Free Louisiana Cift 620 Template

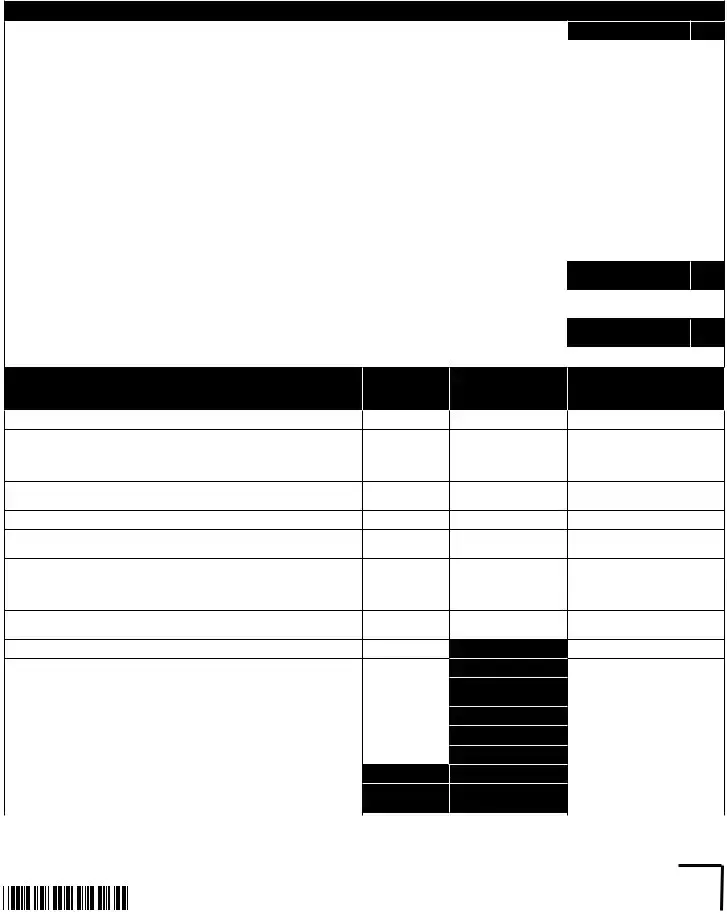

At the heart of Louisiana's tax compliance for corporations lies the Louisiana CIFT-620 form, a document compiled with crucial information that serves dual purposes. Designed for the Louisiana Department of Revenue, this essential form functions as both the Corporation Income Tax and the Corporation Franchise Tax Return. Tailored for the fiscal year, it delineates specific reporting requirements including the Louisiana Revenue Account Number, legal and trade names, address updates, and amendments to previously filed returns. Moreover, the form caters to a myriad of tax details such as federal taxable income, tax apportionment percentage, gross revenues, total assets, and pertinent deductions. Unique attributes like NAICS code, consolidated tax return inclusion, intercompany debt, and borrowed capital details further elevate its complexity. Computation specifics on income and franchise tax, encompassing net income, exclusions, carryforwards, tax deductions, and nonrefundable credits, underline the critical financial calculations businesses must navigate. Additionally, refundable tax credits, payments, and donations options are outlined, illustrating the opportunities businesses have to manage their tax liabilities efficiently. Filing this form correctly is pivotal, as it ensures compliance with Louisiana’s tax statutes, enabling corporations to avoid penalties and benefit from possible credits and deductions.

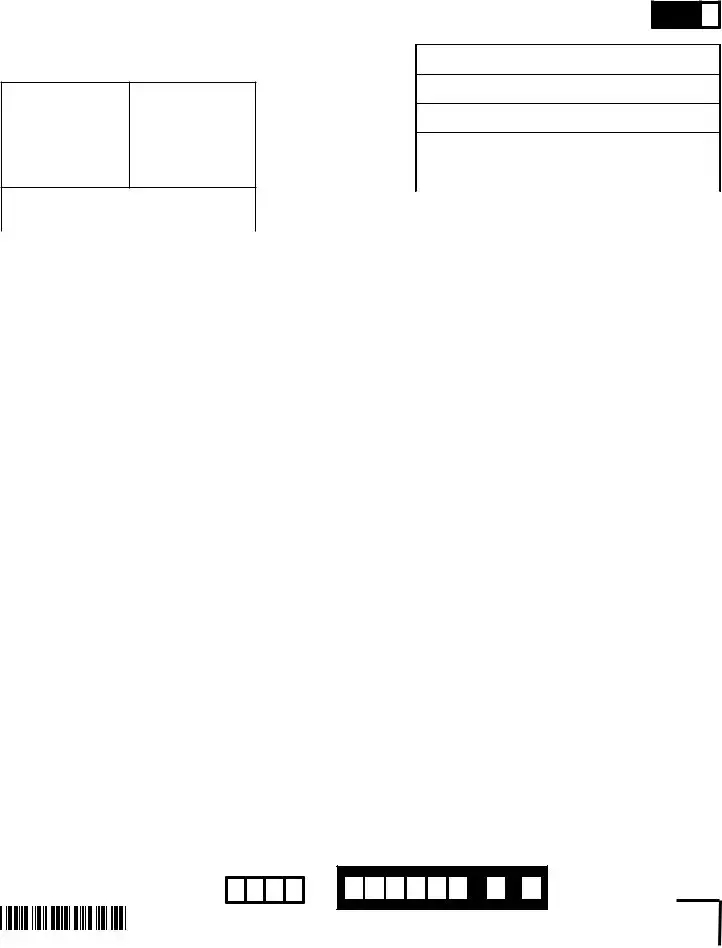

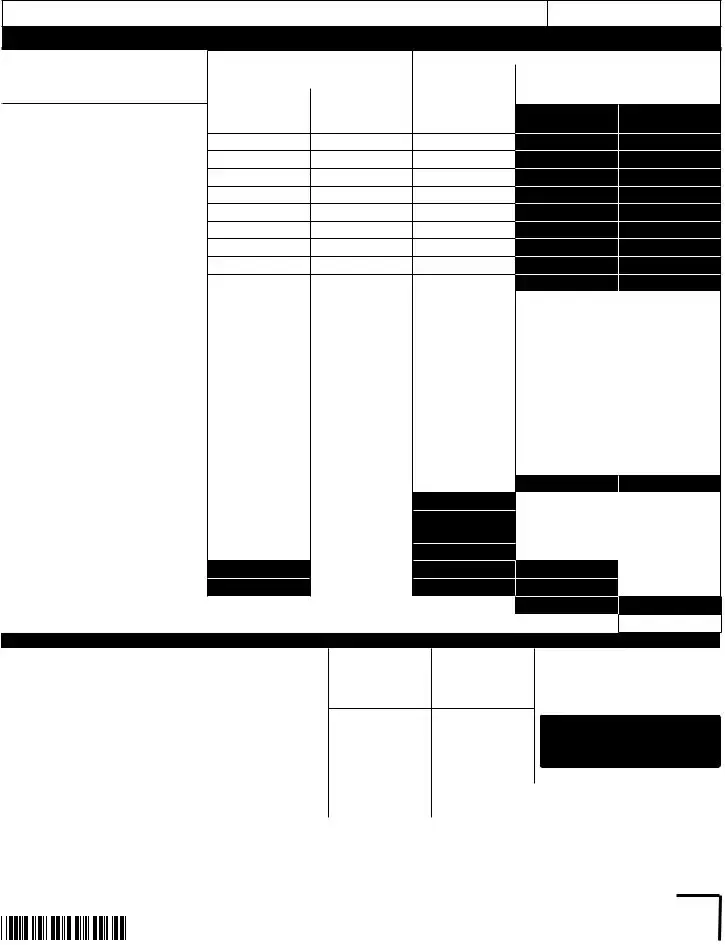

Form Example

Print your LA Revenue Account |

u |

|

|

|

|

|

|

|

|

|

|

|

Louisiana Department |

|

|

|

|

|

|

|

|

|

|

||

Number here (NOT FEIN): |

|

|

|

|

|

|

|

|

|

|

|

|

of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

u

For office use only.

Post Office Box 91011

Baton Rouge, LA

uO |

For name change, mark circle.

Legal Name

Trade Name

Louisiana

Corporation

Income Tax

Return for 2009

or Fiscal Year

Begun _______, 2009

Ended _______, 2010

Louisiana

Corporation

Franchise Tax Return for 2010 or Fiscal Year

Begun _______, 2010

Ended _______, 2011

uO |

uO |

uO |

For address change, mark circle.

For amended return, mark circle.

Entity is not required to ile franchise tax

Address

City |

State |

ZIP |

|

|

|

Calendar year returns are due April 15. See instructions for iscal years.

OFinal return |

Mark the appropriate circle for |

O Short period return |

Short period or Final return. |

Print the corporation’s name and complete mailing address above.

