Free Louisiana R 1086 Template

The Louisiana R-1086 form is a critical document for individuals and businesses looking to claim the solar energy income tax credit for the tax year 2017. This form encompasses detailed sections aimed at guiding both individual taxpayers and businesses through the process of applying for tax credits associated with the purchase and installation of solar electric systems within the state. The form requires information regarding the taxpayer's identity, including Social Security numbers or Louisiana Revenue Account numbers, as well as detailed descriptions of the solar energy systems installed, including costs and specifications. It highlights the specific requirements for leased systems, emphasizing the conditions under which the tax credit can be claimed, including adherence to the Buy American provisions of the American Recovery and Reinvestment Act of 2009. The R-1086 form serves as a comprehensive tool for ensuring compliance with Louisiana's statutes, rules, and regulations concerning solar energy tax credits, directing applicants to provide necessary additional documentation such as proof of system eligibility, installation contracts, and receipts. Moreover, it lays out the declaration that taxpayers must make, affirming the accuracy and completeness of their claim in alignment with Louisiana’s legal framework. The inclusion of sworn statements by licensed dealers and installers as part of the submission process underlines the stringent verification standards set by the state to govern the solar energy tax credit scheme.

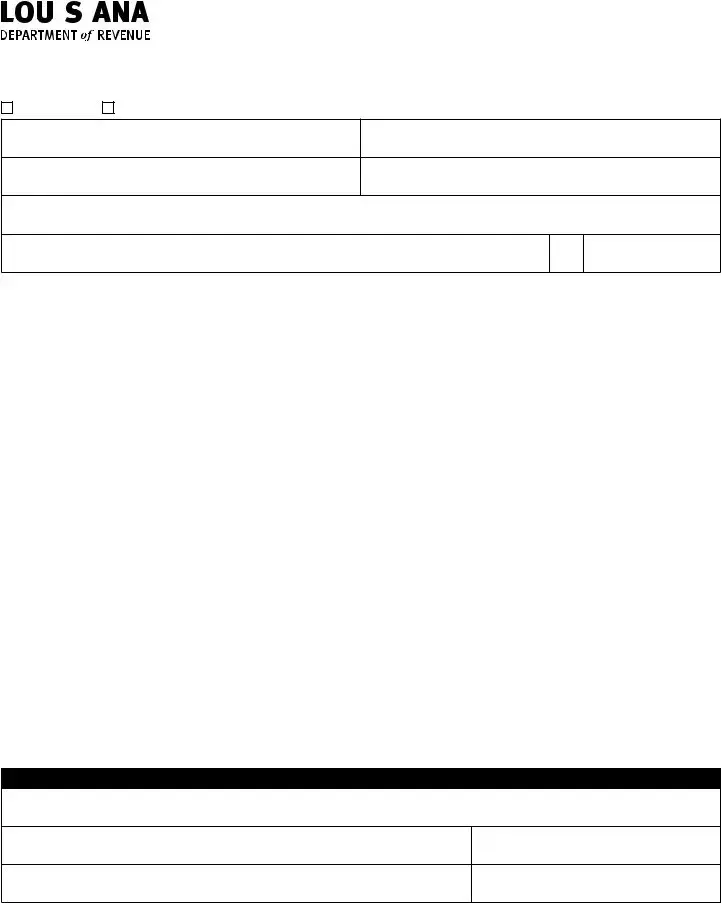

Form Example

|

|

|

|

|

|

FILING PERIOD |

|

|

|

|

|

S o l a r E n e rgy I n c o m e Ta x C re d i t fo r |

2017 |

|

|

|

|

|

I n d i v i d u a l s a n d B u s i n e s s e s |

|

|

|

|

|

|

|

|

Individual |

Business |

PLEASE PRINT OR TYPE |

Name of Taxpayer/Entity Claiming Credit

Social Security No./Entity Louisiana Revenue Account No.

