Free Louisiana R 6922 Template

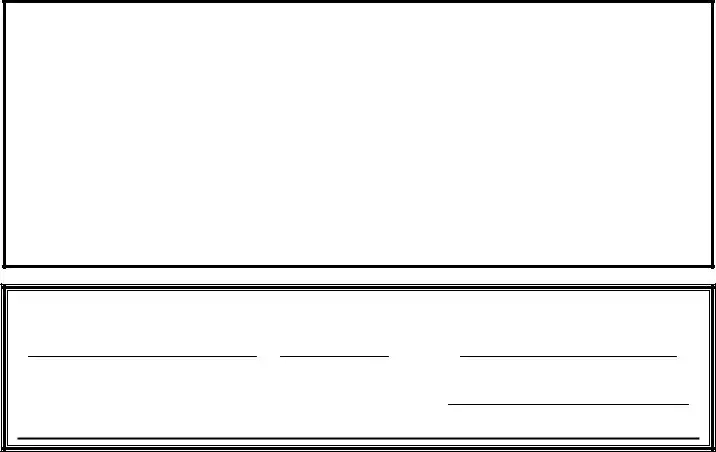

When navigating the complexities of tax obligations in Louisiana, partnerships find a unique form at their disposal: the Louisiana R 6922. This document, issued by the State of Louisiana Department of Revenue, is integral for partnerships that need to file composite tax returns. It's specifically designed to consolidate the tax payment process for both resident and nonresident partners, thereby simplifying the often convoluted tax filing process. The form captures crucial information like the partnership's name, address, and revenue account number, alongside the taxable period's beginning and end dates. It meticulously details the summary of tax paid on behalf of partners, divided between residents and nonresidents, and outlines the computation of the amount due, including tax, interest, and penalties. Furthermore, the R 6920 form emphasizes accountability and accuracy through a declaration that under penalties of perjury, the information provided is true, correct, and complete, requiring signatures from the individual preparing the form and, if applicable, the paid preparer. This form plays a pivotal role in ensuring partnerships comply with state tax laws, offering a streamlined approach to fulfill their tax liabilities.

Form Example

State of Louisiana |

|

|

|

|

|||||

|

|

|

Department of Revenue |

|

|

|

|

||

|

|

|

Louisiana Composite Partnership Return |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Partnership name, address and ZIP |

|

|

|

|

|

||

|

|

|

|

|

Revenue account number |

____________________________ |

|||

|

|

|

|

|

Taxable period beginning |

___________ |

_______ |

_______ |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

Taxable period ended |

___________ |

_______ |

_______ |

|

|

|

|

|

|

|

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Summary of tax paid on behalf of partners |

|

|

|

|

||

1) |

Total distributive share for RESIDENT partners included |

|

|

|

|

||||

|

|

with the Louisiana Composite Partnership Return |

____________________ |

|

|||||

2) |

Total Louisiana Composite Return tax paid on behalf of qualified |

|

|

|

|

||||

|

|

RESIDENT partners |

|

|

|

____________________ |

|

||

3) |

Total distributive share for NONRESIDENT partners included |

|

|

|

|

||||

|

|

with the Louisiana Composite Partnership Return |

____________________ |

|

|||||

4) |

Total Louisiana Composite Return tax paid on behalf of qualified |

|

|

|

|

||||

|

|

NONRESIDENT partners |

|

|

|

____________________ |

|

||

5) |

Total tax paid (add Lines 2 and 4) |

____________________ |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Computation of amount due |

|

6) |

Tax due (Line 5 above) |

|

____________________ |

7) |

Interest – see instructions |

____________________ |

|

8) |

Penalty – see instructions |

____________________ |

|

9) |

Amount due (add Lines 6, 7 and 8 above) |

____________________ |

|

|

Make payment to: |

Louisiana Department of Revenue |

|

|

|

P.O Box 4998 |

|

|

|

Baton Rouge, LA 70821 – 4998 |

|

Do not send cash.

Under penalties of perjury, I declare that I have examined this return including all accompanying documents, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of paid preparer is based on all available information.

