Free Louisiana 1029 Sales Template

In the landscape of taxation within the state of Louisiana, the R-1029 Sales Tax Return stands as a pivotal document for businesses, embodying a comprehensive report on the transactions involving tangible personal property. Introduced by the Louisiana Department of Revenue, this form is meticulously designed for use from August 2020 onwards, ensuring a structured and streamlined process for accurately presenting sales figures, applicable deductions, and the computed tax obligations. It distinctly outlines various categories such as gross sales, the cost associated with tangible personal property consumed within the state, and services rendered excluding specific exemptions like motor vehicle leases. Additionally, it offers a detailed schedule for allowable deductions, enabling businesses to correctly identify and deduct legitimate business expenses. This form also delineates provisions for calculating the net tax due, inclusive of vendor’s compensation, penalties, and interest where applicable. To facilitate taxpayer convenience, instructions for electronic payment accompany this form, alongside the option to contribute to the Louisiana Military Family Assistance Fund, enshrining a sense of community responsibility within the corporate compliance framework. Through its intricate design, the R-1029 facilitates a rigorous yet clear pathway for businesses to fulfill their tax liabilities, underscoring the state’s efforts to encourage transparency, accuracy, and civic duty among its commercial entities.

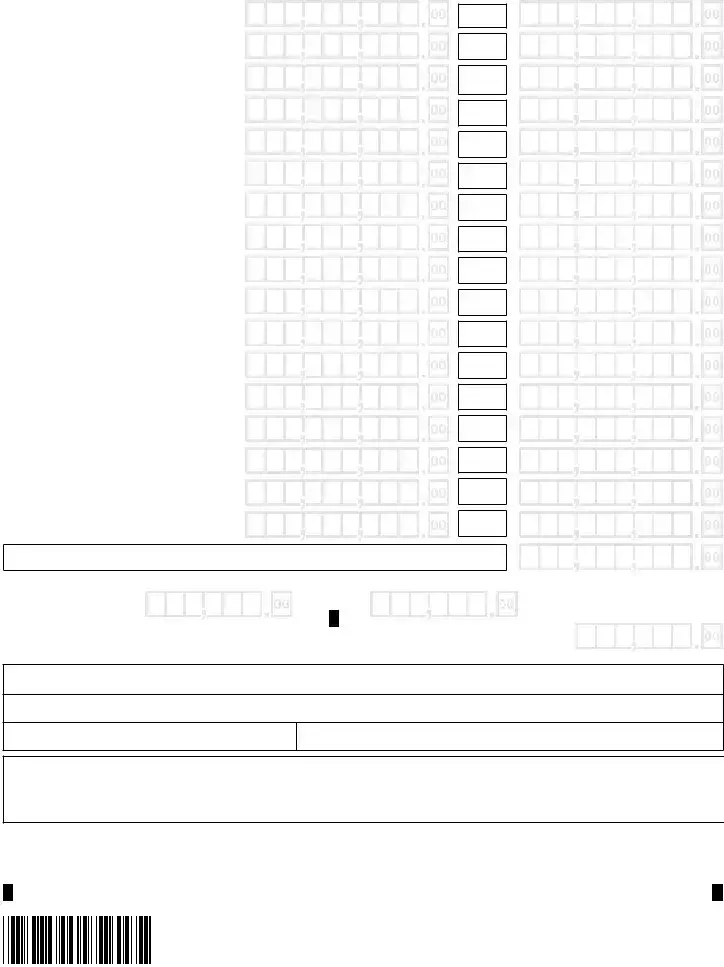

Form Example

FOR OFFICE USE ONLY. Field flag

|

|

|

Louisiana Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Sales Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Location address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

CITY |

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LEGAL NAME |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not use this form |

|

|

|

|

|

|

|

TRADE NAME |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

for filing periods |

prior |

|

|

|

|

|

|

|

MAILING ADDRESS |

UNIT TYPE |

UNIT NUMBER |

||||||||||||||||||

|

|

|

|

to July 2022. |

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

STATE |

|

|

|

ZIP |

|||||

|

|

|

|

Filing period |

|

|

M |

M |

Y |

Y |

|

|

|

|

FOREIGN NATION, IF NOT UNITED STATES (DO NOT ABBREIVATE) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please use blue or black ink. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

