Free Louisiana Up 1 Template

In the heart of Louisiana's financial responsibility to its residents lies the UP-1 State of Louisiana Department of the Treasury Unclaimed Property Division form, an integral document facilitating the return of unclaimed property to its rightful owners. Updated in February 2013, this essential form serves as a conduit through which businesses and organizations report personal property deemed "unclaimed" by its owners to the Louisiana Department of the Treasury. Grounded in the pursuit of reconnecting individuals with their lost or forgotten assets, the UP-1 form outlines a structured process for reporting unclaimed property, including financial assets like salaries, dividends, and savings, that have been abandoned for a period. Critical for maintaining fiscal integrity and transparency, this form not only delineates the specific information necessary for a successful report, such as holder details and the amount due, but also emphasizes the importance of timely submissions – setting a stern deadline of November 1st every year, with provisions for weekends and holidays. Furthermore, the form underpins the significance of accuracy and honesty, mandating an official verification of the report under the penalty of perjury, thereby ensuring that each submission is approached with the utmost seriousness and dedication to truthfulness. By employing this form, the state strengthens its commitment to reuniting Louisiana residents with their unclaimed properties, thus underlining the importance of thoroughness, precision, and accountability in the management and reporting of unclaimed assets.

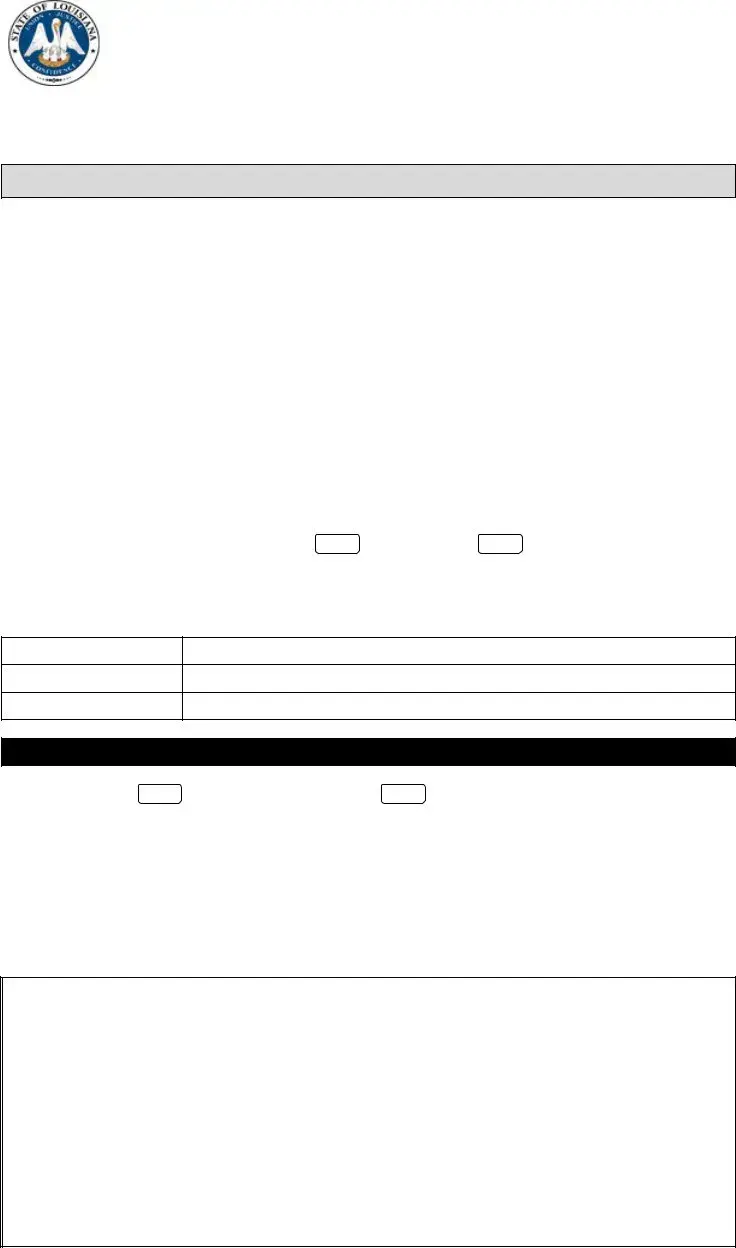

Form Example

Rev. 02/2013 |

||

State of Louisiana |

||

|

||

Department of the Treasury |

|

|

Unclaimed Property Division |

This form may |

|

P.O. Box 91010 |

be reproduced |

|

Baton Rouge, LA |

|

|

(225) |

|

|

LOUISIANA REPORT OF UNCLAIMED PROPERTY VERIFICATION |

|

Report Year: __________________________________ Period Covered: _________________ to ________________

FILE BEFORE NOVEMBER 1.