Name of Taxpayer’s Spouse (if joint individual income tax return)

Spouse’s Social Security No. (if joint individual income tax return)

Taxpayer Residence Address (if individual income tax return) or Business Address

City

State ZIP

|

|

|

Total Available Credit |

|

|

|

1 |

Complete the worksheet, found on page 2, for each solar energy system. Add the |

1 |

|

|||

amounts from Line 12 of each worksheet and enter the total. |

|

|||||

|

|

|

|

|

|

|

|

Share of qualifying tax credit from partnerships, trusts or small business corporations |

|

|

|||

|

(Number of units ____________ ) |

|

|

|||

2 |

Name of Entity: |

|

|

2 |

|

|

|

|

|

||||

|

Louisiana Revenue Acct No: |

|

|

|||

|

|

|

|

|

|

|

3 |

Total Credit Available to the taxpayer (Add Lines 1 and 2.) |

3 |

|

|||

|

|

|

|

|

|

|

LA R.S. 47:6030 provides for a credit against income tax for the purchase and installation of a solar electric system (“system”). The credit may be claimed by a

System components purchased on or after July 1, 2013, must be compliant with the “Buy American” requirements of the federal American Recovery and Reinvestment Act of 2009. See Revenue Information Bulletin

The tax credit for a leased system installed in 2017 is equal to 38 percent of the first $20,000 of eligible costs. For the purpose of determining the cost basis of the credit for a leased system, the eligible cost is $2.00 per watt limited to six kilowatts.

If the taxpayer received this credit through an interest in a partnership, trust, or small business corporation, please retain copies of the Schedule

This credit may be used in addition to any federal credits earned for the same system, but the taxpayer is prohibited from using any other state tax benefit for property for which the credit is claimed.

Declaration

I declare that to the best of my knowledge of all available information, this refund claim is true and complete and complies with all statutes, rules and regulations, and any other policy pronouncements related to the solar energy income tax credit.

Signature of Taxpayer, Entity Officer or Other (for other, attach power of attorney, Form

Date (mm/dd/yyyy)

Signature of Spouse (if joint return)

Date (mm/dd/yyyy)

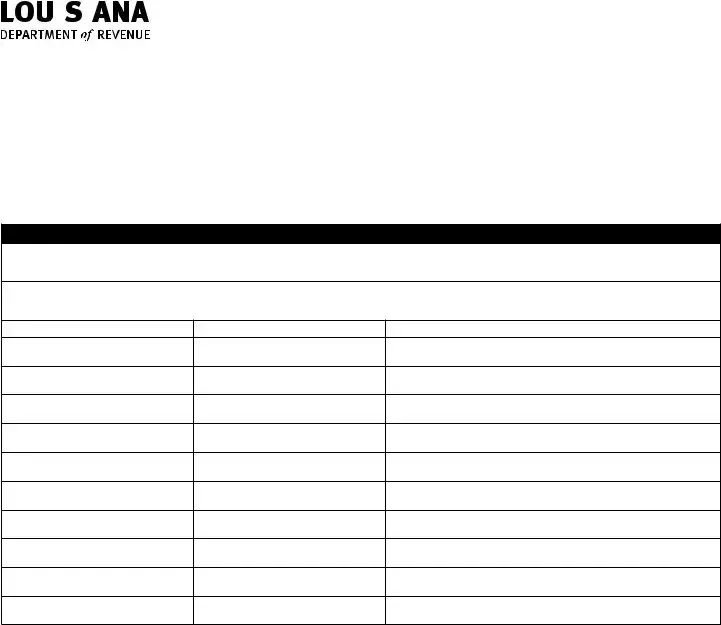

Please complete a separate worksheet and supplemental information sheet for each solar energy system for which you are requesting credit. Attach each worksheet to page 1.

1

|

|

|

|

|

|

S o l a r E n e rgy I n c o m e Ta x |

|

|

|

|

|

FILING PERIOD |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|||||

|

|

|

|

|

|

Leased Systems (Credit Code 74F) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Worksheet |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT OR TYPE |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer/Entity Claiming Credit |

|

Social Security No. /Entity Louisiana Revenue Account No. |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer’s Spouse (if joint individual income tax return) |

|

Spouse’s Social Security No. (if joint individual income tax return) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Address of Location Where System Installed |

|

City |

|

State |

ZIP |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

LA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

||||||||||||||||

Date the Installation of the Energy System was Completed |

________________________________________ |

(mm/dd/yyyy) in a Louisiana Residence |

|

||||||||||||||

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractor’s Name |

|

Contractor’s Louisiana License Number |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Computation of the Credit |