U.S. NAICS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round to the nearest dollar. Do not use dashes. |

|||||||||||||

1 |

|

Gross sales of tangible personal property |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

2 |

|

Cost of tangible personal property |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(Used, consumed, or stored for use or consumption in Louisiana.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

3 |

|

(a) Leases and rentals of tangible personal property |

|

|

|

|

3(a) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

(Do not include motor vehicle leases or rentals, which must be filed electronically. |

See instructions.) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

(b) Taxable services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3(b) |

|

|

|

|

|

|

|

|

|

|||||||

3 |

|

Total leases, rentals, and taxable services (Add Lines 3(a) and 3(b).) |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

4 |

|

Total (Add Lines 1, 2, and 3.) |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5 |

|

Total allowable deductions (From Line 32, Schedule A. Do not |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

include as a deduction any item not reported on either Line 1, 2, or 3.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

6 |

|

Amount taxable (Subtract Line 5 from Line 4.) |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

7 |

|

Tax due (Multiply amount on Line 6 by 4.45%.) |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8 |

|

Excess tax collected (Do not include local sales tax.) |

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

9 |

|

Total (Add Line 7 and Line 8.) |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10 |

Vendor’s compensation 0.944% (0.944% of Line 9 if not delinquent. Limited to $1500. The |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

0.944% rate is the equivalent of 4 cents out of 4.45 cents of the 1.05% V.C. rate. See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

11 |

Net tax due (Subtract Line 10 from Line 9.) |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

11 |

(a) Donation to The Louisiana Military Family Assistance Fund |

|

|

|

11(a) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

(Enter the amount from Line 33 from the back of the return.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12 |

Penalty (See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

13 |

Interest (See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

14 |

Total payment due (Add Lines 11, 11(a), 12, and 13.) |

|

|

Mark this box if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

payment made |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Make payment to: Louisiana Department of Revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

electronically. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

WEB |

PAY THIS AMOUNT (DO NOT SEND CASH.) u |

14 |

|

|

Each physical location must register to

obtain a separate Revenue Account ID. |

|

|

|

|

Taxpayer’s FEIN |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

Enter date |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

business |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

sold/terminated. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Parent Company FEIN