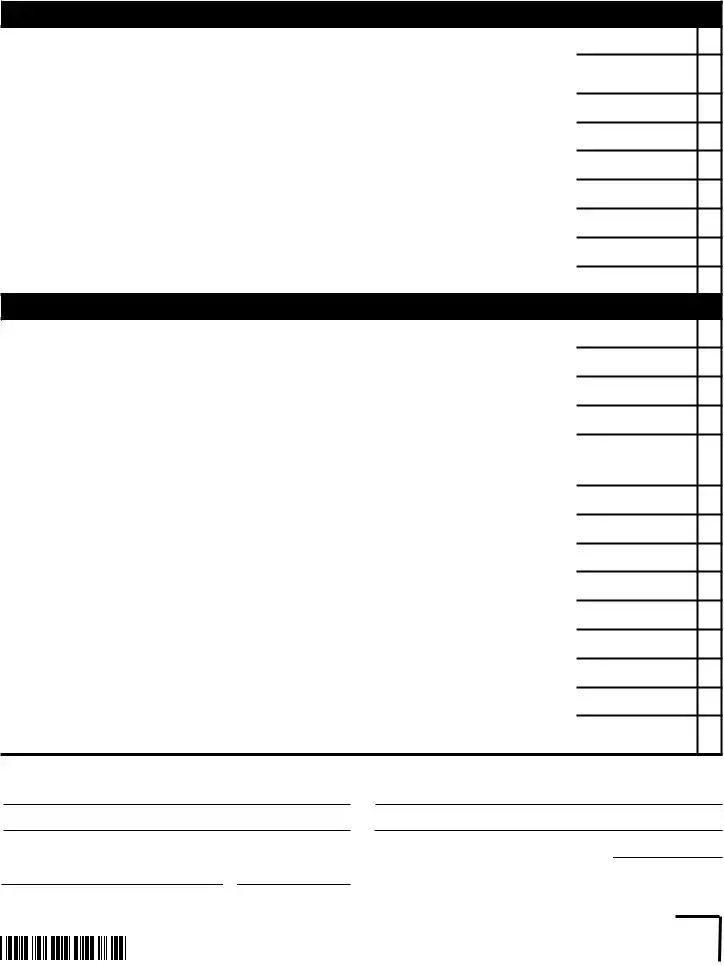

A. |

Federal Employer Identiication Number |

|

A. u |

|

|

|

||

|

|

|

|

|

|

|

|

|

B. |

Federal taxable income |

|

|

B. u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

C. |

Federal income tax |

|

|

C. u |

|

|

00 |

|

|

|

|

|

|

|

|

||

D. |

Income tax apportionment percentage (two decimal places) |

|

D. u |

. |

|

% |

||

E. |

Gross revenues |

|

|

E. u |

|

|

00 |

|

F. |

Total assets |

|

|

F. u |

|

|

00 |

|

G. |

NAICS code |

|

|

G. u |

|

|

|

|

|

|

|

|

|

|

|||

H. |

Was the income of this corporation included in a consolidated federal income tax return? |

|

H. u |

o Yes |

o No |

|||

I. |

Is |

|

I. u |

o Yes |

o No |

|||

J. |

Do the books of the corporation contain intercompany debt? |

|

J. u |

o Yes |

o No |

|||

K. |

Is borrowed capital computed on a calendar or iscal year closing immediately prior to August 28, 2005? |

K. u |

o Yes |

o No |

||||

|

|

Computation of Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1A. |

Louisiana net income before loss adjustments and federal income tax deduction – |

|

|

u |

|

|

00 |

|

|

From either |

|

1A. |

|

|

|||

|

|

|

|

|

|

|

|

|

1B. |

Subchapter S corporation exclusion – See instructions, page 16. Attach schedule. |

|

1B. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

1C. |

Loss carryforward [$ |

.00] less federal tax refund applicable to loss [$ |

.00] Attach schedule. |

1C. |

u |

|

|

00 |

1D. |

Loss carryback [$ |

.00] less federal tax refund applicable to loss [$ |

.00] Attach schedule. |

1D. |

u |

|

|

00 |

1E. |

Federal income tax deduction – See instructions, page 16. |

|

1E. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

1E1. |

Federal Disaster Relief Credits – See instructions, page 17. |

|

1E1. |

u |

|

|

00 |

|

1F. |

Louisiana taxable income – Subtract Lines 1B, 1C, 1D, and 1E from Line 1A. |

|

1F. |

u |

|

|

00 |

|

2. |

Louisiana income tax – From |

|

2. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

3. |

Total nonrefundable income tax credits – From |

|

3. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

4. |

Income tax after nonrefundable credits – Subtract Line 3 from Line 2. |

|

4. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

5. |

Estimated tax payments – From |

|

5. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

6. |

Amount of income tax due or overpayment – Subtract Line 5 from Line 4. |

|

6. |

u |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

*Complete the following page, sign and date return and remit

any amount due shown on Line 25. Do not send cash.

WEB

FOR OFFICE USE ONLY.

