprinted details on the report should not be changed. If there are inaccuracies, corrections must be reported on the Employer’s Report of Change Form available on www.laworks.net.

- Every employee's exact wages need to be reported down to the cent. Employers are actually instructed to round the total wages paid to the nearest dollar, simplifying the reporting process and reducing minor discrepancies.

- There is no need to report if no wages were paid during a quarter. Employers must file a report for every quarter, even if no wages were paid, by entering zero in the applicable section to remain compliant.

- The social security number of employees is optional. To ensure proper credit for wages paid, it is mandatory to list the social security numbers of employees. This is critical for accurate record-keeping and tax purposes.

- Calculating excess wages is complex and unnecessary. While it might seem daunting, calculating excess wages is straightforward and essential for determining the total of reported employees’ excess wages for the quarter, based on the wage base in effect.

- Continuation sheets are only for those who exceed the form's employee limit. If reporting more than six employees, continuation sheets are necessary, ensuring complete and organized reporting of all employees.

- Total wages entered in the report don’t need to include continuation sheets. The total wages for the quarter must include amounts from the initial form and all continuation sheets, ensuring accurate wage reporting.

- Interest and penalties for late filing are negligible. Interest and penalties can significantly increase the amount owed. Accurate calculation and timely submission of reports can avoid unnecessary financial charges.

Understanding these misconceptions can help employers ensure they are fully compliant with Louisiana's reporting requirements, thus avoiding errors and potential penalties. Accurate reporting benefits both the employer and the employees by ensuring proper credit for wages earned and contributions made.

Key takeaways

Filling out the Louisiana Wage Report form accurately is crucial for employers to ensure compliance with state regulations. Here are some key takeaways to assist in the process:

- Employers are required to file electronically if they have 100 or more employees, indicating a push towards more streamlined, digital processes. This digital requirement facilitates faster processing and reduces errors associated with manual entries.

- The form already has certain information pre-printed, such as the employer’s account number and year/quarter. It's important not to alter these pre-printed fields. Instead, any necessary changes should be reported using the Employer’s Report of Change Form available at www.laworks.net. This ensures that all data is accurately captured and associated with the correct employer account.

- When listing employees' wages, the form requires the total wages paid, including tips, to be rounded to the nearest dollar, and it mandates the inclusion of employees' social security numbers. These requirements ensure uniformity in reporting and help in the accurate allocation of wage records to employee social security accounts.

- The form includes a section for reporting the total amount of all employees' excess wages for the quarter. Excess wages refer to the amount over the state wage base ($7,700 as of the latest update) within a quarter. Properly calculating and reporting excess wages is vital for determining the correct unemployment insurance contributions and for future credits on the FUTA 940 tax form.

Understanding these nuances can assist employers in maintaining compliance with Louisiana employment laws and can help streamline the wage reporting process. It's also beneficial for ensuring that contributions are accurately calculated, potentially saving time and resources while avoiding penalties for incorrect filings.

Popular PDF Templates

Wildlife Removal Hammond La - Sign and submit the NWCO Permit Application Release Statement, acknowledging the permit’s terms and your commitment to uphold wildlife laws and ethical standards.

Louisiana Fd 9 - Instructions for how to assemble a registration packet for bottled water products, including fee payment in Louisiana.