If amended return, |

42273 |

|

mark this box. |

||

|

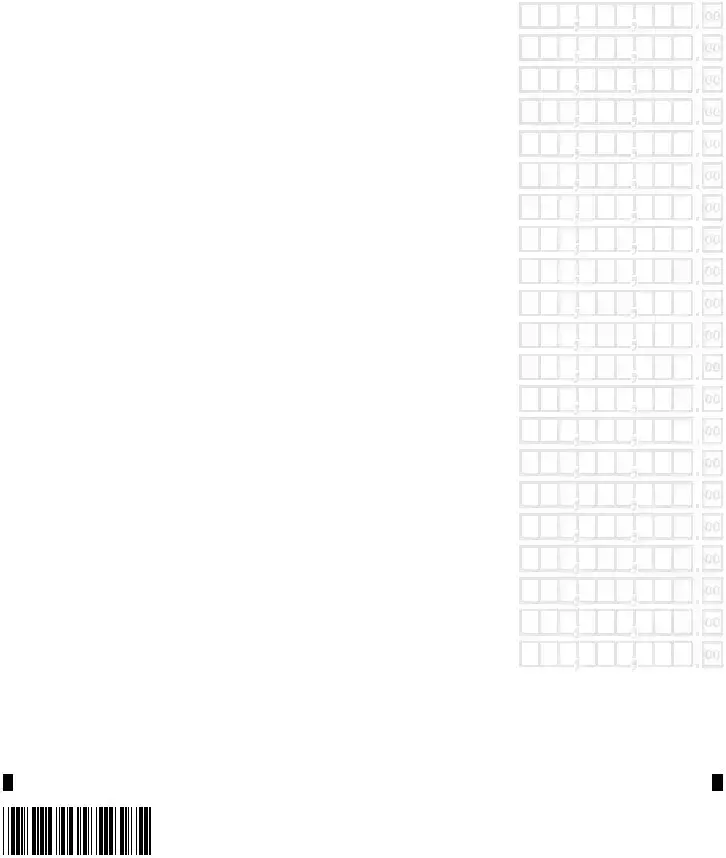

Allowable Deductions – Schedule A |

Total Sales |

|||

|

||||

|

|

|

|

|

15 |

Intrastate telecommunication services |

|

|

|

|

(Do not include prepaid telephone cards.) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

16 |

Interstate telecommunication services |

|

||

|

|

|

|

|

|

|

|

|

|

17 |

Prepaid telephone cards |

|

||

|

|

|

|

|

|

|

|

|

|

18 |

Electricity and natural gas or energy for non- |

|

||

|

residential use |

|

||

|

|

|

|

|

|

|

|

|

|

19 |

Steam and bulk or utility water used for non- |

|

||

|

residential purposes |

|

||

|

|

|

|

|

|

|

|

|

|

20 |

Boiler fuel for nonresidential use |

|

||

|

(See instructions.) |

|

||

|

|

|

|

|

|

|

|

|

|

21 |

Sales/purchase/leases/rentals of manufactur- |

|

||

|

ing machinery or equipment |

|

||

|

|

|

|

|

22 |

Sales to U. S. government and Louisiana |

|

||

|

state and local government agencies |

|

||

|

|

|

|

|

|

|

|

|

|

23 |

Sales of prescription drugs |

|

||

|

|

|

|

|

|

|

|

|

|

24 |

Sales of food for home consumption |

|

||

|

|

|

|

|

|

|

|

|

|

25 |

Electricity, natural gas, and bulk water for |

|

||

|

residential use |

|

||

|

|

|

|

|

|

|

|

|

|

26 |

Sales in interstate commerce |

|

||

|

|

|

|

|

|

|

|

|

|

27 |

Sales for resale |

|

||

|

|

|

|

|

|

|

|

|

|

28 |

Cash discounts, sales returns and |

|

||

|

allowances |

|

||

|

|

|

|

|

29 |

Tangible personal property sold for lease or |

|

||

|

rental (See instructions.) |

|

||

|

|

|

|

|

|

|

|

|

|

30 |

Sales of gasoline, diesel, and motor fuel |

|

||

|

(Sales for resale must be reported on Line 27.) |

|

||

|

|

|

|

|

31 |

Total from SCHEDULE |

|

||

|

(Transactions taxed at 0%.) |

|

||

|

|

|

|

|

Percent Exempt

22.472%

44.944%

22.472%

55.056%

55.056%

55.056%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

100%

32 Add Lines 15 through 31; enter here and on Line 5.

33(a) Donation of Vendor’s Compensation |

33(b) Donation in Addition to Tax Due |

|

The Military Family |

|

|

Assistance Fund |

|

|

Worksheet |

|

|

33 Total Donation (Add Lines 33(a) and 33(b)) Enter here and on Line 11(a) on front of return |

33 |

|

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature

Print Name

|

Date (mm/dd/yyyy) |

Title |

Telephone |

|

|

PAID

PREPARER USE ONLY

Print Preparer’s Name |

Preparer’s Signature |

Date (mm/dd/yyyy) |

Check if |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s Name ➤ |

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s EIN ➤ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s Address ➤ |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone ➤ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PTIN, FEIN, or LDR account |

For Office |

number of paid preparer |

Use Only. |

Louisiana Department of Revenue Post Office Box 3138 |

Baton Rouge, LA |

This return is due on or before the 20th day following the taxable period covered and becomes delinquent on |