Field lag

SPEC

CODE

www.revenue.louisiana.gov2052

2052924

Print your LA Revenue Account Number here. u _____________________________

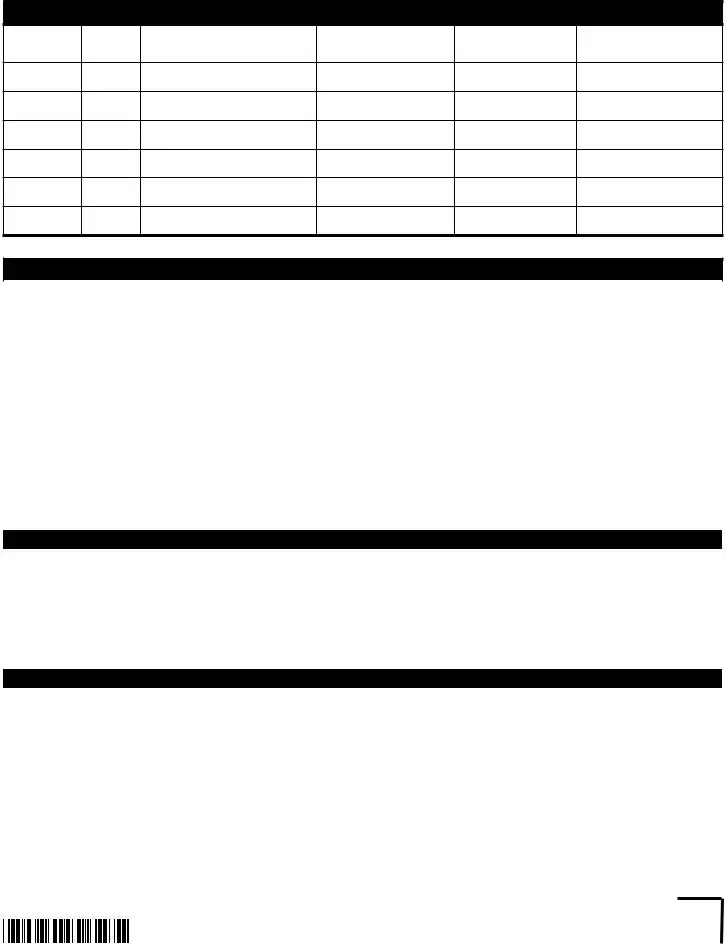

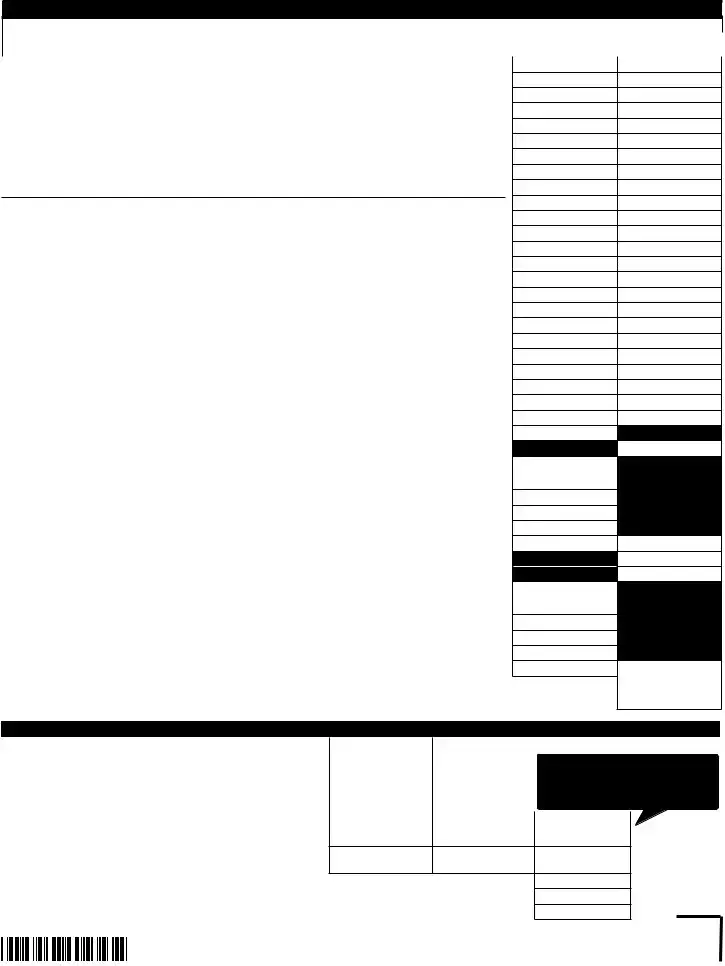

Computation of Franchise Tax

7A. |

Total capital stock, surplus, undivided proits, & borrowed capital – From |

7A. |

u |

|

|

|

|

|

|

7B. |

Franchise tax apportionment percentage – From |

|

|

|

|

Percentage must be carried out to 2 decimal places. Do not exceed 100.00%. |

7B. |

u |

. |

|

|

|

|

|

7C. |

Franchise taxable base – Multiply Line 7A by Line 7B. |

7C. |

u |

|

|

|

|

|

|

8. |

Amount of assessed value of real and personal property in Louisiana in 2009 |

8. |

u |

|

|

|

|

|

|

9. |

Louisiana franchise tax – From |

9. |

u |

|

|

|

|

|

|

10. |

Total nonrefundable franchise tax credits – From |

10. |

u |

|

|

|

|

|

|

11. |

Franchise tax after nonrefundable credits – Subtract Line 10 from Line 9. |

11. |

u |

|

|

|

|

|

|

12. |

Previous payments |

12. u |

|

|

|

|

|

|

|

13. |

Amount of franchise tax due or overpayment – Subtract Line 12 from Line 11. |

13. |

u |

|

|

Net Amount Due |

|

|

|

|

|

|

|

|

00

%

00

00

00

00

00

00

00

14. |

Total income and franchise tax due or overpayment – Add Lines 6 and 13. |

14. u |

|

|

|

|

|

15. |

Louisiana Citizens Insurance Credit – See instructions, page 17. |

15. |

u |

|

|

||

15A. Other refundable credits – From |

15A. u |

||

|

|

|

|

15B. Subtotal – Add Lines 15 and 15A and print the result. |

15B. |

u |

|

|

|

|

|

16. |

Net income and franchise taxes overpayment. If Line 14 is equal to Line 15B, print zero on |

|

|

|

Lines 16 through 23 and go to Line 24. If Line 14 is less than Line 15B, subtract Line 14 from |

|

|

|

Line 15B and print the result here. If Line 14 is greater than Line 15B, print zero on Lines 16 |

|

u |

|

through 19 and go to Line 20. – See instructions, page 17. |

16. |

|

17. |

Amount of overpayment you want to donate to The Military Family Assistance Fund |

17. |

u |

|

|

|

|

18. |

Amount of overpayment you want Refunded |

18. u |

|

|

|

|

|

19. |

Amount of overpayment you want Credited to 2010 |

19. u |

|

|

|

|

|

20. |

Amount due – If Line14 is greater than Line 15B, subtract Line 15B from Line 14 and print the result. |

20. |

u |

|

|

|

|

21. |

Delinquent iling penalty – See instructions, page 17. |

21. |

u |

|

|

|

|

22. |

Delinquent payment penalty – See instructions, page 17. |

22. |

u |

|

|

|

|

23. |

Interest – See instructions, page 17. |

23. |

u |

|

|

|

|

24. |

Additional donation to The Military Family Assistance Fund |

24. |

u |

|

|

|

|

25. |

Total amount due – Add Lines 20 through 24. |

25. |

u |

|

Make payment to Louisiana Department of Revenue. DO NOT SEND CASH. |

||

|

|

|

|

|

|

|

|

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he has any knowledge.

Print name of officer

Signature of oficer

Signature of preparer

Firm name

|

( |

) |

|

Title of oficer |

|

|

Telephone |

Date

()

Telephone

Date

WEB |

2053 |

Print your LA Revenue Account Number here. u _____________________________

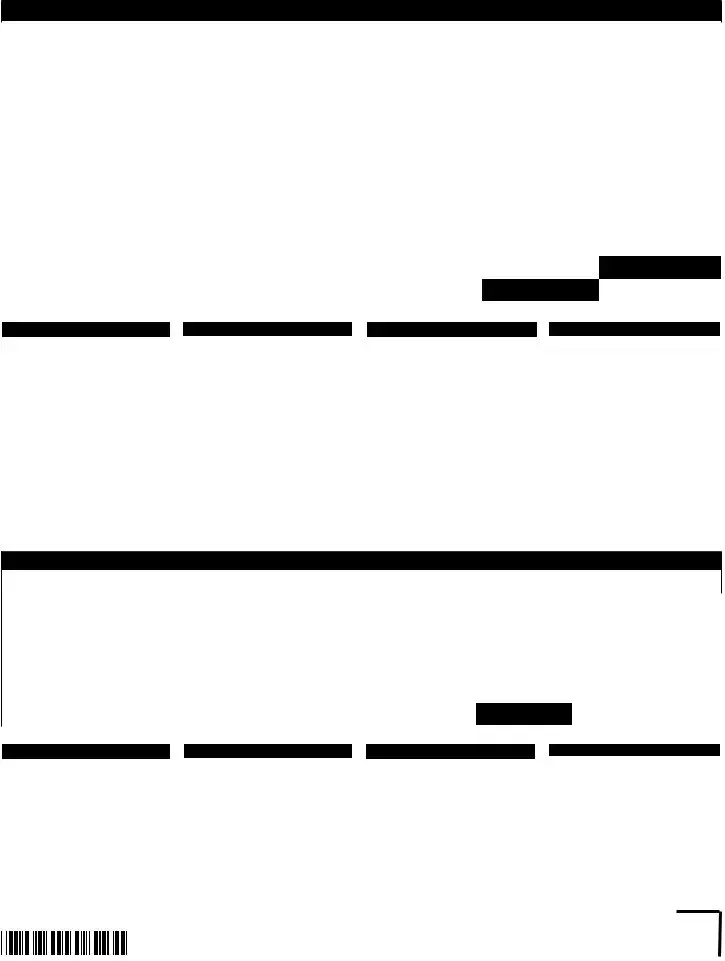

Schedule NRC – Nonrefundable Tax Credits, Exemptions, and Rebates

|

Description |

|

Code |

Corporation |

|

Corporation |

||

|

|

|

|

|

Franchise Tax (B) |

|||

|

|

|

|

Income Tax (A) |

|

|||

|

|

|

|

|

|

|

|

|

1. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

2. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

3. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

4. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

5. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

6. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

7. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

8. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

9. |

|

u |

|

|

|

00 |

|

00 |

|

|

|

|

|

|

|

|

|

10. |

Total Income Tax Credits: Add credit amounts in Column A. Print here and on |

|

|

00 |

|

|

||

|

|

|

|

|

|

|

||

11. |

Total Franchise Tax Credits: Add credit amounts in Column B. Print here and on |

|

|

|

|

00 |

||

|

|

|

|

|

|

|

|

|

For further information about these credits, please see instructions beginning on page 18.