Signature |

Date |

Signature of paid preparer other than taxpayer |

Social Security Number, PTIN, or FEIN of paid preparer

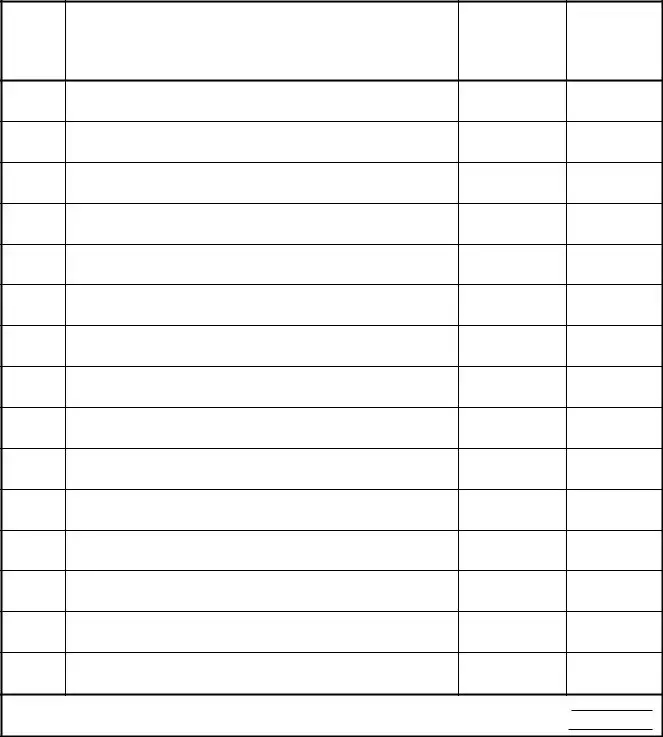

State of Louisiana

Department of Revenue

Louisiana Resident Composite Tax Return Schedule

Partnership name ____________________________ |

Page _____ of _____ |

Revenue account number______________________ |

|

Partner Number

Name and address of partner

Partner ID

number

Distributable

share

Total distributive share for resident partners included with the Louisiana Composite Return…………………

Total LA Composite Return Tax paid on behalf of qualified resident partners included with the LA Composite Return…..

State of Louisiana

Department of Revenue

Louisiana Nonresident Composite Tax Return Schedule

Partnership name ____________________________ |

|

Page ____ of ____ |

|||||||

Revenue account number______________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non- |

|

|

|

Partner |

Name and address of partner |

Partner ID |

Distributable |

|

|

resident |

Included in |

||

Number |

number |

share |

|

|

partner |

Composite |

|||

|

|

agreement |

Return |

||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total distributive share for nonresident partners included with the Louisiana Composite Return………………. |

|

|

|

|

|

||||

Total LA Composite Return Tax paid on behalf of qualified nonresident partners included with the LA Composite Return…. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Document Breakdown

| Fact | Detail |

|---|---|

| Form Purpose | The Louisiana R-6922 form is used for filing a composite partnership return, allowing partnerships to report and remit income tax on behalf of their partners, both residents and non-residents of Louisiana. |

| Sections Included | This form includes sections for listing partnership information, summary of tax paid on behalf of partners, computation of the amount due, and a schedule for both resident and nonresident partners’ distributive shares and taxes paid. |

| Governing Law | This form is governed by Louisiana state law, specifically under the jurisdiction of the Louisiana Department of Revenue, and is designed to comply with state-specific tax filing requirements for partnerships. |

| Payment Instructions | Payments made with the Louisiana R-6922 form should be addressed to the Louisiana Department of Revenue and must not be sent in cash, highlighting the requirement for checks or money orders for tax dues. |

Instructions on Filling in Louisiana R 6922

The Louisiana R-6922 form is pivotal for partnerships that need to report and remit taxes on behalf of both resident and nonresident partners. Considered a composite return, this form combines the individual tax liabilities of the partners into a single filing, making it crucial for partnerships aiming to comply with Louisiana state tax laws. Careful attention to detail and adherence to the following steps ensure accurate reporting and can help avoid common pitfalls associated with tax filings.

