Free It 540 2D Louisiana Template

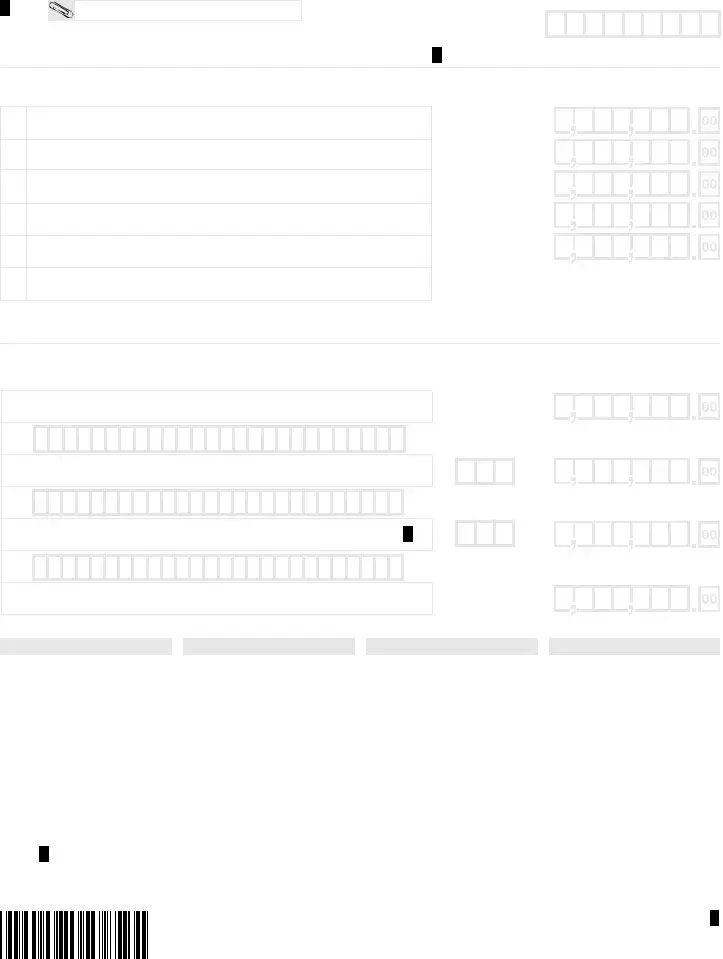

Tackling the complexities of state tax filings can be daunting for residents, especially when confronted with forms like the IT-540-2D in Louisiana. This document, designed specifically for the 2013 tax year, serves as a comprehensive platform for Louisiana residents to declare various aspects of their income, adjustments, and credits, ensuring their state tax responsibilities are fulfilled accurately. Spanning four extensive pages, the form begins by requesting basic yet crucial personal information including the taxpayer’s social security number, filing status, and any applicable name changes, extending through to detailed financial disclosures. It also offers options for individuals to amend previously filed returns or file as a decedent's spouse. Among its numerous sections, the form elaborates on exemptions based on age, blindness, or filing status, and drills down into the minutiae of dependents, adjusted gross income from federal returns, allowable deductions, and the application of nonrefundable and refundable tax credits. Notably, it adjusts for unique Louisiana-specific credits and deductions, extending to donations towards various charitable causes, ultimately culminating in the calculation of the taxpayer's refund or amount owed to the state. Designed to work in tandem with federal tax submissions, the IT-540-2D form underscores the interconnectedness of federal and state tax systems while catering to the distinct fiscal policies of Louisiana.