Description |

Code |

|

Premium Tax |

100 |

|

|

|

|

Bone Marrow |

120 |

|

|

|

|

Nonviolent Offenders |

140 |

|

|

|

|

Qualiied Playgrounds |

150 |

|

|

|

|

Debt Issuance |

155 |

|

|

|

|

Contributions to |

160 |

|

Educational Institutions |

||

|

||

Donations to |

170 |

|

Public Schools |

||

|

Description |

Code |

Donations of Materials, |

|

Equipment, Advisors, |

175 |

Instructors |

|

Other |

199 |

|

|

Atchafalaya Trace |

200 |

|

|

Previously Unemployed |

208 |

|

|

Recycling Credit |

210 |

|

|

Basic Skills Training |

212 |

|

|

Dedicated Research |

220 |

|

|

New Jobs Credit |

224 |

|

|

Refunds by Utilities |

226 |

|

|

Description |

Code |

|

Eligible |

228 |

|

Neighborhood Assistance |

230 |

|

|

|

|

Cane River Heritage Area |

232 |

|

|

|

|

La Community Economic Dev |

234 |

|

Apprenticeship |

236 |

|

|

|

|

Ports of Louisiana Investor |

238 |

|

|

|

|

Ports of Louisiana Import |

240 |

|

Export Cargo |

||

|

||

Motion Picture Investment |

251 |

|

Research and Development |

252 |

|

|

|

|

Historic Structures |

253 |

|

|

|

|

Digital Interactive Media |

254 |

Description |

Code |

Motion Picture Resident |

256 |

Capital Company |

257 |

LCDFI Credit |

258 |

New Markets |

259 |

Brownields Investor |

260 |

Motion Picture Infrastructure |

261 |

Other |

299 |

Biomed/University Research |

300 |

Tax Equalization |

305 |

Manufacturing Establishments |

310 |

Enterprise Zone |

315 |

Other |

399 |

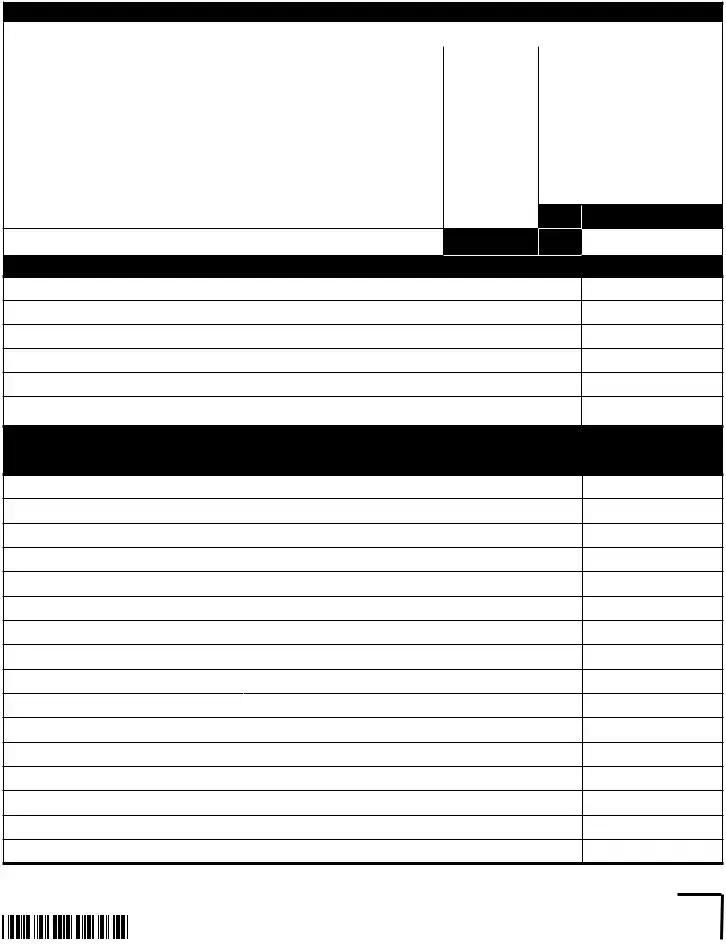

Schedule RC – Refundable Tax Credits and Rebates

|

Description |

|

Code |

Amount of Credit Claimed |

|

|

|

|

|

|

|

1. |

|

u |

F |

|

00 |

|

|

|

|

|

|

2. |

|

u |

F |

|

00 |

|

|

|

|

|

|

3. |

|

u |

F |

|

00 |

|

|

|

|

|

|

4. |

|

u |

F |

|

00 |

|

|

|

|

|

|

5. |

|

u |

F |

|

00 |

|

|

|

|

|

|

6. |

Total: Add lines 1 through 5. Print the result here and on Line 15A. |

u |

|

|

00 |

|

|

|

|

|

|

For further information about these credits, please see instructions beginning on page 20.

Description |

Code |

|

Inventory Tax |

50F |

|

Ad Valorem Natural Gas |

51F |

|

Ad Valorem Offshore Vessels |

52F |

|

Telephone Company |

54F |

|

Property |

||

|

||

|

|

|

Prison Industry Enhancement |

55F |

|

|

|

|

Urban Revitalization |

56F |

Description |

Code |

|

57F |

||

|

|

|

Milk Producers |

58F |

|

|

|

|

Technology |

59F |

|

Commercialization |

||

|

||

Angel Investor |

61F |

|

|

|

|

Musical and Theatrical |

62F |

|

Production |

||

|

||

|

|

Description |

Code |

|

Wind and Solar Energy |

64F |

|

Systems |

||

|

||

|

|

|

School Readiness Child |

65F |

|

Care Provider |

||

|

||

|

|

|

School Readiness Business |

67F |

|

- Supported Child Care |

|

|

School Readiness Fees |

|

|

and Grants to Resource |

68F |

|

and Referral Agencies |

|

Description |

Code |

|

Sugarcane Trailer Conversion |

69F |

|

|

|

|

Retention and Modernization |

70F |

|

|

|

|

Conversion of Vehicle to |

71F |

|

Alternative Fuel |

||

|

||

Research and Development |

72F |

|

|

|

|

Other Refundable |

80F |

|

|

|

WEB2054

Print your LA Revenue Account Number here. u _____________________________

All applicable schedules must be completed.

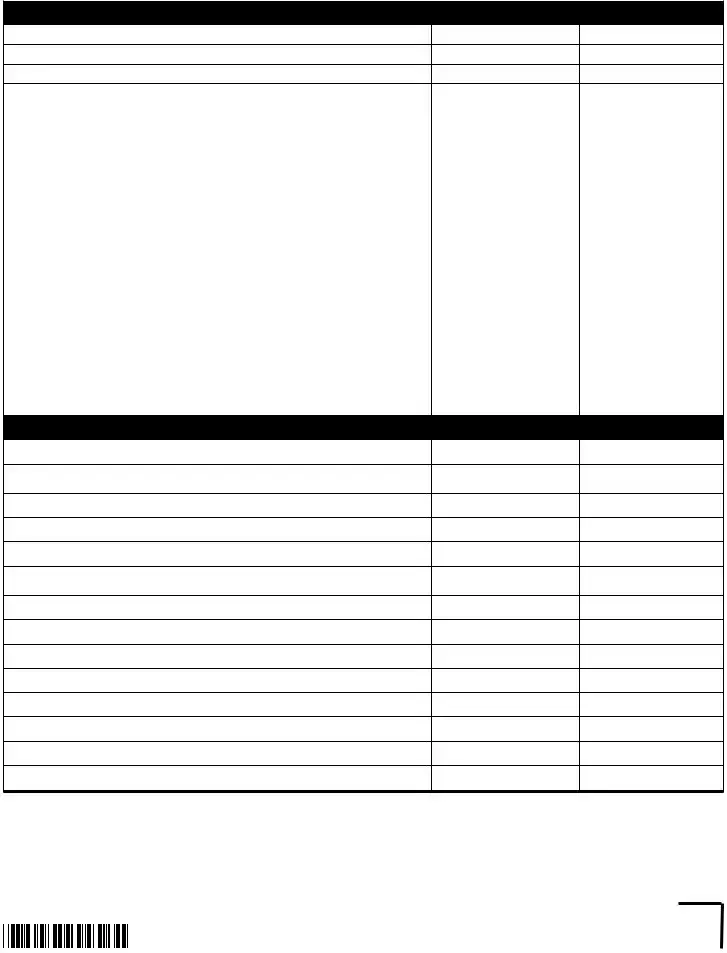

Schedule A – Balance Sheet

ASSETS |

1. Beginning of year |

2. End of year |

1.Cash

2.Trade notes and accounts receivable

3. |

Reserve for bad debts |

( |

) |

( |

) |

4. |

Inventories |

|

|

|

|

|

|

|

|

|

|

5. |

Investment in United States government obligations |

|

|

|

|

|

|

|

|

|

|

6. |

Other current assets – Attach schedule. |

|

|

|

|

|

|

|

|

|

|

7. |

Loans to stockholders |

|

|

|

|

|

|

|

|

|

|

8. |

Stock and obligations of subsidiaries |

|

|

|

|

|

|

|

|

|

|

9. |

Other investments – Attach schedule. |

|

|

|

|

|

|

|

|

|

|

10. Buildings and other ixed depreciable assets |

|

|

|

|

|

|

|

|

|

|

|

11. Accumulated amortization and depreciation |

( |

) |

( |

) |

|

12. Depletable assets |

|

|

|

|

|

|

|

|

|

|

|

13. Accumulated depletion |

( |

) |

( |

) |

|

14. Land |

|

|

|

|

|

|

|

|

|

|

|

15. Intangible assets |

|

|

|

|

|

|

|

|

|

|

|

16. Accumulated amortization |

( |

) |

( |

) |

|

17. Other assets – Attach schedule. |

|

|

|

|

|

|

|

|

|

|

|

18. Excessive reserves or undervalued assets – Attach schedule. |

|

|

|

|

|

|

|

|

|

|

|

19. Totals – Add Lines 1 through 18. |

|

|

|

|

|

Liabilities and Capital

20. Accounts payable

21. Mortgages, notes, and bonds payable one year old or less at balance sheet date and having a maturity of one year or less from original date incurred

22. Other current liabilities – Attach schedule.

23. Loans from stockholders – Attach schedule.

24. Due to subsidiaries and affiliates

25. Mortgages, notes, and bonds payable more than one year old at balance sheet date or having a maturity of more than one year from original date incurred

26. Other liabilities – Attach schedule.

27. Capital stock: a. Preferred stock

b. Common stock

28.

29. Surplus reserves – Attach schedule.

30. Earned surplus and undivided proits

31. Excessive reserves or undervalued assets

32. Totals – Add Lines 20 through 31.

WEB |

2055 |

Print your LA Revenue Account Number here. u _____________________________

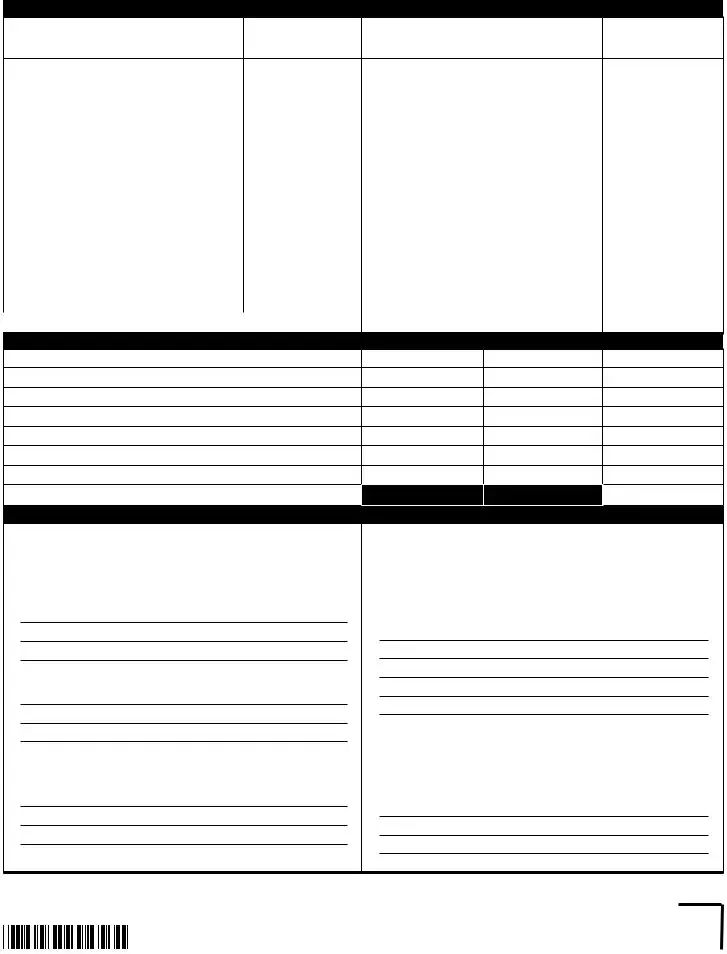

For Schedule

All applicable schedules must be completed. Complete lines 1 through 11 only if there is an end of year balance in the “Due to Subsidiaries and Affiliates” account or an equivalent account on the books of the corporation.