- Start by entering the partnership name, address, and ZIP code at the top of the form.

- Provide the revenue account number assigned to the partnership.

- Indicate the taxable period beginning and end dates, ensuring to fill out the month, day, and year fields.

- Under the Summary of tax paid on behalf of partners section:

- Enter the total distributive share for RESIDENT partners included with the Louisiana Composite Partnership Return.

- State the total Louisiana Composite Return tax paid on behalf of qualified RESIDENT partners.

- Specify the total distributive share for NONRESIDENT partners included with the Louisiana Composite Partnership Return.

- Mention the total Louisiana Composite Return tax paid on behalf of qualified NONRESIDENT partners.

- Calculate the total tax paid by adding the amounts from Lines 2 and 4.

- In the Computation of amount due section, detail the:

- Tax due, as shown on Line 5 above.

- Applicable interest and penalties – refer to instructions for accurate calculations.

- Total amount due by adding the figures on Lines 6, 7, and 8.

- Sign and date the form, affirming under penalty of perjury that the information provided is complete and correct. If a paid preparer was used, ensure their signature, identification numbers, and the date are also included.

- Address the payment to the Louisiana Department of Revenue, P.O Box 4998, Baton Rouge, LA 70821 – 4998, as indicated. Remember, sending cash is not an option.

After filling out the form, compiling any required documentation, and securing the necessary signatures are complete, your next steps involve submitting the paperwork to the specified address. Ensure that the form and any accompanying payment accurately reflect the total tax responsibilities owed by the partnership for the period in question to avoid delays or inquiries from the tax authority. Timeliness and accuracy in this submission process are key to maintaining compliance and minimizing any potential penalties or interest that could accric from discrepancies or omissions.

Listed Questions and Answers

What is the Louisiana R-6922 form?

The Louisiana R-6922 form is a document used by the State of Louisiana Department of Revenue for partnerships to file a composite tax return. This form enables partnerships to report and pay state income taxes on behalf of their resident and nonresident partners collectively. The R-6922 ensures that income earned within Louisiana by partners is taxed appropriately, simplifying the tax processes for partnerships and their partners by consolidating tax obligations into a single return.

Who needs to file the Louisiana R-6922 form?

Any partnership that has earned income in the state of Louisiana and has either resident or nonresident partners is required to file the R-6922 form. This includes partnerships looking to streamline the tax filing process for their partners by opting to file a composite return rather than having each partner file individually for their share of the partnership's income earned in Louisiana.

What information is required on the R-6922 form?

The R-6922 form requires various pieces of information, including:

- The partnership's name, address, and revenue account number.

- The taxable period beginning and ending dates.

- Summary of tax paid on behalf of both resident and nonresident partners.

- The total distributive shares for both resident and nonresident partners included with the Louisiana Composite Return.

- Computation of the amount due, including tax, interest, and penalties.

This form also involves declarations by the preparer and a designated official from the partnership, attesting to the truthfulness and completeness of the information provided.

How is the tax calculated on the R-6922 form?

Tax calculation on the R-6922 form involves several steps, starting with determining the total distributive shares for resident and nonresident partners. The form then requires the filer to compute the total tax paid on behalf of qualified partners. These figures lead to the calculation of the total tax liability by adding lines for both resident and nonresident taxes paid, followed by adjustments for any interest and penalties applicable. The final amount due is the sum of these calculations.

Where do I send the completed R-6922 form and any payment due?

Completed R-6922 forms along with any payment due should be sent to the following address:

Louisiana Department of Revenue

P.O Box 4998

Baton Rouge, LA 70821-4998

It's important to note that cash payments are not accepted. Payments should be made via check or money order payable to the Louisiana Department of Revenue.

What are the consequences of failing to file the R-6922 form?

Failing to file the R-6922 form can lead to several consequences, including:

- Imposition of penalties and interest on the unpaid tax due.

- Potential audits and further scrutiny by the Louisiana Department of Revenue.

- Legal action to recover unpaid taxes, penalties, and interest.