Form Example

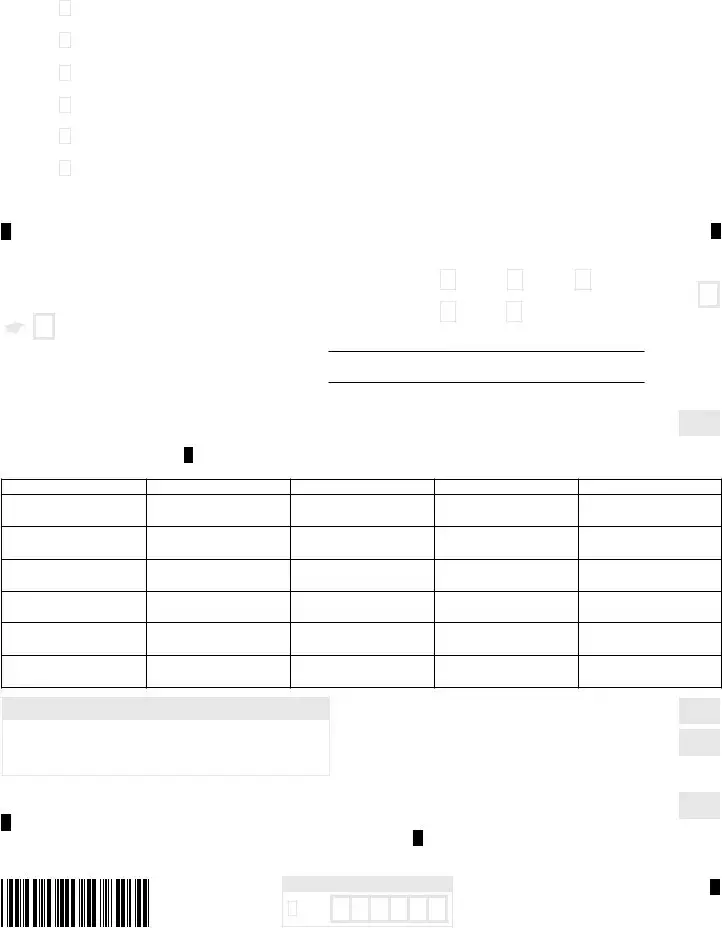

LOUISIANA FILE ONLINE

Fast. Easy. Absolutely Free.

revenue.louisiana.gov/fileonline

Are you due a refund? If you file this paper return, it will take up to 14 weeks to get your refund check. With Louisiana File Online and direct deposit, you can receive your refund within 45 days.

Mark Box:

Name

Change

Decedent Filing

Spouse Decedent

Address Change

Amended Return

NOL Carryback

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT! |

||||||||

2022 LOUISIANA RESIDENT |

|

|

|

You must enter your SSN below in the same |

|||||||||||||||

|

|

|

|

|

|

|

|

|

order as shown on your federal return. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your legal first name |

Init. |

Last name |

|

|

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s name |

Init. |

Last name |

|

|

|

Suffix |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Spouse’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

Present home address (number and street including rural route) |

Unit Type |

Number |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town, or APO |

|

|

|

State |

|

ZIP |

|

Area code and daytime telephone number |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Nation, if not United States (do not abbreviate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

Your Date of Birth |

|

Spouse’s Date of Birth |

|||||||||||||

FILING STATUS: Enter the appropriate number in the filing status box. It must agree with your federal return.

Enter a “1” in box if single.

Enter a “2” in box if married filing jointly. Enter a “3” in box if married filing separately. Enter a “4” in box if head of household.

If the qualifying person is not your dependent, enter name here.

6EXEMPTIONS:

6A |

X |

Yourself |

6B |

|

Spouse |

|

||

|

|

|

65or older

65or older

Blind

Blind

Qualifying Widow(er)

Total of 6A & 6B

Enter a “5” in box if qualifying widow(er).

If the qualifying person is not your dependent, enter name here.

6C DEPENDENTS – Enter dependent information below. If you have more than 6 dependents, attach a statement to your return with the required information. Enter the number of dependents claimed on Federal Form 1040 or

6C

First Name

Last Name

Social Security Number

Relationship to you

Birth Date (mm/dd/yyyy)

IMPORTANT!

All four (4) pages of this return MUST be mailed in together along with your

6D |

EXEMPTIONS – Total of 6A, 6B, and 6C |

6D |

6E |

DEPENDENTS FOR CERTAIN ADOPTIONS DEDUCTION – |

6E |

|

Enter the number of dependents included on Line 6C for whom |

|

|

you are claiming the Deduction for Certain Adoptions. |

|

|

Enter name here. _________________________________ |

|

6F |

TOTAL EXEMPTIONS – Subtract Line 6E from Line 6D. |

6F |

FOR OFFICE USE ONLY

Field

Flag

WEB 62330

2022 Form

Enter your Social Security Number.