Schedule

1. Capital Stock:

1A. |

Common Stock – Include |

|

|

00 |

|

|

|

|

|

1B. |

Preferred Stock – Include |

|

|

00 |

2. Total Capital stock – Add Lines 1A and 1B. |

|

|

00 |

|

|

|

|

|

|

3. Surplus and undivided proits |

|

|

00 |

|

|

|

|

|

|

4. Surplus reserves – Include any excessive reserves or undervalued assets. |

|

|

00 |

|

|

|

|

|

|

5. Total – Add Lines 2, 3, and 4. |

|

|

00 |

|

|

|

|

|

|

6. Due to subsidiaries and affiliates |

|

|

00 |

|

7. Deposit liabilities to affiliates – Included in the amount on Line 6 |

|

|

00 |

|

|

|

|

|

|

8. Accounts payable less than 180 days old – Included in the amount on Line 6 |

|

|

00 |

|

|

|

|

|

|

9. Adjusted debt to affiliates – Subtract Lines 7 and 8 from Line 6. |

|

|

00 |

|

|

|

|

||

10A. If Line 9 above is greater than zero, AND Line 5 above is greater than or equal to zero, subtract Line 5 |

|

00 |

||

from line 9. If both conditions of this line do not apply, skip to Line 10B. |

|

|

||

|

|

|

||

|

|

|

||

10A1. If Line 10A is less than zero, print zero on Line 11 and Line 24, column 3. If Line 10A is greater than zero, |

|

|

||

multiply Line 10A by 50% and print this amount on Line 11 and Line 24, column 3. |

|

|

|

|

|

|

|

||

10B. If Line 9 is greater than zero, AND Line 5 is less than or equal to zero, subtract Line 5 from Line 9. |

|

00 |

||

Multiply the difference by 50% and print the result here. |

|

|

||

|

|

|

||

10B1. Print the lesser of Line 9 or Line 10B on Line 11 and Line 24, column 3. If Line 9 equals Line 10B, print that |

|

|

||

amount on Line 11 and on Line 24, column 3. |

|

|

|

|

11. Print the amount from either Line 10A1 or 10B1. |

|

|

00 |

|

|

1 |

2 |

3 |

|

|

End of year |

70% reduction |

Total |

|

|

|

for items of debt |

(See note below.) |

|

|

|

|

|

|

12.Accounts payable

13.Mortgages, notes and bonds payable one year old or less at balance sheet date and having a maturity of one year or less from original date incurred. – Complete Schedule B. Do Not include indebtedness from the Louisiana Infrastructure Bank.

14.Other current liabilities – Attach Schedule.

Do Not include items of surplus. See RIB

15.Loans from stockholders – Attach Schedule.

16.End of year balance due to subsidiaries and affiliates, less amount on Line 11. If less than zero, print zero.

17.Mortgages, notes and bonds payable more than one year old at balance sheet date or having a maturity of more than one year from original date incurred. – Do Not include indebtedness from the Louisiana Infrastructure Bank.

18.Other liabilities – Attach schedule.

Do Not include items of surplus. See RIB

19.Capital Stock: Common Stock

|

|

Preferred Stock |

|

|||||

|

|

|

|

|

|

|

|

|

20. |

|

|||||||

|

|

of par value. |

|

|

|

|||

21. |

Surplus reserves – Attach schedule. |

|

||||||

|

|

|

|

|

|

|

|

|

22. |

Earned surplus and undivided proits |

|

||||||

|

|

|

|

|

|

|

|

|

23. |

Excess reserves or undervalued assets |

|

||||||

|

|

|

|

|

|

|

|

|

24. |

Additional surplus and undivided proits – From Line 11 above |

|

||||||

|

|

|

|

|

|

|

||

|

25. Total – Add the amounts in Column 3, Lines 12 through 24. Print the total in |

|

||||||

|

|

Column 3 and on |

|

|||||

Note: Print in Column 1 those items that are included in the franchise taxable base. Multiply Lines 12 through 18 by the percentage |

|

|||||||

|

of reduction in Column 2. Subtract the result from Column 1 and print the amount in Column 3. |

|

||||||

|

|

|

|

|

||||

|

|

|

WEB |

|

2056 |

|||

|

|

|

|

|

|

|

|

|

Print your LA Revenue Account Number here. u _____________________________

All applicable schedules must be completed.

Schedule B – Analysis of Schedule A1, Column 1, Lines 13, 15, and 18

Original date of inception

Due date

Payee

Installment amount

Balance due

Taxable amount

Schedule C – Analysis of Schedule A, Line 30, Column 2 – Earned surplus and undivided profits per books

1. |

Balance at beginning of year |

|

5. Distributions: |

a. Cash |

|

|

|

|

|

|

|

|

|

|

|

2. |

Net income per books |

|

|

b. Stock |

|

|

|

|

|

|

|

|

|

|

|

3. |

Other increases – Itemize. |

|

|

c. Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Other decreases – Itemize. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Total – Add Lines 5 and 6. |

|

|

|

|

|

|

|

|

|

||

4. |

Total – Add Lines 1, 2, and 3. |

|

8. Balance at end of year – Subtract Line 7 from Line 4. |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Schedule D – Computation of Louisiana Taxable Income |

|

|

||

|

|

Schedule D need not be completed if Form |

|||||

|

|

|

|

|

|

|

|

1. |

|

Federal taxable income |

|

|

1. |

|

|

|

|

|

|

|

|

||

|

|

|

Additions to Federal Taxable Income |

|

|

||

|

|

|

|

|

|

|

|

2. |

|

Net operating loss deduction claimed on federal return |

|

|

2. |

|

|

|

|

|

|

|

|

|

|

3. |

|

Dividends received deduction claimed on federal return |

|

|

3. |

|

|

|

|

|

|

|

|

|

|

4. |

|

Louisiana income tax deducted on federal return |

|

|

4. |

|

|

|

|

|

|

|

|

|

|

5. |

|

Other additions to federal taxable income – Attach schedule. |

|

|

5. |

|

|

|

|

|

|

|

|

|

|

6. |

|

Total additions – Add Lines 2 through 5. |

|

|

6. |

|

|

|

|

|

|

|

|

||

|

|

|

Subtractions from Federal Taxable Income |

|

|

||

|

|

|

|

|

|

|

|

7. |

|

Refunds of Louisiana income tax reported on federal return |

|

|

7. |

|

|

|

|

|

|

|

|

||

8. |

|

Louisiana depletion in excess of federal depletion – Attach schedule. |

|

8. |

|

||

|

|

|

|

|

|||

9. |

|

Expenses not deducted on the federal return due to Internal Revenue Code Section 280(C) |

9. |

|

|||

|

|

|

|

|

|||

10. |

Road Home – The amount included in federal taxable income. |

|

10. |

|

|||

|

|

|

|

|

|

||

11. |

Other subtractions – Attach schedule. |

|

|

11. |

|

||

|

|

|

|

|

|

||

12. |

Total subtractions – Add Lines 7 through 11. |

|

|

12. |

|

||

|

|

|

|

||||

13. |

Louisiana net income before S corporation exclusion, loss adjustments, and federal income tax deduction – |

|

|

||||

|

|

Add the amount on Line 1 to the amount on Line 6, and subtract the amount on Line 12. Round to the |

13. |

|

|||

|

|

nearest dollar. Print here and on |

|

|

|

|

|

WEB |

2057 |

|

Print your LA Revenue Account Number here. u _____________________________

All applicable schedules must be completed.

Schedule E – Calculation of Income Tax

1. Print the amount of net taxable income from |

|

|

|

|

|

|

|

|

|

|

Column 1 |

|

Column 2 |

|

2. Calculation of tax |

Net income |

RATE |

||

TAX |

||||

|

in each bracket |

|

||

|

|

|

||

|

|

|

|

|

a. First $25,000 of net income |

|

x 4% = |

|

|

|

|

|

|

|

b. Next $25,000 |

|

x 5% = |

|

|

|

|

|

|

|

c. Next $50,000 |

|

x 6% = |

|

|

|

|

|

|

|

d. Next $100,000 |

|

x 7% = |

|

|

|

|

|

|

|

e. Over $200,000 |

|

x 8% = |

|

|

|

|

|

|

3.Add the amounts in Column 1, Lines 2a through 2e and print the result.