|

|

|

|

|

||||||

1 |

Cost of new system equipment |

|

|

|

|

|

|

1 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Cost of new system installation |

|

|

|

|

|

|

2 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Taxes associated with new system |

|

|

|

|

|

|

3 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Total (Add Lines 1 through 3.) |

|

|

|

|

|

|

4 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Enter the smaller of $20,000 or the amount on Line 4. |

|

|

|

|

|

|

5 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6 |

Enter the sum of the nameplate kW of all of the photovoltaic panels in the system. |

|

6 |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Multiply Line 6 by 1,000. |

|

|

|

|

|

|

7 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Enter the smaller of $6,000 or the amount on Line 7. |

|

|

|

|

|

|

8 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

System cost per watt |

|

|

|

|

|

|

9 |

|

$2.00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Multiply Line 8 by Line 9. |

|

|

|

|

|

|

10 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Enter the smaller of Line 5 or Line 10. |

|

|

|

|

|

|

11 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Multiply Line 11 by 38% (.38). This is your credit. |

|

|

|

|

|

|

|

12 |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

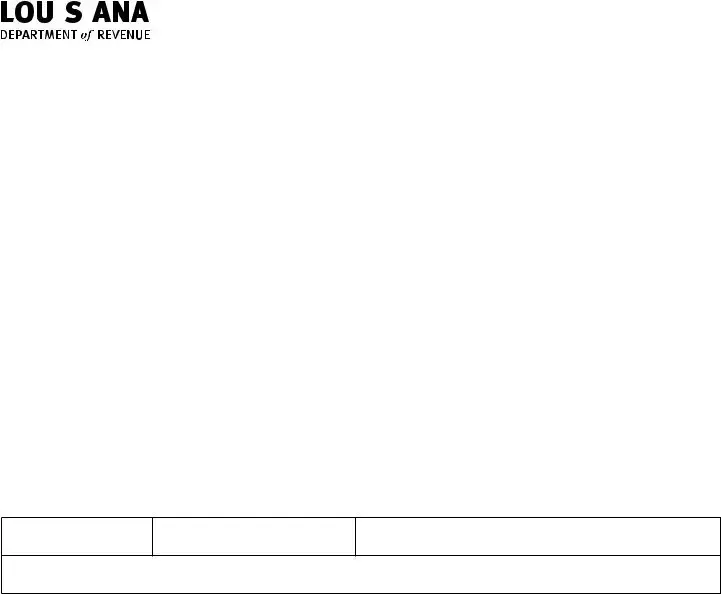

Solar Energy |

|

|

FILING PERIOD |

|

|

|

|

|

|

|

|

2017 |

|||

|

|

|

|

|

|

Income Tax Credit |

|

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Supplemental Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer/Entity Claiming Credit |

|

Social Security No./ Louisiana Revenue Account No. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Physical Address of Location Where System Installed |

|

City |

State |

ZIP |

||||||

|

|

|

|

|

|

|

|

|

LA |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer’s Spouse (if joint return) |

|

Spouse’s Social Security No. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

System Information

Total nameplate listed kW of all installed panels:

Provide the make, model, and serial number of generators, alternators, turbines, photovoltaic panels, and inverters for which a credit is being applied.

Make

Model

Serial Number

Attach Additional Sheets if Needed

LAC 61:I.1907 requires certain information about the system be provided to determine eligibility for the credit. Below is a list of additional information required about the solar system. Failure to provide this information shall result in the disallowance of the credit.

1.A copy of the modeled array output report using the PV Watts Solar System Performance Calculator. The calculator was developed by the National Renewable Energy Laboratory and is available at the website www.pvwatts.nrel.gov. The analysis must be performed using the default PV Watts

2.A copy of the solar site shading analysis conducted on the installation site using a recognized industry site assessment tool such as a Solar Pathfinder or Solmetric demonstrating the suitability of the site for installation of a solar energy system.

3.A copy of the installation contract signed by the taxpayer and a copy of the receipt or paid invoice detailing the amount of purchase.