It is crucial for partnerships to file this form accurately and timely to avoid these negative outcomes.

Common mistakes

-

Incorrect Information for Partnership and Partners: The form requires detailed information such as the partnership's name, address, ZIP code, revenue account number, and the taxable period. Sometimes, entries are made inaccurately, whether through typos or outdated information. Similarly, for both resident and nonresident schedules, precise information for each partner, including their name, address, and Partner ID number, is critical. Errors in these sections can lead to processing delays or misdirected correspondence.

-

Miscalculations of Distributive Shares: The form asks for the total distributive share for both resident and nonresident partners. Mistakes in calculating these amounts can impact the accuracy of the total tax liability reported. This is particularly true when aggregating the total distributive share for residents and nonresidents, which should reflect the proper income allocation among partners according to the partnership agreement.

-

Failure to Properly Calculate Taxes Paid: Another common error is inaccurately calculating the total Louisiana Composite Return tax paid on behalf of qualified resident and nonresident partners. These figures feed into the total tax paid, which impacts the computation of the amount due or refundable. Making sure these calculations are done correctly and based on the updated tax rates and regulations is essential for ensuring the correct amount is paid and reported.

-

Omission of Signatures and Relevant Dates: The completion of the Louisiana R-6922 form includes the requirement for signatures and the dating of the document by the taxpayer and, if applicable, the paid preparer. Forgetting to sign or date the form, or doing so improperly, can invalidate the return, necessitating its resubmission and potentially delaying processing times.

In addition to these specific errors, it's always recommended to review the entire form and accompanying documentation before submission. Checking for accuracy and completeness can help streamline the tax filing process and minimize the risk of issues with the Louisiana Department of Revenue.

Documents used along the form

When dealing with the Louisiana Composite Partnership Return, known as the R-6922 form, it's quite common for several other forms and documents to be utilized in tandem for a comprehensive approach to tax filing for partnerships in Louisiana. These documents ensure that partnerships comply fully with the state’s tax legislation, providing a structured method for reporting income, calculating tax obligations, and identifying partnership and partner details accurately.

- Form R-10610: This is the Declaration for Electronic Filing for partnerships. It's used when submitting the R-6922 or other related forms electronically, ensuring that the electronic submission is authorized by the partnership.

- Form IT-565: The Louisiana Partnership Return of Income. This comprehensive form is where a partnership reports its income, deductions, and credits for the tax year, which is essential for determining the values entered into R-6922.

- Schedule K-1 (Form IT-565): Part of the IT-565, this schedule details each partner's share of the partnership's income, deductions, credits, etc., critical for completing R-6922 sections on distributive shares.

- Form CIFT-620: Corporate Income and Franchise Tax Return. While this form is specifically for corporations, partnerships that are treated as corporations for tax purposes may also need to file this alongside R-6922 if applicable.

- Form R-1029: This is a Sales Tax Return form. Partnerships engaged in selling goods or certain services in Louisiana must file this form to report state and local sales taxes.

- Form R-1035: Louisiana Consumer Use Tax Return. For partnerships that purchase goods or services for use in Louisiana from vendors who do not collect Louisiana sales tax, this form is necessary.

- Form L-1: Employer’s Quarterly Return of Louisiana Withholding Tax. Partnerships with employees must file this form to report and remit taxes withheld from employees' wages.

- Form 540-ES: Estimated Tax for Individuals. While this form is for individuals, partners in a partnership may need to file it for their share of partnership income, pertinent when discussing the tax responsibilities of individual partners.

- Form R-6465: Tax Registration Application. Any new partnership operating in Louisiana should complete this form to register for a tax identification number, which is necessary before filing the R-6922 or conducting other tax-related activities in the state.

In summary, each of these documents serves a unique role in the tax filing and compliance process for partnerships in Louisiana. Together with the R-6922, they form a web of documentation that ensures both the partnership and its individual partners meet their tax obligations comprehensively. Understanding and utilizing these forms appropriately can significantly streamline the tax filing process and help avoid potential complications with the Louisiana Department of Revenue.