42274 |

|

the first day thereafter. If the |

due date falls on a weekend or holiday, the return is due the next business day and |

|

becomes delinquent the first |

day thereafter. |

|

|

|

|

Enter your Louisiana Revenue Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description |

|

|

|

Sales Tax |

|

|

|

Total Sales |

|

|

||||||||||||

|

|

Exemption Code |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

21 |

Add Lines 1 - 20; enter here and on Line 31 of Schedule A, under the Total Sales column. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42275

Document Breakdown

| Fact | Detail |

|---|---|

| 1. Form Identifier | R-1029 (8/20) |

| 2. Issuer | Louisiana Department of Revenue |

| 3. Purpose | For filing sales tax returns |

| 4. Validity Start | Not for use in filing periods prior to August 2020 |

| 5. Ink Requirement | Must use blue or black ink and round to the nearest dollar |

| 6. Focused Content | Sales of tangible personal property and related allowable deductions |

| 7. Special Instructions | Motor vehicle leases or rentals must be filed electronically |

| 8. Maximum Vendor Compensation | Limited to $1500 |

| 9. Governing Law | Louisiana State Law |

| 10. Due Date and Delinquency | Due on or before the 20th day following the taxable period covered; becomes delinquent the day after |

Instructions on Filling in Louisiana 1029 Sales

Filling out the Louisiana 1029 Sales Tax Return form is a necessary procedure for businesses to comply with state tax regulations. It’s crucial for accurate reporting and ensuring that businesses pay the correct amount of sales tax. This form applies to transactions related to tangible personal property, leases, rentals, and taxable services conducted in Louisiana. To complete this form correctly, follow the step-by-step instructions below. Remember to use blue or black ink and round your figures to the nearest dollar for simplicity and clarity.

- Enter your Louisiana Department of Revenue Location address at the top of the form.

- Specify the filing period and U.S. NAICS Code at the designated spot.

- In Line 1, report the Gross sales of tangible personal property. This includes all sales before any deductions.

- For Line 2, calculate and report the Cost of tangible personal property that was used, consumed, or stored for use or consumption in Louisiana.

- Line 3 should include Leases, rentals, and services provided. Note that motor vehicle leases or rentals are not to be included here and must be filed electronically.

- Add the figures from Lines 1 through 3 to get the total for Line 4.

- Line 5 asks for Total allowable deductions, which can be found from Line 34, Schedule A. Ensure you don’t include deductions not reported on Lines 1 through 3.

- Determine the Amount taxable by subtracting Line 5 from Line 4 and enter this in Line 6.

- Calculate the Tax due by multiplying the amount on Line 6 by the tax rate of 4.45% and enter this in Line 7.

- If there is any Excess tax collected (excluding local sales tax), report it in Line 8.

- Add Line 7 and Line 8 to find the total for Line 9.

- For Line 10, calculate the Vendor’s compensation, which is 0.944% of Line 9, ensure it is not more than $1500. Refer to the instructions for additional information.

- The Gross tax due is found by subtracting Line 10 from Line 9. Report this in Line 11.

- Line 12 is intentionally left blank.

- Report the Net tax due, which is the same figure as Line 11, in Line 13.

- Optionally, add a Donation to The Louisiana Military Family Assistance Fund as indicated in Line 13A.

- For Lines 14 and 15, calculate and enter any Penalty and Interest according to the instructions provided with the form.

- Line 16 requires you to add up Lines 13, 13A, 14, and 15 to find the Total payment due. Mark the box if payment is made electronically.

- Finally, sign and date the form at the bottom, ensuring to also print your name, title, and telephone number. If you're a paid preparer, complete the "PAID PREPARER USE ONLY" section.

Once completed, review the form to ensure all information is accurate and complete. The signed and dated form should then be mailed to the Louisiana Department of Revenue at the address provided on the form by the due date to avoid penalties and interest. Remember, it's essential to keep a copy of the completed form and any related documents for your records.

Listed Questions and Answers

What is the Louisiana 1029 Sales form used for?

The Louisiana 1029 Sales form is a document required by the Louisiana Department of Revenue for reporting sales tax. Businesses use this form to declare the gross sales of tangible personal property, the cost of tangible personal property used, consumed, or stored for use or consumption in Louisiana, and leases, rentals, and services. The form helps calculate the total sales tax due, including any allowable deductions and exemptions.