3

|

|

|

|

|

|

Solar Energy |

|

|

FILING PERIOD |

|

|

|

|

|

|

|

|

2017 |

|||

|

|

|

|

|

|

Income Tax Credit |

|

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

Residential Property Owner Declaration |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer/Entity Claiming Credit |

|

Social Security No./ Louisiana Revenue Account No. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Physical Address of Location Where System Installed |

|

City |

State |

ZIP |

||||||

|

|

|

|

|

|

|

|

|

LA |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer’s Spouse (if joint return) |

|

Spouse’s Social Security No. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

This page must be signed by the owner of the property on which the solar system is installed.

I, the undersigned residential property owner, am the lessee of a solar energy system and may be entitled to claim the Louisiana solar energy income tax credit pursuant to R.S. 47:6030.

I understand and acknowledge my right to consult a tax professional prior to claiming any Louisiana state tax credit for which I may be eligible.

I understand and acknowledge that LAC 61:I.1907(F)(2) and (3) provide costs ineligible for inclusion under the tax credit. I understand that R.S. 47:6030(C)(1) explains that my “cost of purchase” or overall “costs” of a solar energy system cannot include any lease management fee or any inducement to lease a solar energy system.

I understand that an inducement is an incentive for me to lease a solar energy system. An inducement may be offered to me as a rebate, prize, gift certificate, trip, additional energy item or service, or any other thing of value given to me by the seller, installer, or equipment manufacturer as an incentive for me to lease a system.

Whenever marketing rebates or incentives are offered to me in return for a reduction in the lease price of the system or as an inducement to lease, the eligible cost under LAC 61:I.1907(F)(1) will be accordingly reduced by the fair market value of the marketing rebate or incentive that I receive.

Date (mm/dd/yyyy) |

Last 4 Digits of SSN |

Signature |

_______ _______ _______ _______

Print Name

4

|

|

|

|

|

|

FILING PERIOD |

|

|

|

|

|

Sworn Statements by Licensed |

2017 |

|

|

|

|

|

Dealer and Installer |

|

|

|

|

|

|

|

|

Pursuant to Revised Statute (R.S.) 47:6030(D)(3)(d), Form

Residential Property where the Solar Energy System was Installed

Address

City

State

ZIP

To Be Completed by Dealer:

The undersigned is an authorized principal in _______________________________________________________, is licensed by the

Louisiana Board of Contractors as required by R.S. 47:6030, and certifies under penalty of law, particularly R.S. 14:202.2(A), that the

system leased to the homeowner of the residence located at ___________________________________________________ has a total

nameplate value of ___________________ kilowatts, that no solar dealer, solar installer, or installer affiliate financed the repayment

obligations, and that a reasonable good faith belief exists that the residence is eligible for the credit provided for in this Section in the

amount claimed on a Louisiana income tax return.

___________________________________________________ |

__________________________________ |

______________ |

Dealer’s Name (printed) |

Dealer’s Name (signature) |

Date |

___________________________________________________ |

__________________________________ |

_______________ |

Dealer’s Louisiana License Number |

Notary Public |

Date |

To Be Completed by Installer:

The undersigned is an authorized principal in ______________________________________________________________________,

is licensed by the Louisiana Board of Contractors as required by R.S. 47:6030, is a licensed installer, as required by R.S. 37:2156.3, and certifies under penalty of law, particularly R.S. 14:202.2(A), that the system installed at the residence located at ____________________

______________________________________________________ has a total nameplate value of _____________ kilowatts.

___________________________________________________ |

___________________________________ |

_______________ |

|

Installer’s Name (printed) |

Installer’s Name (signature) |

Date |

|

___________________________________________________ |

___________________________________________________ |

||

Installer’s Louisiana License Number |

Date the installation of the energy system was completed and placed in service |

||

___________________________________________________ |

_______________ |

|

|

Notary Public |

Date |

|

|

5

Document Breakdown

| Fact | Detail |

|---|---|

| Form Purpose | R-1086 is used to claim a tax credit for the purchase and installation of a solar electric system in Louisiana. |

| Filing Period | The form mentions a specific filing period, which for the provided version is for the year 2017. |

| Eligible Claimants | Both individuals and businesses can claim the solar energy income tax credit. |

| Governing Law | LA R.S. 47:6030 oversees the provision of the solar energy system tax credit. |