If you are not required to file a federal |

|

Mark this box and enter zero “0” on Line 12. |

|

|

return, indicate wages here. |

|

|

|

|

|

|

|

|

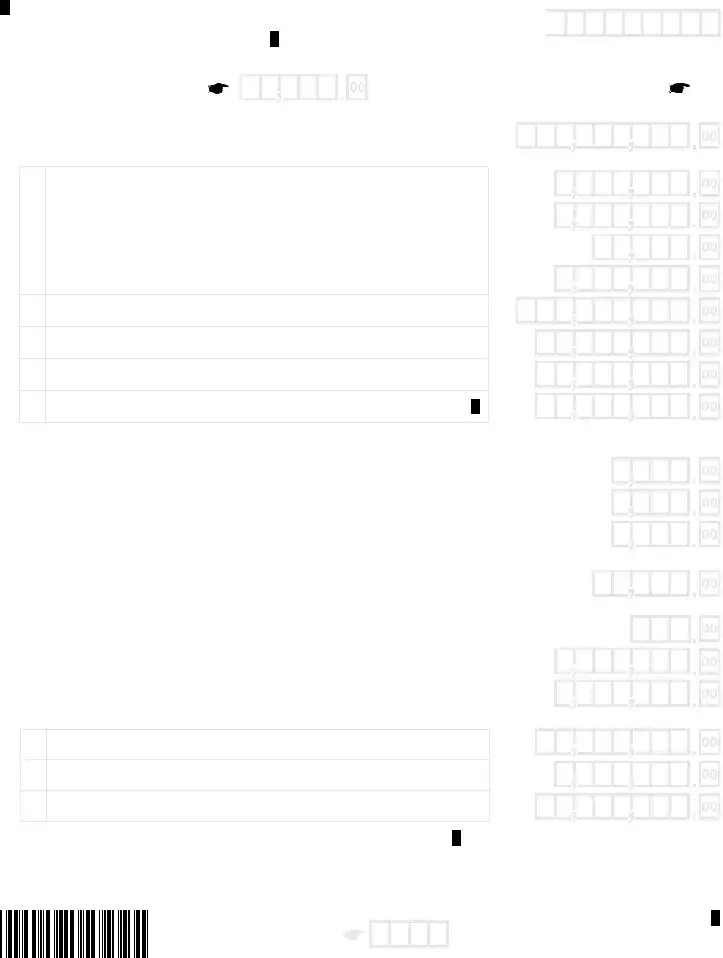

7 |

FEDERAL ADJUSTED GROSS INCOME – If your Federal Adjusted |

|

From Louisiana |

|

Schedule E, |

||

Gross Income is less than zero, enter “0.” |

|

||

|

|

attached |

|

|

|

|

If you did not itemize your deductions on your federal return, leave Lines 8A through 8D blank and go to Line 9.

7

8A |

FEDERAL ITEMIZED DEDUCTIONS |

|

|

8B |

FEDERAL ITEMIZED DEDUCTION FOR MEDICAL AND DENTAL EXPENSES |

|

|

8C |

FEDERAL STANDARD DEDUCTION |

|

|

8D |

EXCESS FEDERAL ITEMIZED DEDUCTIONS – Subtract Line 8C from Line 8B. |

9YOUR LOUISIANA TAX TABLE INCOME – Subtract Line 8D from Line 7. If less than zero, enter “0.” Use this figure to find your tax in the tax tables.

10YOUR LOUISIANA INCOME TAX – Enter the amount from the tax table that corresponds with your filing status.

11NONREFUNDABLE PRIORITY 1 CREDITS – From Schedule C, Line 6

12TAX LIABILITY AFTER NONREFUNDABLE PRIORITY 1 CREDITS – Subtract Line 11 from Line 10. If the result is less than zero, or you are not required to file a federal return, enter zero “0.”

8A

8B

8C

8D

9

10

11

12

|

2022 LOUISIANA REFUNDABLE CHILD CARE CREDIT – Your Federal Adjusted Gross Income |

|

|||||||||||

13 |

must be EQUAL TO OR LESS THAN $25,000 to claim the credit on this line. See the instructions |

13 |

|||||||||||

|

and the Refundable Child Care Credit Worksheet. |

|

|

|

|

|

|

|

|||||

13A |

Enter the qualified expense amount from the |

Refundable |

Child Care Credit |

Worksheet, Line 3. |

13A |

||||||||

|

|

|

|

|

13B |

||||||||

13B |

Enter the amount from the Refundable Child Care Credit Worksheet, Line 6. |

|

|

|

|||||||||

|

|

|

|||||||||||

|

2022 LOUISIANA REFUNDABLE SCHOOL READINESS CREDIT – Your Federal Adjusted Gross |

|

|||||||||||

|

Income must be EQUAL TO OR LESS THAN $25,000 to claim the credit on this line. See the |

|

|||||||||||

14 |

Refundable School Readiness Credit Worksheet. |

|

|

|

|

|

|

14 |

|||||

|

5 |

|

|

4 |

|

|

3 |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|||

|

|

||||||||||||

15 |

EARNED INCOME CREDIT – See Louisiana Earned Income Credit (LA EIC) Worksheet, Line 3. |

||||||||||||

|

|

|

|

|

|

||||||||

16 |

OTHER REFUNDABLE PRIORITY 2 CREDITS – From Schedule F, Line 9 |

|

|

|

16 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

17 |

TOTAL REFUNDABLE PRIORITY 2 CREDITS – Add Lines 13, and 14 through 16. Do not include |

17 |

|||||||||||

amounts on Lines 13A and 13B. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18TAX LIABILITY AFTER REFUNDABLE PRIORITY 2 CREDITS

19OVERPAYMENT AFTER REFUNDABLE PRIORITY 2 CREDITS

20NONREFUNDABLE PRIORITY 3 CREDITS – From Schedule J, Line 16

Enter the first 4 letters of your last name in these boxes.