Who needs to file the Louisiana 1029 Sales form?

Any business operating in Louisiana that sells tangible personal property, or provides leases, rentals, and certain services within the state, must file the Louisiana 1029 Sales form. Each physical location of a business requires a separate filing. It's essential for businesses to determine if their sales activities fall under the requirements for filing this form.

How do I calculate the tax due on the Louisiana 1029 Sales form?

To calculate the tax due on the Louisiana 1029 Sales form, follow these steps:

- Add together the amounts from Lines 1 through 3 to get your total gross sales.

- Subtract the total allowable deductions (Line 5) from the total gross sales (Line 4) to find the amount taxable.

- Multiply the amount taxable by 4.45% to calculate the tax due.

- If you have collected any excess tax, add it to the tax due to determine the total sales tax owed.

- Finally, subtract any vendor’s compensation you're eligible for from the total tax due to find the gross tax due.

What deductions are allowable on the Louisiana 1029 Sales form?

The Louisiana 1029 Sales form allows various deductions from gross sales, including but not limited to:

- Costs of tangible personal property used, consumed, or stored for use in Louisiana.

- Leases, rentals, and certain services that are nontaxable.

- Sales, purchases, leases, or rentals of manufacturing machinery or equipment.

- Sales to the U.S. government, and Louisiana state and local government agencies.

- Sales of prescription drugs and food for home consumption.

It's important to consult the instructions provided with the form for specifics regarding allowable deductions, as not all items reported on Lines 1 through 3 may be deducted.

When is the Louisiana 1029 Sales form due?

The Louisiana 1029 Sales form is due on or before the 20th day following the taxable period covered by the report. If the due date falls on a weekend or holiday, the return is due the next businessjurday. It's crucial to submit the form and any payment due by this deadline to avoid penalties and interest for late filing.

Common mistakes

When filling out the Louisiana 1029 Sales Tax Return form, it's important to avoid common mistakes to ensure accurate reporting and to minimize the risk of penalties. Here are seven key errors often made:

- Incorrect Filing Period: Not adhering to the stipulation that this form should not be used for filing periods prior to August 2020. It's critical to verify that the form is appropriate for the given period you are reporting.

- Using the Wrong Ink Color: Filling out the form in ink colors other than blue or black can lead to processing errors. The instructions designate only these colors for clarity and legibility.

- Improper Rounding: Values should be rounded to the nearest dollar. Failing to round, or rounding incorrectly, can lead to discrepancies in the reported amounts.

- Omitting Deductions: Neglecting to include allowable deductions from Line 34, Schedule A, or incorrectly including items not reported on Lines 1 through 3 can alter the tax liability.

- Vendor’s Compensation Errors: Not calculating the vendor’s compensation correctly or overlooking the $1500 limit. It's also important to ensure eligibility for this compensation, which depends on the timeliness of the filing.

- Not Reporting Excess Tax Collected: Leaving out excess tax collected (Line 8) that doesn't include local sales tax can lead to underreporting of taxable amounts.

- Incorrect Deduction Applications: Applying for deductions not specified within the instructions, particularly those that don't align with the sales documented on Lines 1 through 3. It's crucial to strictly follow the guidelines for allowable deductions to avoid inaccuracies.

Making these mistakes can not only lead to filing inaccuracies but may also result in penalties, additional taxes owed, or processing delays. Careful attention to the form's instructions and details is imperative for accurate completion and submission.

Documents used along the form

When filing the Louisiana 1029 Sales Tax Return form, businesses often need to manage and submit additional forms and documents to ensure compliance with state tax regulations. Understanding these documents helps in organizing financial records and streamlining the tax filing process. Below is a list of other essential forms and documents typically used alongside the Louisiana 1029 Sales form.

- R-1064 - This form is the Exemption Certificate for purchasing items that will be resold or used in exempt transactions, ensuring the buyer isn't charged sales tax on these purchases.