| Credit Amount | The credit for leased systems installed in 2017 is equal to 38 percent of the first $20,000 of eligible costs, capped at $2.00 per watt for up to six kilowatts. |

| Additional Requirements | System components purchased must be compliant with the Buy American requirements of the federal American Recovery and Reinvestment Act of 2009. |

| Supporting Documents | Documentation such as a modeled array output report, solar site shading analysis, and the installation contract is required to establish eligibility. |

| Claim Limitations | Only one tax credit is allowed per residence, and no other state tax benefit can be used for property for which the credit is claimed. |

| Additional Provisions for Leased Systems | A residential property owner must acknowledge the specific costs that are ineligible for the credit and any inducements received will reduce the eligible cost. |

| Sworn Statements Requirement | Form R-1086 requires sworn statements by both the licensed dealer who leased the system and the licensed installer who installed it as part of the documentation. |

Instructions on Filling in Louisiana R 1086

To properly complete the Louisiana R-1086 form for claiming the solar energy income tax credit, a step-by-step approach ensures accuracy and compliance with the state's requirements. This form is crucial for individuals and businesses looking to benefit from their investment in solar energy installations. It encompasses distinct sections, including taxpayer information, calculation of the eligible credit, and necessary declarations from property owners, dealers, and installers. Careful attention to detail and thorough documentation will facilitate a smooth process for claiming the tax credit.

- Begin by entering the filing period and marking the type of taxpayer - either Individual or Business.

- Provide the Name of Taxpayer/Entity Claiming Credit along with the Social Security No./Entity Louisiana Revenue Account No.

- If a joint individual income tax return is being filed, include the Name of Taxpayer’s Spouse and the spouse's Social Security No..

- Enter the Taxpayer Residence Address (if individual income tax return) or Business Address, including City, State, and ZIP code.

- Calculate the Total Available Credit by completing the worksheet found on page 2 for each solar energy system and enter the total sum of amounts from Line 12 of each worksheet.

- For credits through partnerships, trusts, or small business corporations, specify the share of the qualifying tax credit and provide the Name of Entity along with its Louisiana Revenue Acct No.

- Summarize the Total Credit Available to the taxpayer by adding Lines 1 and 2.

- Under the Leased Systems section, reenter the taxpayer/entity details and proceed to record the physical address of where the system is installed.

- Complete the Computation of the Credit by detailing costs of system equipment, installation, and associated taxes, and follow through with the computations as instructed on the form.

- In the Supplemental Information section, provide detailed system information including make, model, and serial number of components, and attach additional sheets if necessary.

- Attach copies of the modeled array output report, solar site shading analysis, and the installation contract with a receipt or paid invoice as required to substantiate the eligibility for credit.

- For the Residential Property Owner Declaration, the property owner must affirm their understanding and acknowledgment related to the lease and tax credit eligibility, and sign the declaration.

- Complete the Sworn Statements by Licensed Dealer and Installer section, providing detailed assurance of compliance and eligibility from the professionals involved in the solar system's sale and installation.

- Ensure that all relevant sections of the form are signed, including the Declaration by the Taxpayer/Entity Officer and, if applicable, the Taxpayer's Spouse.

After all sections of the form are accurately completed, the taxpayer should compile the form along with all required documents, declarations, and worksheets. These materials must then be submitted to the designated office as specified by Louisiana's Department of Revenue for processing and evaluation of the tax credit claim. Retention of copies for records is also advised should further verification or queries arise.

Listed Questions and Answers

What is the Louisiana R-1086 form?

The Louisiana R-1086 form is used for claiming the Solar Energy Income Tax Credit for individuals and businesses. This credit applies to the purchase and installation of a solar electric system in Louisiana for the 2017 filing period.

Who can claim the solar energy income tax credit?

Both individuals and businesses that have purchased and installed a solar energy system in Louisiana can claim this tax credit. Third-party owners who lease a solar energy system to a homeowner of a single-family detached residence in the state are also eligible to claim the credit.

Are there any restrictions on claiming this credit?

Yes. The Louisiana R-1086 form outlines several restrictions, including:

- A tax credit can only be claimed once per residence, and no additional credits are allowed for any other systems installed at the same residence.

- System components purchased on or after July 1, 2013, must comply with the "Buy American" requirements.