4.Add the amounts in Column 2, Lines 2a through 2e. Round to the nearest dollar. Print in Column 2 and on

Schedule F – Calculation of Franchise Tax

1.Print the amount from

2.Print the amount of Line 1 or $300,000, whichever is less.

3.Multiply the amount on Line 2 by $1.50 for each $1,000 or major fraction and print the result.

4.Subtract Line 2 from Line 1 and print the result.

5.Multiply the amount on Line 4 by $3.00 for each $1,000 or major fraction and print the result.

6.Add Lines 3 and 5. Round to the nearest dollar. Print the result here and on

Schedule G – Reconciliation of Federal and Louisiana Net Income

Schedule G is required if Form

Important! See R.S. 47:287.71 and R.S. 47:287.73 for information.

1.Print the total net income calculated under federal law before special deductions.

2.Additions to federal net income: a. Louisiana income tax

b.

c.

d.

e.

f.

Subtractions from federal net income:

a.Dividends

b.Interest

c.Road Home – The amount included in federal taxable income

3.Louisiana net income from all sources – The amount should agree with Form

WEB |

2058 |

|

Print your LA Revenue Account Number here. u _____________________________ |

|

All applicable schedules must be completed. |

||

|

Schedule H – Reconciliation of Income Per Books with Income Per Return |

|

|

|

|

1. Net income per books |

|

7. Income recorded on books this year, but not |

|

|

included in this return – Itemize. |

2. Louisiana income tax |

|

|

3. Excess of capital loss over capital gains |

|

|

|

|

|

|

|

|

|

4. Taxable income not recorded on books this |

|

|

|

|

year – Itemize. |

|

|

|

|

|

|

|

8. Deductions in this tax return not charged |

|

|

|

|

|

|

|

|

|

|

against book income this year: |

|

|

|

|

|

|

|

|

|

a. Depreciation |

|

|

|

|

|

|

|

|

|

b. Depletion |

|

|

|

|

|

5. Expenses recorded on books this year, but not |

c. Other |

|||

|

||||

deducted in this return: |

|

|

|

|

|

|

|

|

|

a. Depreciation |

|

|

|

|

|

|

|

|

|

b. Depletion |

|

|

|

|

|

|

|

|

|

c. Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Total – Add Lines 7 and 8. |

|

|

|

|

|

|

|

|

|

10. Net income from all sources per return – |

6. Total – Add Lines 1 through 5. |

|

|

|

Subtract Line 9 from Line 6. |

|

|

|

|

|

|

|

|

|

|

|

Schedule I – Summary of Estimated Tax Payments |

|||

Check number |

Date |

Amount |

1.Credit from prior year return

2.First quarter estimated payment

3.Second quarter estimated payment

4.Third quarter estimated payment

5.Fourth quarter estimated payment

6.Payment made with extension request

7. Total

Additional Information Required

1.Indicate principal place of business. ___________________________

2.Describe the nature of your business activity and specify your principal product or service, both in Louisiana and elsewhere.

Louisiana:

Elsewhere:

3.Indicate the date and state of incorporation. ____________________

4.Indicate parishes in which property is located.

5.At the end of the tax year, did you directly or indirectly own 50% or more of the voting stock of any corporation or an interest of any part- nership, including any entity treated as a corporation or partnership?

o Yes o No

If “yes,” show name, address, and percentage owned.

6.At the end of the tax year, did any corporation, individual, partnership, trust, or association directly or indirectly own 50% or more of your vot-

ing stock? o Yes o No

If “yes,” show name, address, and percentage owned.

WEB |

2059 |

|

Corporation Apportionment and Allocation Schedules |

|

COMPLETE ALL APPLICABLE SCHEDULES. |

Print your LA Revenue Account Number here. u ___________________________________ |

Name as shown on

Income taxable period covered

Schedule M - Computation of Corporate Franchise Tax and Income Tax Property Ratios

|

|

|

|

Located in Louisiana |

|

|

|

Located everywhere |

Franchise tax |

Income tax property factor |

|||

|

|

|

property factor |

|||

|

|

|

|

|

|

|

1. Items |

2. Beginning of year |

3. End of year |

4. End of year |

5. Beginning of year |

|

6. End of year |

Intangible assets

1.Cash.........................................................

2.Notes and accounts receivable................

3. Reserve for bad debts |

( |

) ( |

) ( |

) |

4.Investment in U.S. govt. obligations.........

5.Stock and obligations of subsidiaries.......

6.Other investments – Attach schedule. .....

7.Loans to stockholders ..............................

8.Other intangible assets – Attach schedule.

9. Accumulated depreciation |

( |

) ( |

) ( |

) |

10. Total intangible assets – Add Lines

|

Real and tangible assets |

|

|

|

|

|

|

|

|

|

|

11. |

Inventories |

|

|

|

|

|

|

|

|

|

|

12. |

Bldgs. and other depreciable assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13. |

Accumulated depreciation |

|

|

|

|

|

|

|

|

|

|

( |

) |

( |

) |

( |

) |

( |

) |

( |

) |

||

14. |

Depletable assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15. |

Accumulated depletion |

|

|

|

|

|

|

|

|

|

|

( |

) |

( |

) |

( |

) |

( |

) |

( |

) |

||

16. |

Land |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

17. |

Other real & tangible assets – Attach sch. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18. |

Excessive reserves, assets not relected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

on books, or undervalued assets |

|

|

|

|

|

|

|

|

|

|

19. |

Total real and tangible assets – |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Add Lines 11 through 18 |

|

|

|

|

|

|

|

|

|

|

20. |

Total assets – Add Lines 10 and 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

21. |

Print the amount from Line 19 above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

22. |

Less real and tangible assets not used |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

in production of net apportionable income |

|

|

|

|

|

|

|

|

|

|

|

– Attach schedule |

|

|

|

|

|

|

|

|

|

|

23. |

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

24. |

Beginning of year balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

25. |

Total – Add Lines 23 and 24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||

26. Franchise tax property ratio (Line 20, Column 4 ÷ Line 20, Column 3) |

............................ |

|

__ __ __ . __ __ % |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

27. Income tax property ratio (Line 25, Column 6 ÷ Line 25, Column 3) ..........................................................................................................

Schedule N - Computation of Corporate Franchise Tax Apportionment Percentage

__ __ __ . __ __ %

1. Description of items used as ratios |

2. Total amount 3. Louisiana amount 4. Percent (Col. 3 ÷ Col. 2) |

|

1. Net sales of merchandise, charges for services, and other revenues |

|

|

A. Sales – See instructions, page 24 |

|

|

B. Charges for services – See instructions, page 24 |

|

|

C. Other Revenues – See instructions, page 24.

(i) |

Rents and royalties |

|

For Manufacturers |

|||

This is your apportionment ratio. Print |

||||||

(ii) |

Dividends and interest from subsidiaries |

|

||||

here and on Page 2, Line 7B of |

||||||

(iii) |

Other dividends and interest |

Do NOT proceed further. |

||||

|

|

|

▼ |

|

||

(iv) All other revenues |

|

|||||

D. Total – Add the amounts in Columns 2 and 3. Calculate the ratio and |

|

|

|

|||

print the result in Column 4. For taxpayers whose primary business is |

|

__ __ __ . __ __ % |

|

|||

. ..manufacturing, use this apportionment ratio. See instructions, page 24 |

|

|

||||

2. Franchise tax property ratio – Print in Column 4 the percentage from Schedule M, Line 26 |

__ __ __ . __ __ % |

|

||||

...........................................................................................................................3. Total of applicable percents in Column 4 |

__ __ __ . __ __ % |

|

||||

4. Average of percents – Divide Line 3 by applicable number of ratios. Print here and on |

|

|

||||

__ __ __ . __ __ % |

|

|||||

WEB

2060

Print your LA Revenue Account Number here. u _____________________________

Schedule P - Computation of Louisiana Net Income

Column 3 must be completed. Column 2 must also be completed if the separate accounting method is used.

Those corporations employing the separate accounting method should review R.S. 47:287.94H for guidance. |

2. LA amounts |

3. Totals |

|

1. Items |

(Lines 1 through 25) |

||

|

1.Gross receipts ______________________ Less returns and allowances _______________

2.Less: Cost of goods sold and/or operations – Attach schedules. ........................................................................

3.Gross proit ...........................................................................................................................................................

4.Gross rents ...........................................................................................................................................................

5.Gross royalties ......................................................................................................................................................

6.Income from estates, trusts, partnerships.............................................................................................................

7.Income from construction, repair, etc. ..................................................................................................................

8.Other income – Attach schedule. .........................................................................................................................

9.Total income – Add Lines 3 through 8.............................................................................................................................................

10. Compensation of officers .....................................................................................................................................

11. Salaries and wages (not deducted elsewhere).....................................................................................................

12. Repairs – Do not include cost of improvements or capital expenditures. ............................................................

13. Bad debts..............................................................................................................................................................

14. Rent ......................................................................................................................................................................

15. Taxes – Attach schedule. .....................................................................................................................................

16. Interest ..................................................................................................................................................................

17. Contributions.........................................................................................................................................................

18.Depreciation – Attach schedule. ...........................................................................................................................

19.Depletion – Attach schedule. ................................................................................................................................

20.Advertising ............................................................................................................................................................