- R-1086 - The E-File Authorization Form for Businesses allows companies to set up electronic filing and payments, streamlining their tax handling processes.

- Sales Tax Registration Application - Before businesses can file the Louisiana 1029 Form, they must register for a sales tax account with the state, using this application.

- Schedule of Apportionment - Companies operating in multiple parishes use this form to determine how much sales tax is owed to each jurisdiction, based on sales activities.

- Annual Resale Certificate - Issued by the Louisiana Department of Revenue, it permits businesses to purchase items tax-free if they are being bought for resale.

- Adjusted Gross Sales Worksheet - Helps businesses calculate their total sales, including any adjustments for returns or exemptions, before completing the 1029 form.

- Notice of Change of Business Status - If a business closes, changes ownership, or undergoes another significant status change, this form notifies the Department of Revenue for sales tax purposes.

- Direct Payment Permit - Allows qualified purchasers to buy goods tax-free at the point of purchase and then self-assess and remit use tax directly to the state.

Utilizing these documents, in addition to the Louisiana 1029 Sales form, ensures that businesses comply with all applicable sales tax laws and regulations. Properly managing these forms can lead to a more efficient tax filing process, helping businesses avoid penalties and maintain good standing with the Louisiana Department of Revenue.

Similar forms

The Louisiana 1029 Sales form, designed for reporting sales tax, showcases similarities to other state-specific sales tax forms across the United States, yet it holds specific nuances tailored to Louisiana's tax regulations and requirements. Particularly, its structure and the type of information it gathers align closely with forms used in other states for similar purposes but adapted to reflect local tax laws, exemptions, and specific taxable and nontaxable items.

One document that the Louisiana 1029 Sales form bears resemblance to is the New York ST-100, the quarterly sales and use tax return used by registered sales tax vendors in New York. Both documents require detailed reporting of gross sales, taxable and nontaxable amounts, deductions, and net tax due. They also include specific schedules for different types of transactions and adjustments, such as exempt sales, leases, and rentals. However, the Louisiana 1029 form is specifically structured to align with Louisiana's tax code, emphasizing items and categories relevant to Louisiana's economy like the inclusion of hurricane preparedness supplies and specific agricultural exemptions unique to the state.

Another comparable form is the California Sales and Use Tax Return. Similar to the Louisiana 1029 form, it mandates detailed reporting of gross sales, returns and allowances, and taxable sales. Each form offers guidelines for calculating and reporting the tax due, including specific percentages and tax rates applicable to various goods and services. While both forms serve the same purpose, they are customized to their respective state's tax laws, with the California form providing explicit instructions for reporting use tax and accommodating California's district taxes, which vary by location within the state.

Dos and Don'ts

When preparing to fill out the Louisiana 1029 Sales form, there are several best practices to follow to ensure accuracy and compliance. Below are three key dos and three don'ts to help guide you:

Do:- Use blue or black ink: To ensure your form is legible and adheres to the state’s requirements, always fill out the form in blue or black ink.

- Round to the nearest dollar: When reporting amounts on the form, round your figures to the nearest dollar to comply with the formatting requirements.

- Review the deductions section carefully: Deductions are allowable under specific conditions. Make sure to accurately report deductions in Line 5 by referring to the details provided in Schedule A. Ensure that these are deductions related to items reported on Lines 1 through 3.

- Use dashes or decimals: The form specifies not to use dashes or decimals in the numeric fields. Ensure all amounts are rounded and presented in whole numbers.

- Forget to sign and date: Completing the declaration at the end of the form is essential. An unsigned or undated form may be considered invalid. Ensure that the declaration reflects a thorough review and honest representation of the information provided.

- Overlook electronic filing requirements: For certain transactions, such as motor vehicle leases or rentals, electronic filing is mandated. Always check the latest guidelines and adjust your filing method accordingly.

Misconceptions

Misconception 1: The Louisiana 1029 Sales form is only for reporting gross sales of tangible property.