- The credit cannot be combined with any other state tax benefit for the same property.

How do I calculate the credit amount?

The credit amount for leased systems installed in 2017 is equal to 38 percent of the first $20,000 of eligible costs. For determining the cost basis of a leased system, the eligible cost is $2.00 per watt limited to six kilowatts.

What supporting documents are required when claiming the credit?

You need to retain and potentially submit:

- Copies of Schedule K-1 or other documents supporting your share of the distributed credit amount, if the credit was received through a partnership, trust, or small business corporation.

- A copy of the solar system's modeled array output report, site shading analysis, the installation contract, and the receipt or paid invoice detailing the purchase amount.

Can this credit be used along with federal credits?

Yes, this credit may be used in addition to any federal credits earned for the same system. However, it cannot be combined with other state tax benefits for the property for which the credit is claimed.

What if I am leasing the solar energy system?

If you are leasing the system, the cost of purchase or costs cannot include any lease management fee or any inducement to lease a solar energy system. Any marketing rebates or incentives will reduce the eligible cost accordingly.

Where can I find more information or assistance?

You can refer to Revenue Information Bulletins 13-026, 15-026, and Louisiana Administrative Code (LAC) 61:I.1907 for additional information on the solar energy income tax credit. For further assistance, consulting a tax professional is recommended.

Common mistakes

When filling out the Louisiana R-1086 form, which is related to the Solar Energy Income Tax Credit for 2017, individuals and businesses often make mistakes that can affect their eligibility for the tax credit or lead to the rejection of their application. Highlighted below are seven common mistakes to avoid:

- Incorrect or Incomplete Name and Identification Information: One of the primary errors involves not correctly providing the name of the taxpayer/entity claiming the credit or inaccurately entering their Social Security Number or Louisiana Revenue Account Number. It's crucial to print or type information clearly to ensure accuracy.

- Omitting Spouse Information on Joint Returns: For those filing jointly, failing to include the spouse’s name and Social Security Number can lead to processing delays or rejections. If the return is joint, this information is as crucial as that of the primary taxpayer.

- Incorrect Address Information: Entering wrong addresses, whether it’s the taxpayer residence address for individuals or the business address for entities, can cause confusion and delay the credit process.

- Not Thoroughly Completing the Credit Computation Worksheet: The worksheet provided on the second page of the R-1086 form is often overlooked or filled out incorrectly. Not entering the correct cost of new system equipment, installation costs, or incorrectly calculating the credit amount can significantly impact the credit eligibility.

- Failing to Provide the Required Documentation: Not attaching the necessary documentation like the modeled array output report, solar site shading analysis, installation contract, or proof of payment will almost certainly result in the denial of the credit. These documents are essential for verifying the eligibility of the solar energy system for the credit.

- Not Adjusting for Marketing Rebates or Incentives: Another mistake is failing to adjust the total eligible cost of the system for any marketing rebates or incentives received. These should be deducted from the eligible cost under LAC 61:I.1907(F)(1) to accurately determine the tax credit amount.

- Incorrect or Missing Signatures: The tax credit claim must be signed by the taxpayer, and if applicable, the taxpayer’s spouse. In the case of leased systems, sworn statements by the licensed dealer and installer are also mandatory. Failing to include these signatures or submitting incomplete statements can invalidate the claim.

Avoiding these mistakes enhances the likelihood of a successful tax credit claim. Careful attention to detail and thoroughness are key when completing the Louisiana R-1086 form.

Documents used along the form

When preparing and filing the Louisiana R-1086 form, which is aimed at claiming the solar energy income tax credit for individuals and businesses, several other forms and documents may often be needed to complete the process effectively. These additional forms and documents ensure compliance with tax regulations, verify eligibility, and provide necessary details related to the solar energy system installed. Here is an overview of the various forms and documents that are commonly used alongside the Louisiana R-1086 form:

- R-1086 Worksheet and Supplemental Information Sheet: Essential for providing detailed calculations and system information required to substantiate the credit claimed on the main form.

- R-10610: Louisiana Department of Revenue's "Power of Attorney Declaration," which authorizes a representative to handle tax matters on behalf of the taxpayer.

- R-7006: A related power of attorney form that specifically grants someone else the power to sign documents and make declarations on behalf of the taxpayer or entity.