21.Pension, proit sharing, stock bonus, and annuity plans ......................................................................................

22.Other employee beneit plans...............................................................................................................................

23.Other deductions – Attach schedule.....................................................................................................................

24.Total deductions – Add Lines 10 through 23........................................................................................................

25.Net income from Louisiana sources – If separate (direct) method of reporting is used, print here and on Line 31.

26.Net income from all sources – Subtract Column 3, Line 24 from Column 3, Line 9. ..........................................

27.Allocable income from all sources – See instructions, page 25. Attach schedule supporting each amount.

A.Net rents and royalties from immovable or corporeal movable property .........................................................

B.Royalties from the use of patents, trademarks, etc. – See instructions, page 25............................................

C.Income from estates, trusts, and partnerships .................................................................................................

D.Income from construction, repair, etc. – See instructions, page 25.................................................................

E.Other allocable income.......................................................................................................................................

28.Net income subject to apportionment – Subtract Lines 27A through 27E from Line 26, Column 3. ...................

29.Net income apportioned to Louisiana – See instructions, page 25. .....................................................................

30.Allocable income from Louisiana sources – See instructions, page 26. Attach schedule supporting each amount.

A.Net rents and royalties from immovable or corporeal movable property .........................................................

B.Royalties from the use of patents, trademarks, etc. – See instructions, page 26............................................

C.Income from estates, trusts, and partnerships .................................................................................................

D.Income from construction, repair, etc. – See instructions, page 26.................................................................

E.Other allocable income.....................................................................................................................................

31.Louisiana net income before loss adjustments and federal income tax deduction –

Add Column 3, Line 29 to Column 2, Lines 30A through 30E. Print the result or the amount on Line 25,

whichever is applicable, here and on Form

Schedule Q - Computation of Income Tax Apportionment Percentage

1. Description of items used as ratios |

2. Total amount 3. Louisiana amount |

4. Percent (Col. 3 ÷ Col. 2) |

|

1. Net sales of merchandise and/or charges for services |

|

For Manufacturers or Merchandisers. |

|

A. Sales – See instructions, page 26 |

|

This is your apportionment ratio. Use this |

|

|

result in determining income apportioned |

||

B. Charges for services – See instructions, page 26 |

|

||

|

to Louisiana on Line 29, Sch. P above. Do |

||

C. Other gross apportionable income |

|

NOT proceed further. |

|

|

|

|

|

D.Total – Add the amounts in Columns 2 and 3. Calculate the ratio and print the result in Column 4. For taxpayers whose primary business is manufacturing

or merchandising, use this apportionment ratio. See instructions, page 26 |

__ __ __ . __ __ % |

2.Wages, salaries, and other personal service compensation paid

|

during the year – Print the amounts in Column 2 and Column 3. |

|

|

|

__ __ __ . __ __ % |

|

Calculate the ratio and print the result in Column 4 |

|

3. |

Income tax property ratio – Print percentage from Schedule M, Line 27 |

__ __ __ . __ __ % |

4. |

Total of percents in Column 4 |

__ __ __ . __ __ % |

5. Average of percents – Multiply this result by the amount on Schedule P, Line 29 to determine the amount of Louisiana apportionable income. |

__ __ __ . __ __ % |

|

|

WEB |

|

|

|

2061 |

Document Breakdown

| Fact | Detail |

|---|---|

| Form Number | CIFT-620 |

| Purpose | Louisiana Corporation Income and Franchise Tax Return |

| Governing Law | Louisiana State Revenue Laws |

| Due Date for Calendar Year Returns | April 15 |

| Amendment Feature | Mark circle for amended return |

| Address for Submission | Post Office Box 91011, Baton Rouge, LA 70821-9011 |

Instructions on Filling in Louisiana Cift 620

Filling out tax forms can be daunting, but understanding each step can simplify the process and ensure accuracy. The Louisiana CIFT-620 form is essential for reporting corporation income and franchise taxes. This document is crucial for businesses operating within Louisiana, serving as a means to calculate taxes owed to the state. By taking it one step at a time, businesses can navigate through the form with greater confidence and precision.

- Start by locating your Louisiana Revenue Account Number and writing it in the designated space at the top of the form.

- If there's been a change to your legal name, trade name, or address, mark the corresponding circle to indicate such changes.

- If you are filing an amended return, mark the appropriate circle to indicate that this is an amended submission.

- Indicate whether your entity is exempt from franchise tax by marking the corresponding option.

- Specify the type of return by marking the circle for short period or final return if applicable.

- Complete the section with your corporation’s name, mailing address, and Federal Employer Identification Number (FEIN).

- Enter your federal taxable income, federal income tax, and income tax apportionment percentage in sections B, C, and D respectively.

- Report your gross revenues and total assets in sections E and F.

- Fill in your NAICS code in section G.

- Answer questions H through K with "Yes" or "No" regarding consolidated federal income tax return, CIFT-620A schedules, intercompany debt, and the computation date for borrowed capital.

- Calculate your Louisiana net income before adjustments, subchapter S corporation exclusion, loss carryforwards and backs, and federal income tax deduction, entering these in sections 1A through 1E respectively.

- Compute your Louisiana taxable income in section 1F by subtracting the amounts in lines 1B through 1E from 1A.

- Fill out the Louisiana income tax based on schedule E, nonrefundable tax credits from schedule NRC, and the resulting income tax after credits in sections 2 through 4.

- Enter your estimated tax payments as per schedule I and calculate whether you have a tax due or an overpayment in section 6.

- Proceed to the Computation of Franchise Tax starting with total capital, surplus, etc., in section 7A, and follow through to section 13 for the amount of franchise tax due or overpayment, applying all relevant apportionments and credits.

- Sum the income and franchise tax figures to ascertain the total tax due or overpayment in section 14.

- Address any applicable refundable credits, like the Louisiana Citizens Insurance Credit and other refundable credits in schedule RC, and enter these totals in sections 15 through 15B.

- Determine whether you have a net overpayment or amount due, and allocate any overpayment towards future taxes, refunds, or donations in sections 16 through 19.

- If you owe additional tax, calculate the amount due, any penalties, and interest, and finalize the totals in sections 20 through 25.

- Sign and date the form, ensuring all necessary schedules and documentation are attached before submission.

- Double-check all calculations and information for accuracy before sending the form and any payment owed to the Louisiana Department of Revenue, adhering to the submission guidelines provided in the form's instructions.

Completing the Louisiana CIFT-620 form meticulously will help avoid potential errors and ensure compliance with state tax requirements. Remember, seeking assistance from a tax professional can provide additional guidance tailored to your specific circumstances.

Listed Questions and Answers

What is the Louisiana CIFT-620 form?

The Louisiana CIFT-620, also known as the Louisiana Corporation Income Tax and Franchise Tax Return, is a document that businesses operating as corporations in Louisiana must fill out and submit to the Louisiana Department of Revenue. This form is used to calculate and pay both the corporation income tax and franchise tax for a given tax year. It covers details such as revenue, assets, net income, and applicable credits.

Who needs to file the Louisiana CIFT-620 form?

Any corporation that earns income in Louisiana, is registered, or does business in the state must file the CIFT-620 form. This includes both income taxes and franchise taxes for corporations. The requirement applies regardless of if the corporation made a profit or incurred a loss during the tax year.

When is the Louisiana CIFT-620 form due?

The due date for the CIFT-620 form depends on the corporation's tax year. If the corporation follows a calendar year, the form is due by April 15th of the following year. For corporations that operate on a fiscal year, the due date is the 15th day of the 4th month following the end of their fiscal year. Corporations must ensure their returns are filed by these dates to avoid late penalties and interest.

What information do I need to fill out on the CIFT-620 form?

To complete the CIFT-620 form, you will need information including, but not limited to:

- Legal name and trade name of the corporation

- Revenue account and Department number

- Federal Employer Identification Number (FEIN)

- Details about income, adjustments, deductions, and credits

- Total assets and gross revenues

- Information regarding the corporation's tax apportionment percentage

- Details on any nonrefundable and refundable tax credits

How can I file the Louisiana CIFT-620 form?

The Louisiana Department of Revenue offers several methods for filing the CIFT-620 form:

- Electronic Filing: Corporations can file electronically through the Louisiana Department of Revenue's online services, offering a quicker processing time.

- Mail: Corporations may also fill out the form manually and mail it to the address provided by the Louisiana Department of Revenue.

Corporations should choose the method that best suits their record-keeping and financial practices.

Common mistakes

When filling out the Louisiana CIFT-620 form, certain mistakes can lead to issues with the processing of the form, delays, or even penalties. Being aware of these common errors can help ensure the form is filled out correctly:

-

Incorrect Louisiana Revenue Account Number: Many people mistakenly enter the Federal Employer Identification Number (FEIN) instead of the Louisiana Revenue Account Number where specified. This error can lead to misidentification and processing delays.

-

Not marking the appropriate circles: Failing to mark the circles for name changes, address changes, or amended returns can cause the necessary updates to not be recorded or acknowledged.

-

Incorrect computation of income and franchise tax: Calculating these taxes requires careful attention to detail, particularly in sections like the Computation of Income Tax and Franchise Tax. Errors here affect tax liability and may result in underpayments or overpayments.

-

Omission of necessary schedules: The form often requires additional schedules like CIFT-620A for Apportionment and Allocation Schedules. Not including these when necessary can result in an incomplete return.