If the due date falls on a weekend or holiday, the report is due on the next business day and becomes delinquent on the first day thereafter.

Holder Account Number |

|

|

|

(If Known) |

|

|

|

Holder Name: |

|

|

|

|

|

|

|

Address 1: |

|

|

|

|

|

|

|

Address 2: |

|

|

|

|

|

|

|

City, State, Zip: |

|

|

|

|

|

|

|

Contact Person: |

|

|

|

|

|

|

|

Telephone Number: |

|

Fax Number: |

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

Federal ID Number: |

|

|

|

|

|

|

|

State of Incorporation: |

|

Date of Incorporation: |

|

|

|

|

|

Primary Business Activity: |

|

|

|

|

|

|

|

Did you file a report of |

|

|

|

Unclaimed Property last year? |

YES |

NO |

|

|

|

|

|

If NO, please explain: |

|

|

|

|

|

|

|

If you are the successor to a previous holder of the property, or if you have changed your name or address, please make corrections and list your previous name below:

Previous Name:

Previous Address:

Previous City, State, Zip:

YOUR REMITTANCE MUST ACCOMPANY THIS REPORT

PLEASE MARK ONE: |

Annual Report (DUE NOVEMBER 1) |

Supplemental/Additional Report |

||

|

|

|

|

|

|

Total Amount Due From Last Page: |

|

$ |

|

|

|

|

|

|

|

Interest: |

|

$ |

|

|

|

|

|

|

|

Penalty: |

|

$ |

|

|

|

|

|

|

|

Total Remittance: |

|

$ |

|

|

|

|

|

|

|

Total Number of Shares of Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICIAL VERIFICATION OF REPORT

I, __________________________________, hereby declare, under penalty of perjury, that to the best of my knowledge

and belief, the following documentation contain a full, true, and complete report consisting of ____ page(s) totaling

$____________ regarding to the property presumed abandoned, remitted with this documentation, under the

provisions of La. R.S.

I further declare that this documentation contains complete and accurate information pertaining to the

_____________________________________ |

______________________________ |

__________________________ |

Signature of Official |

Title |

Date |

|

|

|

Document Breakdown

| Fact | Detail |

|---|---|

| Form Title | Louisiana Report of Unclaimed Property (Form UP-1) |

| Revision Date | February 2013 |

| Issuing Body | State of Louisiana Department of the Treasury, Unclaimed Property Division |

| Contact Information | P.O. Box 91010, Baton Rouge, LA 70821-9010; Phone: (225) 219-9400 |

| Annual Filing Deadline | November 1 (or the next business day if the due date falls on a weekend or holiday) |

| Governing Law | La. R.S. 9:151-181 |

| Submission Requirements | Remittance must accompany the report; the form verifies whether each unit of remitted property bears interest. |

| Penalty for Non-compliance | Failure to designate a remitted unit of property as bearing interest is considered an express statement that the property is not interest bearing, which might imply legal implications under specified provisions. |

Instructions on Filling in Louisiana Up 1

Filling out the Louisiana UP-1 form is a crucial step for entities holding unclaimed property in Louisiana. This document plays a significant role in ensuring that property that has gone unclaimed is reported accurately to the State of Louisiana, Department of the Treasury. It's a process that requires attention to detail and accuracy to fulfill legal obligations and support the return of property to rightful owners. Here are the steps to complete the form correctly:

- Start by entering the Report Year and the Period Covered at the top of the form to specify the timeframe your report will cover.

- Fill out the Holder Account Number if known; if not, leave this field blank.

- Under Holder Name, provide the full legal name of the entity holding the unclaimed property.

- For Address 1 and Address 2, enter the holder’s primary business location where the records are kept.

- Include the City, State, Zip for the address you have provided above.

- Detail your contact information under Contact Person, including Telephone Number, Fax Number, and Email Address.

- Provide your Federal ID Number, State of Incorporation, and the Date of Incorporation to identify the legal entity of the holder.

- Describe your entity’s Primary Business Activity in the designated area.

- Indicate whether you filed a report of Unclaimed Property in the last year by selecting YES or NO. If NO, you are required to explain why.

- If applicable, make corrections to the previous holder’s information, including Previous Name and Previous Address, and provide the previous City, State, Zip.

- Select the appropriate report type: Annual Report or Supplemental/Additional Report and note the Total Amount Due from the last page, including any interest and penalties.