- Installation Contract: A copy of the contract between the taxpayer and the solar system installer, detailing the scope of work and the financial terms of the installation project.

- Paid Invoice/Receipt: Document showing the total amount paid for the solar system, including equipment and installation costs, necessary for verifying the financial basis of the tax credit.

- Modelled Array Output Report: Generated using the PV Watts Calculator, this report projects the solar energy system's performance, a critical piece for tax credit eligibility.

- Solar Site Shading Analysis: A report that assesses the installation site's solar potential, typically conducted using recognized industry tools like Solar Pathfinder or Solmetric. It provides evidence of the system’s efficiency capabilities.

- Sworn Statements: From the licensed dealer and installer, these documents affirm that the system was leased and installed according to state laws and regulations, including the "Buy American" requirements.

- Schedule K-1 or Equivalent Document: For taxpayers who received the solar credit through a partnership, trust, or S corporation, documentation supporting their share of the credit is necessary.

Together, these forms and documents form a comprehensive dossier that supports the claim for a solar energy tax credit under Louisiana's R-1086 program. They provide a structured way to demonstrate compliance with state tax laws, detail the investment in solar energy, and ultimately, help secure the tax benefits designed to encourage the adoption of renewable energy. Proper preparation and submission of these forms are crucial steps in leveraging Louisiana's tax incentives for solar energy installation.

Similar forms

The Louisiana R 1086 form is similar to various other tax documents designed to claim credits or deductions from both state and federal governments. These documents serve a common purpose: to incentivize certain behaviors or investments through the tax code. Two notable examples include the Federal Residential Renewable Energy Tax Credit form and the state-specific forms for claiming Energy Efficient Appliance Rebates.

Federal Residential Renewable Energy Tax Credit shares a similar purpose with the Louisiana R 1086 form, as it encourages homeowners across the United States to install solar energy systems by offering a significant tax credit. While the R 1086 form is specific to Louisiana residents and focuses on solar energy credits for both leased and purchased systems, the federal form applies more broadly to several types of renewable energy installations, including solar, wind, and geothermal systems. The key similarity lies in the mechanism of encouraging the adoption of renewable energy through tax incentives. Both forms require detailed information about the energy system, the cost, and the installation date, and they calculate the credit in a manner that directly reduces the taxpayer's liability, thereby lowering the overall cost of going green.

Energy Efficient Appliance Rebate forms, available in various states, share a similar goal with the R 1086 form: promoting environmentally friendly practices. While R 1086 is focused on solar energy systems, these rebate forms typically cover a wider range of products, including high-efficiency appliances and heating and cooling systems. The similarity between these documents lies in their shared objective of reducing energy consumption and promoting sustainability. Both types of forms require purchasers to provide proof of purchase and detailed information about the product or system, ensuring that only qualifying purchases receive the incentive. This approach mutually benefits the environment by encouraging the uptake of more energy-efficient solutions and provides financial relief to consumers and businesses making environmentally conscious decisions.

Dos and Don'ts

Filling out the Louisiana R-1086 form, related to solar energy income tax credit for individuals and businesses, requires attention to detail and an understanding of state tax codes. To ensure your submission is accurate and compliant, here are things you should and shouldn't do:

- Do carefully read all instructions on the form before starting. This understanding can help prevent common mistakes.

- Do ensure that all required documentation is complete and accurate. This includes the installation contract, receipts, and any supplementary sheets necessary for each solar energy system being claimed.

- Do provide clear and legible information when printing or typing. This helps in avoiding delays in processing due to unreadable entries.

- Do take advantage of the "PV Watts Solar System Performance Calculator" to accurately fill out the worksheet portion related to the computation of the credit.

- Don't overlook the requirement for a "solar site shading analysis" or the modeled array output report. Failing to attach these could result in the disallowance of your credit.

- Don't forget to sign and date the declaration page. All forms require a signature for validation, and not doing so could render your submission invalid.

- Don't ignore the "Buy American" requirements for system components purchased on or after July 1, 2013. Ensure that your solar energy system components comply to avoid disqualification.

- Don't use this credit in conjunction with any other state tax benefit for property for which this specific credit is claimed. It is crucial to understand that claiming dual benefits for the same installation is prohibited.