Similar forms

The Louisiana R-6922 form, by its nature, is specialized for partnerships in Louisiana, detailing the income distribution and taxes paid for both resident and nonresident partners. This form reflects specific requirements for composite partnership tax returns within the state of Louisiana, and while it is unique, there are components that bear similarity to other tax documents used by partnerships across the United States.

Similar to the Louisiana R-6922 form is the Form 1065, known as the U.S. Return of Partnership Income. Form 1065 is a requirement for domestic partnerships to report their income, gains, losses, deductions, credits, etc., to the Internal Revenue Service (IRS). Both the Louisiana R-6922 and Form 1065 capture essential financial data to ensure proper tax calculation and compliance for partnerships. Yet, the difference lies in their jurisdictional use; the R-6922 is specific to the State of Louisiana, focusing on resident and nonresident partners' tax liabilities, while Form 1065 is a federal requirement that doesn't differentiate between resident statuses of partners.

Another document closely related to the Louisiana R-6922 form is the K-1 Schedule, which is an attachment to the Form 1065. The K-1 Schedule outlines the share of the partnership's income, deductions, and credits allocated to each partner, serving a purpose similar to the breakdowns in R-6922's schedules for resident and nonresident partners. Essentially, both forms provide detailed partnership income and tax information on a per-partner basis. Unlike the more comprehensive approach of R-6922, which facilitates tax payment for both resident and nonresident partners within a single form, the K-1 Schedule is primarily informational, requiring partners themselves to incorporate this data into their individual state and federal tax returns.

The comparison between these documents underscores the nuanced approach required by different tax jurisdictions. While the form types and their purposes overlap, the specific content and structure adapt to fulfill the legal and administrative requirements at both the state and federal levels. Understanding the similarities and differences among these forms is crucial for tax preparation and compliance for partnerships operating in Louisiana and beyond.

Dos and Don'ts

Filling out the Louisiana R-6922 form, the Louisiana Composite Partnership Return, requires attention to detail and accuracy. Here's a list of dos and don'ts to guide you through the process effectively.

Do:

- Read the instructions carefully before you start filling out the form. This ensures you understand each section and what information is required.

- Use black ink or type the information when filling out the form to ensure clarity and readability.

- Ensure all partnership and partner information is accurate, including names, addresses, and identification numbers. Mistakes here can lead to processing delays or incorrect taxation.

- Double-check the math on the summary of tax paid and computation of amount due sections. Errors could result in underpayment or overpayment of taxes.

- Attach all required documentation, such as schedules and additional forms that support the information provided in the return.

- Keep a copy of the completed form and all attachments for your records. This is crucial for future reference or in case of an audit.

- Submit the form by the deadline to avoid penalties and interest for late filing.

Don't:

- Leave sections blank unless instructed. If a section does not apply, enter "N/A" (not applicable) or "0" if it's a numerical entry.

- Use correction fluid or tape. If you make a mistake, it's better to start over on a new form to maintain legibility.

- Guess on figures or estimations. Use actual numbers from your financial records to ensure the accuracy of the return.

- Overlook the declaration section at the end of the form. The return must be signed, and the declaration of the paid preparer (if applicable) should be completed.

- Forget to include the payment if you owe taxes. Ensure the check is payable to the Louisiana Department of Revenue and includes your partnership's name and revenue account number.

- Send cash as payment with your form. This is unsafe and not accepted by the Louisiana Department of Revenue.

- Ignore the instructions regarding interest and penalties if applicable. Understanding how to calculate these can save you from unexpected costs.

Misconceptions

When navigating the complexities of Louisiana's Tax forms, particularly the R-6922 form, misconceptions can occur easily due to its detailed nature. Here are nine common misconceptions about the Louisiana R-6922 form, which is crucial for both resident and nonresident partners in composite partnerships.

- Only for Large Partnerships: A prevalent misconception is that the R-6922 form is only required for large partnerships. In reality, any partnership in Louisiana that has income that must be reported to resident or nonresident partners needs to file this form, regardless of the size of the partnership.