- Complete the Official Verification of Report section at the bottom of the form by printing your name, signing, and dating the form. Ensure you declare the total pages and amount being reported as presumed abandoned.

- Review your entries carefully to ensure that the form is complete and accurate. Any mistakes can delay the processing or potentially lead to compliance issues.

- Submit the completed form before November 1st to the Louisiana Department of the Treasury, Unclaimed Property Division. If this deadline falls on a weekend or holiday, the form is due on the next business day. Late submissions are subject to penalties.

By following these steps, you ensure your compliance with Louisiana's unclaimed property laws. Accurately completing and submitting the UP-1 form facilitates the process of reconnecting lost or forgotten assets with their rightful owners. It is a meaningful responsibility and contributes positively to the financial well-being of individuals and families within Louisiana.

Listed Questions and Answers

What is the Louisiana UP-1 Form?

The Louisiana UP-1 Form, also known as the Report of Unclaimed Property, is a document that entities must file with the Louisiana Department of the Treasury's Unclaimed Property Division. It is used to report personal property that is considered abandoned or unclaimed by its rightful owner. The form details the property in question, including financial assets or tangible items, that have gone unclaimed past a certain period.

Who is required to file a Louisiana UP-1 Form?

This requirement falls on entities, also known as holders, that are in possession of property that has remained unclaimed by the owner for a period as defined by Louisiana state law. These holders can include banks, insurance companies, corporations, and other entities that may hold assets or property deemed unclaimed.

When is the UP-1 Form due?

The form must be filed before November 1st each year. If November 1st falls on a weekend or holiday, the report is due on the next business day. It is important to submit the form on time to avoid penalties, as it becomes delinquent the day after its due date.

What information is required on the UP-1 Form?

Completing the UP-1 Form requires detailed information, including:

- Holder name and address

- Contact information

- Federal ID number and State of Incorporation

- Primary business activity

- Details of the unclaimed property

- Verification of report by a signed declaration under penalty of perjury

What if I did not file an unclaimed property report last year?

If you did not file a report in the previous year, the UP-1 Form provides a section to explain why. Whether it was due to not having unclaimed property to report or any other reason, it is crucial to disclose this information accurately.

How should changes in holder information be reported?

If there have been any changes to your name or address, or if you are the successor to a previous holder of the property, these changes should be clearly indicated on the UP-1 Form. Provide your previous name, address, and other pertinent details to ensure records are correctly updated.

What are the consequences of not filing the UP-1 Form?

Failing to file the UP-1 Form can result in penalties and interest charges. Additionally, it is a missed opportunity to return the property to its rightful owner and comply with state laws regarding unclaimed property.

Where can I find more information or assistance with the UP-1 Form?

For additional guidance or questions about filing the UP-1 Form, you can contact the Louisiana Department of the Treasury’s Unclaimed Property Division directly. Their phone number is (225) 219-9400, and they are available to help with the process, clarify instructions, and provide any further information needed.

Common mistakes

When filling out the Louisiana UP 1 form, it's easy to make mistakes due to its detailed requirements. Being aware of these common errors can help ensure a smoother process and compliance with the State of Louisiana Department of the Treasury's guidelines. Here are four mistakes to avoid:

-

Incorrect Report Year and Period Covered: One of the most common mistakes is not accurately filling in the report year and the period covered. This is crucial for the form's validity and for ensuring that the data corresponds to the correct timeframe.

-

Omitting Holder Information: Failing to completely fill out the holder information, including the Holder Account Number (if known), Holder Name, and complete address. This information is vital for the Department to reach out if there are questions or further actions required regarding the reported unclaimed property.

-

Forgetting to Indicate Previous Holder Information: If there have been any changes in address, name, or if you're reporting as a successor, it's essential to indicate this by filling out the previous holder's information. This detail is often overlooked but is critical for maintaining accurate records.

-

Leaving the Verification Section Incomplete: The Official Verification section at the end of the form must be completed, including a signature, title, and date. Leaving this section incomplete can invalidate the report. This acts as a legal declaration of the accuracy and completeness of the information provided in the report.

Mistakes on the form can be more than just clerical errors; they can delay the processing of your report, potentially leading to penalties or additional steps to correct the information. Making sure that every section is completed with accurate information is crucial in fulfilling your obligations under the Louisiana Revised Statutes regarding unclaimed property.

Documents used along the form

When handling the Louisiana UP-1 Form, a Report of Unclaimed Property, it's essential to accompany it with several other documents to ensure compliance and accuracy in submission. These other forms and documents play vital roles in the process from providing detailed information on the property to ensuring proper handling per state regulations.