Properly completing the Louisiana R-1086 form not only supports the transition to renewable energy but also ensures you receive the financial benefits to which you're entitled. Paying attention to the details and avoiding common pitfalls can streamline the process, making it a smooth experience for both individuals and businesses.

Misconceptions

Many people have misconceptions about the Louisiana R-1086 form. Here are nine common ones explained:

Only homeowners can claim the credit: Actually, both individuals and businesses can apply for the Solar Energy Income Tax Credit using the Louisiana R-1086 form. This includes third-party owners leasing systems to residential property owners.

The credit is unlimited: There's a cap on the credit. It's 38 percent of the first $20,000 of eligible costs for leased systems, with specific limits based on the system's output capacity in watts.

Any solar energy system qualifies: The system must meet specific criteria, including compliance with "Buy American" requirements for components purchased after July 1, 2013. Not every solar system will qualify for the credit.

You can claim other state benefits too: If you receive the Solar Energy Income Tax Credit, you cannot use any other state tax benefits for the same property, even though federal credits are still permissible in addition.

The credit is applied automatically: Taxpayers must complete and submit the R-1086 form properly, including necessary supplemental information and worksheets for each solar energy system, to claim the credit.

All installation costs are covered: Certain costs, such as lease management fees or inducements to lease, are explicitly excluded from the calculation of eligible expenses for the tax credit.

It's only for new installations: While the credit is primarily aimed at new system equipment and installation, the key criterion is that the purchase and installation occurred within the filing period, specifically for 2017 in the version of the form provided.

You need to file just one form for multiple installations: You must complete a separate worksheet and supplemental information sheet for each solar energy system you are claiming the credit for and attach each worksheet to the main form.

The form is complicated and requires legal expertise to complete: While it's always wise to consult with a tax professional if you are unsure, the R-1086 form and its instructions are designed to be completed by the taxpayer. Necessary documentation, such as the installation contract and proof of costs, should be readily available to most system owners.

Understanding the facts about the Louisiana R-1086 form can greatly simplify the process of claiming the Solar Energy Income Tax Credit and ensure that eligible individuals and businesses receive the benefits to which they are entitled.

Key takeaways

Filling out and using the Louisiana R 1086 form can be a straightforward process if you understand the key steps and requirements. Here are some essential takeaways to guide you:

- The Louisiana R 1086 form is designed for individuals and businesses seeking to claim a Solar Energy Income Tax Credit for the purchase and installation of solar energy systems.

- It’s crucial to print or type the information required on the form clearly to avoid any processing delays or issues with your tax credit claim.

- One of the first steps is to complete a worksheet for each solar energy system for which credit is being claimed. It’s essential to accurately add up the amounts from line 12 of each worksheet and record the total to determine your total available credit.

- If you are claiming part of a tax credit through an interest in partnerships, trusts, or small business corporations, you'll need to document your share of the qualifying tax credit carefully. Keeping copies of the Schedule K-1 or other supporting documents is advisable for substantiating your claim.

- The credit can complement federal credits for the same system, but the rules stipulate that you cannot claim any other state tax benefit for the property associated with the claimed credit.

- Affirmation by the taxpayer is a critical step in the process; you must declare that the information provided is true, complete, and in compliance with relevant statutes, rules, and regulations related to the solar energy income tax credit.

- Additional documentation may be required to validate your claim, including a copy of the system's modeled array output report, a solar site shading analysis, and copies of the installation contract and payment receipts.

- Remember to sign the form and, if applicable, have your spouse sign it too if filing a joint return. This signature is a declaration of the accuracy and completeness of the claim.

By keeping these key points in mind and gathering the necessary documentation in advance, you can ensure a smoother process when claiming your Solar Energy Income Tax Credit in Louisiana.

Popular PDF Templates

Can Veterans Concealed Carry in Louisiana Without a Permit - Indicates that submission of medical information may be necessary for applicants with a history of mental illness or medication for mental disorders.

Dpsmv 1968 - An explicit instruction to read all attachments before signing emphasizes thorough understanding and compliance with application requirements.

Louisiana 2022 Tax Forms - An efficient way for residents to communicate their needs to the state government, enhancing accessibility to services in Louisiana.