- Residents and Nonresidents Filed Separately: Some people mistakenly believe that resident and nonresident partners' income must be filed on separate forms. The R-6922 form includes schedules for both resident and nonresident partners, allowing for a consolidated filing process.

- No Individual Tax Filing Required: Another common error is the belief that partners do not need to file individual tax returns if the partnership files an R-6922. This form does not negate the requirement for individual partners to file their personal tax returns.

- Penalties and Interest are Automatically Waived: It's wrongly assumed sometimes that penalties and interest for late payments are automatically waived with the R-6922. As the form specifies, interest and penalties apply per the instructions and must be calculated and added to the amount due if applicable.

- One-Time Submission: The notion that the R-6922 is a one-time submission and not an annual requirement is incorrect. Partnerships must file this return annually for each taxable period.

- Same as Individual State Tax Returns: Some confuse the R-6922 with individual state tax returns. Though it involves income distribution to partners, the R-6922 is specifically a composite return for partnerships, distinct from individual tax obligations.

- Does Not Reflect Total Tax Paid: There's a misconception that the form doesn't show the total tax paid on behalf of partners. However, the form clearly outlines the total Louisiana Composite Return tax paid for both resident and nonresident partners.

- Only Includes Taxable Income: A misunderstanding exists that only taxable income needs to be reported on the R-6922. The form actually requires reporting of distributive share amounts, inclusive of all income, deductions, and credits attributable to the partners.

- Electronic Filing Not Allowed: Lastly, some believe that the R-6922 cannot be filed electronically. While the specific filing options may vary, the Louisiana Department of Revenue has been taking steps to facilitate electronic filing for many of its forms.

Navigating Louisiana's tax requirements can be challenging, but understanding the specifics of the R-6922 form is essential for partnerships to accurately report and pay taxes on behalf of their partners. Dispelling these misconceptions is crucial in ensuring compliance and reducing the risk of penalties or interest due to misunderstandings.

Key takeaways

When dealing with the Louisiana R 6922 form, a comprehensive approach is essential for accurate completion and submission. This document is crucial for partnerships operating within Louisiana, encompassing several important aspects of tax documentation for both resident and nonresident partners. Below are key takeaways to guide you through the process:

- The form serves dual purposes, acting as both the Louisiana Composite Partnership Return and, through its schedules, detailing tax paid on behalf of qualified resident and nonresident partners.

- It's essential to include the partnership's name, address, ZIP code, and revenue account number at the beginning of the form, ensuring identification and proper processing.

- The taxable period must be clearly stated, with precise start and end dates, to inform the Department of Revenue of the specific timeframe the return covers.

- Payment should not be made in cash; instead, the form specifies making payments to the Louisiana Department of Revenue at a designated P.O. Box in Baton Rouge, LA, ensuring secure and traceable transactions.

- Accurately calculate the total tax paid on behalf of both resident and nonresident partners. This includes the total distributive share and the tax paid, which are crucial for the summary of tax paid and the computation of amount due sections.

- Interest and penalties, as applicable, should be calculated according to the instructions provided with the form. Including these amounts correctly ensures compliance with tax laws and reduces the risk of errors.

- A declaration under the penalties of perjury at the end of the form requires signatures, affirming the accuracy and truthfulness of the information provided. This underscores the legal responsibility in presenting correct data.

- The involvement of a paid preparer, if applicable, must be disclosed, including their Social Security Number, PTIN, or FEIN, alongside their signature, indicating their role in preparing the return.

Thorough attention to detail and adherence to the instructions provided with the Louisiana R 6922 form are fundamental to a successful filing. Partnerships should ensure that all relevant information is accurately captured and reported to the Louisiana Department of Revenue, facilitating compliance with state tax obligations for both resident and nonresident partners.

Popular PDF Templates

How to Gift a Car to a Family Member in Louisiana - It allows for the immediate transfer of ownership upon the document's execution, making it an efficient tool for asset distribution.

Healthy Louisiana Medicaid Card - Includes a variety of service categories, allowing providers to accurately represent their specialty areas to Medicaid beneficiaries.