- NAUPA Standard Electronic File Format: Used for reporting unclaimed property in a standardized electronic format that facilitates the upload and processing of data.

- Holder Notice Report Form: Before submitting the UP-1 Form, holders must send notices to the apparent owners of the unclaimed property, informing them about the property. This form documents such efforts.

- Due Diligence Letter Templates: These are template letters used to perform due diligence by contacting the owners of unclaimed property prior to reporting and remitting to the state.

- Detailed Property Schedule: Accompanies the UP-1 Form to provide detailed descriptions, including owner information, of the unclaimed property being reported.

- Safe Deposit Box Inventory Form: Required for reporting contents found in safe deposit boxes that have been deemed unclaimed property.

- Securities Delivery Instructions: Outlines the process for transferring securities reported as unclaimed property to the state's custodian.

- Cash Remittance Form: Used to report and remit cash unclaimed property. It details the amount of cash being remitted as unclaimed property.

- Unclaimed Property Affidavit for Safe Deposit Boxes: A sworn statement detailing the opening of a safe deposit box and the inventory found within, used in conjunction with the Safe Deposit Box Inventory Form.

- Power of Attorney and Declaration of Representative: Authorizes a representative to act on the holder's behalf in matters related to reporting and remitting unclaimed property.

- Indemnification Agreement: An agreement between the holder and the state that protects the state from claims or disputes over the remitted property.

Together, these forms and documents streamline the process of reporting unclaimed property, ensure compliance with state laws, and aid in the accurate and efficient transfer of property to the state or rightful owners. They are integral to fulfilling the statutory requirements and facilitating the resolution of unclaimed property matters in Louisiana.

Similar forms

The Louisiana UP-1 form is similar to several other documents used in the financial and legal sectors to report or document specific types of transactions or statuses. These documents share common features with the Louisiana UP-1 form, such as the need for detailed information about the entity reporting, the nature of the transactions or items being reported, deadlines for submissions, and legal attestations regarding the accuracy of the information provided.

The Uniform Unclaimed Property Report is one example of a document that bears resemblance to the Louisiana UP-1 form. Just like the UP-1 form, the Uniform Unclaimed Property Report is utilized by entities to report unclaimed property to state authorities, ensuring compliance with state laws regarding unclaimed assets. Both documents require detailed information about the holder of the unclaimed property, including contact information and the specifics of the unclaimed assets. Additionally, they necessitate a declaration affirming the truthfulness and completeness of the information, underscoring the legal accountability of the reporting party. The primary similarity lies in their shared objective: to facilitate the return of unclaimed property to rightful owners while complying with respective state regulations.

The IRS Form 1099 is another document with functional similarities to the Louisiana UP-1 form. Although the IRS Form 1099 is primarily used for reporting various types of income, dividends, or transactions to the Internal Revenue Service, it parallels the UP-1 form in its requirement for detailed financial and personal information about the parties involved. Both forms serve as official records that must be filed within specific deadlines to avoid penalties, emphasizing their importance in financial and legal reporting processes. Moreover, the act of submitting either form is a declaration of the accuracy and completeness of the report, reflecting the seriousness with which these documents are treated by governmental and regulatory bodies.

State-Specific Business Annual Reports also share commonalities with the Louisiana UP-1 form. These annual reports, required by many states for businesses operating within their jurisdictions, gather comprehensive information about a business’s operational, financial, and organizational status. Similar to the UP-1 form, state-specific annual reports demand detailed information about the business, such as its legal name, address, and the nature of its activities, along with a verification of the accuracy of the information provided. The primary purpose of both the UP-1 form and state-specific annual reports is to ensure entities are transparent with the government regarding their status and activities, which is crucial for regulatory compliance and public interest.

Dos and Don'ts

Do ensure that all information is accurate and up-to-date, especially the contact details and address to prevent any miscommunication.

Don't wait until the last minute to file the report. Remember, the deadline is November 1, and if it falls on a weekend or holiday, the next business name is when it's due.

Do include your Holder Account Number if known. This can speed up the process and ensure that your report is properly matched in the system.

Don't neglect to report whether you filed a Report of Unclaimed Property in the previous year. Your response here provides important context for your submission.

Do clearly indicate if the report is an Annual Report or a Supplemental/Additional Report by marking the appropriate box on the form.

Don't forget to list any previous names or addresses if you're the successor to a previous holder of the property, or if there have been any changes. Full disclosure is required for record accuracy.