This form also requires information on the cost of tangible personal property used, consumed, or stored for use in Louisiana, leases, rentals, and services, along with total allowable deductions and other tax-related details. It's a comprehensive sales tax return document, not limited to gross sales reporting.

Misconception 2: All businesses can use the Louisiana 1029 Sales form for any filing period.

The form clearly states it should not be used for filing periods prior to August 2020. Businesses must ensure they're using the correct version of the form for their specific filing period to avoid compliance issues.

Misconception 3: The form is applicable for motor vehicle leases or rentals.

Contrary to this belief, motor vehicle leases or rentals must be filed electronically, indicating specific considerations and requirements for different types of transactions.

Misconception 4: Vendor’s compensation is automatically applied to all returns.

Vendor’s compensation, calculated at 0.944% of Line 9, is subject to not being delinquent and has a cap of $1500. Businesses need to meet these criteria and refer to additional instructions for eligibility.

Misconception 5: Local sales tax should be included in the excess tax collected.

The form explicitly requires not to include local sales tax in the excess tax collected, emphasizing the focus on state-level taxation matters.

Misconception 6: You can use dashes when filling out the form.

Instructions specify using blue or black ink and rounding to the nearest dollar without the use of dashes, pointing towards precise and clear reporting requirements.

Misconception 7: The Louisiana 1029 Sales form does not offer options to support charitable causes.

In reality, there is an opportunity to donate to The Louisiana Military Family Assistance Fund, highlighting the state's initiative to provide taxpayers with an option to contribute to a noble cause directly through their tax return.

Misconception 8: All sales are taxed at the standard rate.

The form includes a detailed Schedule A for allowable deductions and Schedule A-1 for transactions subject to a 0% tax, indicating that not all sales are taxed equally and some qualify for exemptions or reduced rates.

Misconception 9: A single Louisiana 1029 Sales form is sufficient for multiple business locations.

Each physical location must register and obtain a separate Revenue Account ID. This requirement underscores the importance of treating each location as a unique entity for tax purposes.

Key takeaways

Filling out the Louisiana 1029 Sales Tax Return form responsibly and accurately is important for businesses to comply with state tax regulations. Here are seven key takeaways to consider when dealing with this form:

- Use the Correct Form: The current version of the form is specified for periods after August 2020. This means that businesses should not use this form for filing sales tax returns for periods before this date.

- Fill out Accurately: Information regarding gross sales, cost of tangible personal property, leases, rentals, and services should be carefully calculated and reported. Accuracy in these sections is crucial for correct tax calculation.

- Electronic Filing for Certain Transactions: It's important to note that motor vehicle leases or rentals cannot be included in this form and must be filed electronically, highlighting a move towards digital submissions for certain types of transactions.

- Vendor's Compensation: If a business is not delinquent on its taxes, it can claim vendor’s compensation at a rate of 0.944% of the total tax due, up to a limit of $1500, which can offset some of the tax owed.

- Detailed Deductions: The form allows businesses to list allowable deductions, but it's critical these are only items that have been reported in the previous sections of the form.

- Supporting Local Military Families: Businesses have the option to donate to The Louisiana Military Family Assistance Fund directly through this tax return form. This offers a streamlined way to support local military families while fulfilling tax obligations.

- Timely Submission is Key: To avoid penalties and interest due to late submission, it’s important to send the completed form to the Louisiana Department of Revenue by the 20th day following the taxable period. If the due date falls on a weekend or holiday, the next business day is considered the due date.

Understanding these key points can lead to smoother, more efficient tax filing processes. Always ensure that you have the most current form and instructions to comply with the latest guidelines from the Louisiana Department of Revenue.

Popular PDF Templates

Dpsmv 1631 - Accuracy in completing the DPSMV 1631 is crucial for public agencies to secure the correct plate type, reflecting the vehicle’s true function.

Louisiana Up 1 - Streamlines the submission process for unclaimed property reports in Louisiana, with clear guidance on documentation, remittance, and verification procedures.

Louisiana Education - At a school club meeting, a member's exclusionary behavior towards others was addressed to foster inclusiveness.