-

Error in tax credits and payments section: Misunderstanding or incorrectly entering values in the sections for nonrefundable income tax credits, refundable credits, and estimated payments can lead to incorrect calculation of the amount due or refund owed.

Becoming familiar with these common mistakes and taking steps to avoid them can help in the accurate and timely completion and submission of the Louisiana CIFT-620 form.

Documents used along the form

When dealing with the Louisiana CIFT-620 form, businesses are often navigating the process of filing taxes within the state. This form, crucial for corporations operating in Louisiana, serves as a combined filing for both the corporation income tax and the franchise tax. To ensure a comprehensive approach to tax filing and adherence to regulations, several other forms and documents are often required in tandem with the Louisiana CIFT-620 form. Understanding these additional requirements can streamline the filing process.

- Schedule D: This schedule is crucial for detailing the adjustments to income and loss that affect the Louisiana net income calculation. It helps corporations to reconcile federal taxable income with the state's specific modifications, serving as a bridge between federal and state tax reporting.

- Schedule NRC: The Nonrefundable Tax Credits, Exemptions, and Rebates Schedule is key for documenting eligible nonrefundable tax credits. It outlines various credits the corporation can claim, reducing the amount of income or franchise tax owed to the state.

- Schedule I: Schedule I is essential for calculating and documenting estimated tax payments. It helps corporations to track and apply these prepayments against their total tax liability for the income or franchise taxes, showing the ongoing fiscal responsibility throughout the tax year.

- Schedule RC: The Refundable Tax Credits Schedule, allows corporations to record any applicable refundable tax credits. Unlike nonrefundable credits, these can result in a refund if the credits exceed the corporation's tax liability, providing a potential financial boon for the taxpayer.

Together with the Louisiana CIFT-620 form, these schedules and documents form a comprehensive package for corporate tax filing within the state. They ensure that businesses properly report their income and franchise taxes while taking advantage of all available deductions, credits, and exemptions. Proper completion and submission of these forms are essential for compliance with Louisiana's tax laws and can aid in minimizing the corporation's overall tax liability.

Similar forms

The Louisiana CIFT-620 form is similar to several key documents required by other states or the federal government for tax reporting purposes. These documents typically collect information on a corporation’s income, assets, deductions, and credits to determine tax liability.

The U.S. Corporation Income Tax Return (IRS Form 1120) serves a very similar purpose at the federal level compared to the Louisiana CIFT-620. Both forms are designed to capture vital financial data from corporations to calculate their tax obligations accurately. Specifically, like the Louisiana CIFT-620, IRS Form 1120 requires details on gross income, deductions, and credits. Similar schedules attached to both forms allow for the reporting of additional income, deductions, and tax credit details necessary for accurate tax calculation.

State Franchise Tax Reports, such as the Texas Franchise Tax Report, share common ground with the franchise tax portion of the CIFT-620 form. Both require corporations to report on apportioned earnings, capital, and, in some instances, property value within the respective state to determine franchise tax liability. They calculate a corporation's tax liability based on a variety of factors including, but not limited to, total revenue, capital stock, surplus, and borrowed capital. This parallel structure underscores the form’s role in assessing the value corporations bring to the state's economy and their corresponding tax responsibilities.

The California Corporation Franchise or Income Tax Return (Form 100) is another similar state-level document, which parallels the Louisiana CIFT-620 form in function and purpose. Both forms require detailed financial information so that state tax authorities can assess corporate tax responsibilities accurately. The similarities extend to the categorization of income, allowances for deductions, and the calculation of tax due based on apportioned income. Each form also has provisions for adjustments based on overpayments, underpayments, and tax credits specific to each state's tax code.

Dos and Don'ts

When filing the Louisiana CIFT-620 form, an important state tax document for corporations, accuracy and attention to detail are vital. Here are eight tips to help you navigate this complex form successfully:

- Do ensure that the correct Louisiana Revenue Account Number is entered, not the Federal Employer Identification Number (FEIN). This unique state identifier is crucial for your return to be processed correctly.

- Don't overlook marking the appropriate circle if you're filing for a name change, address change, or if this is an amended return. These small details can significantly impact how your return is handled.

- Do accurately calculate and report your Federal taxable income, Federal income tax, and the income tax apportionment percentage. Errors in these areas could lead to discrepancies in your state tax calculation.

- Don't guess your North American Industry Classification System (NAICS) code. This code is vital for statistical analysis of economic activities. Ensure you have the correct code that reflects your corporation's primary business activity.

- Do attach all the required schedules, including the CIFT-620A, Apportionment and Allocation Schedules, if applicable. Failing to attach necessary documents can delay processing or result in a return being considered incomplete.

- Don't leave any section blank that applies to your corporation. If a section does not apply, ensure to mark it as such or insert "N/A" or "$0.00" as appropriate to indicate it was not overlooked.

- Do double-check all calculations, especially the computation of income tax and franchise tax. Mistakes can lead to underpayment or overpayment, both of which could cost you time and money to rectify.

- Don't forget to sign and date the return. An unsigned tax return is like an unsigned check—it's not valid. Also, ensure that the person signing the return is authorized to do so under the corporation's bylaws or operating agreement.

By following these dos and don'ts, you'll be well on your way to accurately completing the Louisiana CIFT-620 form, which can help avoid delays and ensure compliance with state tax regulations.

Misconceptions

When filing Louisiana CIFT-620, corporations and their accountants often run into misconceptions that can lead to errors or misinterpretations of the filing process. Here is a breakdown of common misconceptions and clarifications to help navigate this crucial tax document.

Only for Profitable Corporations: A common misconception is that the CIFT-620 form is only for corporations that have made a profit. In reality, this form must be filed by most corporations operating in Louisiana, regardless of profitability. It covers both income and franchise taxes.

Franchise Tax Exemption Misunderstanding: Some believe all entities are subject to franchise tax. However, certain entities like non-profit organizations may be exempt. Verification of eligibility for such exemptions is essential.

Ignoring NAICS Code Importance: The North American Industry Classification System (NAICS) code on the form is often overlooked. Correctly reporting your NAICS code is crucial as it assists in identifying the primary business activity and can affect tax liabilities.

Misuse of Address Change Circle: Marking the address change circle without providing a new address or mistakenly marking it can lead to documentation being sent to an incorrect address.

Overlooking the Need for Schedule Attachments: Failing to include required schedules such as CIFT-620A for apportionment and allocation is a common error. These schedules are vital for accurate tax calculations.

Misconstrued Final Return Indications: Marking a return as 'final' should only be done if the corporation is concluding its business or no longer subject to taxation in Louisiana. Misuse of this designation can prematurely end tax obligations.

Misunderstanding of Tax Credit Schedules: Not fully utilizing or misunderstanding tax credit schedules can lead to overpayment of taxes. Careful review of schedules NRC and RC for nonrefundable and refundable tax credits can uncover potential savings.

Assuming Calendar Year for Everyone: Assuming that the calendar year filing applies to all corporations is incorrect. Corporations operating on a fiscal year basis must adhere to different filing deadlines.

Underestimating Penalties for Late Filing: Many underestimate the penalties for late filing and payment. Penalties and interest accrue from the due date until the payment is made, which can substantially increase the amount owed.

Incorrectly Computing Franchise Tax Base: Misunderstanding the computation of the franchise tax base, especially concerning deductions and eligible debts, can result in inaccurate tax liabilities. Ensuring accurate calculations on Schedule A-1 is key.

Understanding these misconceptions and ensuring accurate and complete filings can save corporations from unnecessary headaches, penalties, or additional taxes. Always refer to the latest guidelines and schedules provided by the Louisiana Department of Revenue to remain in compliance.

Key takeaways

Filling out and using the Louisiana CIFT-620 form requires attention to detail and an understanding of your business's financial situation. Below are key takeaways that can help navigate this process more effectively.

It's essential to know your Louisiana Revenue Account Number as you'll need to provide it at the beginning of the form, ensuring that your tax payments are correctly attributed to your account.

For any changes in your corporation's legal name, trade name, or address, specific circles on the form must be marked. These changes are fundamental and need to be updated accurately for tax records.

Whether filing for the first time or amending a return, identifying the correct status of your filing (e.g., an amended return) and the tax period it covers is crucial to avoid processing errors.

The form asks for details on federal taxable income, federal income tax, income tax apportionment percentage, gross revenues, total assets, and the NAICS code, requiring comprehensive financial data preparation.

Understanding apportionment and allocation schedules is important, especially if your corporation operates in multiple states or has complex financial structures. These details impact how income and franchise tax are calculated.

Nonrefundable and refundable tax credits, along with exemptions and rebates, can significantly affect your corporation's tax liability. Ensuring that you accurately calculate and claim these benefits can result in substantial savings.

Accurately completing and submitting the CIFT-620 form is vital for any corporation operating in Louisiana, as it ensures compliance with state tax obligations while allowing businesses to take full advantage of applicable tax credits and deductions.

Popular PDF Templates

Apply for Louisiana Medicaid - The structured format of the form helps in avoiding common mistakes and omissions in the SSI application process.

Dpsmv 1631 - A special segment for off-road vehicle decals on the DPSMV 1631 caters to agencies needing vehicles for non-traditional public work or crime detection in off-road settings.