Do verify the total amount due, including interest and penalties, and ensure that your remittance accompanies the report. The state requires both the reporting and the remittance at the same time.

Don't sign the Official Verification of Report section without reviewing the entire document for completeness and accuracy. By signing, you declare under penalty of perjury that all information is correct to the best of your knowledge.

Misconceptions

Understanding the Louisiana UP-1 form, a document used for reporting unclaimed property to the state's Treasury Department, can sometimes be confusing due to prevalent misconceptions. These misunderstandings can lead to mistakes in the submission process, potentially causing delays or penalties for those required to file the form.

- Misconception 1: The UP-1 form is only for financial institutions. The truth is that this form is not exclusive to financial institutions. Businesses and organizations across various sectors are required to fill it out if they hold unclaimed property, such as uncashed checks, unused gift certificates, or dormant accounts, that must be transferred to the state after a certain period.

- Misconception 2: Personal information is not needed to complete the form. Contrary to this belief, detailed information about the holder, including contact details and federal ID number, is crucial. This allows the Unclaimed Property Division to communicate effectively with the entity reporting the unclaimed property.

- Misconception 3: The form doesn't need to be filed annually if there's no unclaimed property to report. Even if an entity does not have unclaimed property to report in a given year, it must still submit a "negative report" to the Louisiana Department of the Treasury, indicating that there is nothing to report.

- Misconception 4: Any format of the UP-1 form is acceptable. The UP-1 form has specific requirements and formats that must be followed. Using an outdated form or not adhering to the required format can result in the rejection of the form.

- Misconception 5: Late filing of the UP-1 form does not incur penalties. This is incorrect. Failing to file the form by the November 1st deadline can lead to penalties and interest on the unclaimed property that is due. If the due date falls on a weekend or holiday, the next business d ay becomes the effective due date, but penalties can accrue soon after.

- Misconception 6: The UP-1 form can be submitted without remittance. Essential to the submission is the accompanying remittance for the unclaimed property. Submission without remittance is considered incomplete and will not be processed until the total amount due, including any applicable interest and penalties, is paid.

- Misconception 7: Electronic submission is not an option for the UP-1 form. Electronic submission is, in fact, encouraged for efficiency and environmental reasons. Those filing the UP-1 form should check with the Louisiana Department of the Treasury for the most current electronic submission guidelines and procedures.

Understanding these points about the Louisiana UP-1 form can help organizations and businesses ensure their reporting processes are efficient and compliant, thus avoiding unnecessary fines or complications with the state's Unclaimed Property Division.

Key takeaways

Understanding and completing the Louisiana Up 1 form is crucial for businesses and organizations holding unclaimed property in Louisiana. Here are key takeaways that will guide you through the process and ensure compliance:

- The form is issued by the Louisiana Department of the Treasury’s Unclaimed Property Division and is designed to help holders of unclaimed property report those assets as required by state law.

- It is imperative to file the Louisiana Up 1 form before November 1 of the reporting year. If November 1 falls on a weekend or holiday, the next business day is considered the due date, after which the report will be deemed delinquent.

- Ensure you have your Holder Account Number ready, if known. This helps in identifying your account with the Unclaimed Property Division and streamlines the process.

- Accurately filling out your organization's details, such as the name, address, contact person, telephone number, and more, is vital for effective communication and processing of the report.

- The form requires specific information regarding your business, including the Federal ID Number, State of Incorporation, and Date of Incorporation.

- If you did not file a report in the previous year, you must provide an explanation, ensuring transparency and completeness in your reporting.

- Changes in your organization’s name, address, or if there's a succession in holdership, must be duly noted and corrected on the form to maintain accurate records.

- The form serves multiple purposes and can be used for filing an Annual Report or a Supplemental/Additional Report. Be sure to mark the appropriate option and include the total amount due, interest, penalties, and the total number of shares of stock, if applicable.

- Official verification is a critical step where a designated official declares, under penalty of perjury, the completeness, and accuracy of the information provided. This includes an affirmation that the report fully complains with Louisiana Revised Statutes 9:151-181 regarding presumed abandoned property and accurately reflects the interest-bearing nature of the reported property.

Adhering to these key points will help ensure that your Louisiana Up 1 form is filled out accurately and submitted on time, aiding in the efficient management and reporting of unclaimed property in compliance with Louisiana state laws.

Popular PDF Templates

Louisiana 2022 Tax Forms - Encourages a more organized request submission process, allowing for quicker processing times in Louisiana.

Louisiana Oversize Permits - Access essential transport permits for containerized cargo, ideal for businesses engaged in international trade, with the Harvest Season Permit Louisiana form.