18

19

20

CONTINUE ON NEXT PAGE.

WEB 62331

2022 Form

Enter your Social Security Number.

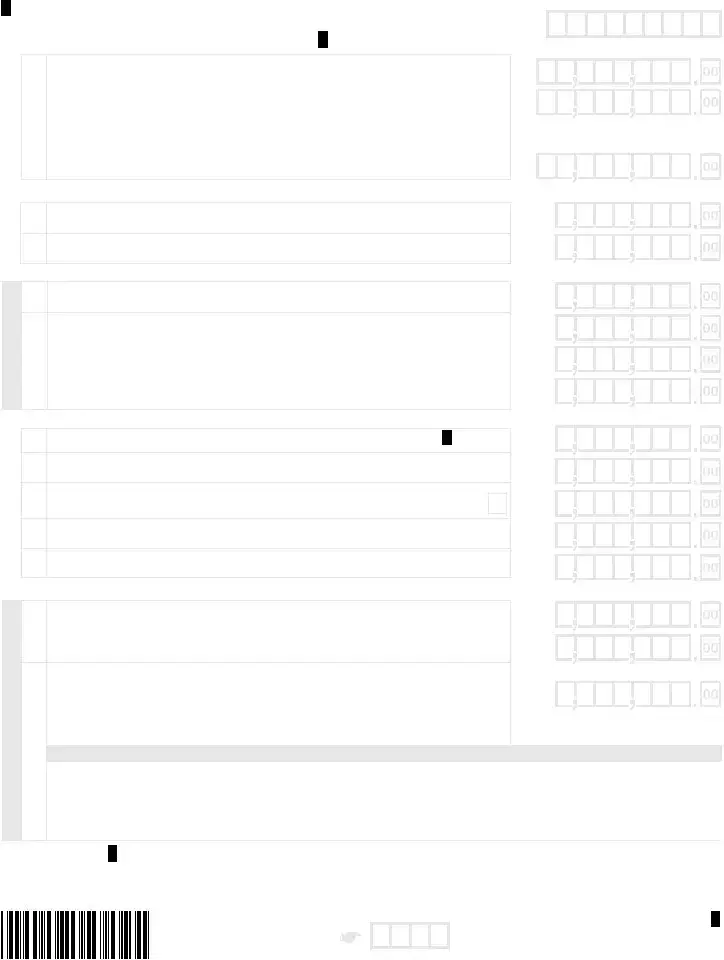

21 |

ADJUSTED LOUISIANA INCOME TAX – Subtract Line 20 from Line 18. |

|||

|

|

|

|

|

|

|

|

|

No use tax due. |

|

|

|

|

|

22 |

CONSUMER USE TAX - You must mark one of these boxes. |

|

|

Amount from the Consumer |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Tax Worksheet. |

|

|

|

|

|

|

|

|

|

|

23TOTAL INCOME TAX AND CONSUMER USE TAX – Add Lines 21 and 22.

24OVERPAYMENT OF REFUNDABLE PRIORITY 2 CREDITS – Enter the amount from Line 19.

25REFUNDABLE PRIORITY 4 CREDITS – From Schedule I, Line 6

21

22

23

24

25

26 AMOUNT OF LOUISIANA TAX WITHHELD FOR 2022 – Attach Forms |

26 |

PAYMENTS |

27 |

AMOUNT OF CREDIT CARRIED FORWARD FROM 2021 |

27 |

|

|||

|

|

|

28 |

|

28 |

AMOUNT OF ESTIMATED PAYMENTS MADE FOR 2022 |

|

|

|

|

29 |

|

29 |

AMOUNT OF EXTENSION PAYMENT |

|

|

|

30 TOTAL REFUNDABLE TAX CREDITS AND PAYMENTS – Add Lines 24 through 29.

31OVERPAYMENT – If Line 30 is greater than Line 23, subtract Line 23 from Line 30. Your overpayment may be reduced by the Underpayment of Estimated Tax Penalty. Otherwise, go to Line 38.

32UNDERPAYMENT PENALTY – See the instructions for Underpayment Penalty and Form

33ADJUSTED OVERPAYMENT – If Line 31 is greater than Line 32, subtract Line 32 from Line 31, and enter on Line 33. If Line 32 is greater than Line 31, subtract Line 31 from Line 32, and enter the balance on Line 38.

34TOTAL DONATIONS – From Schedule D, Line 22

30

31

32

33

34

REFUND DUE

35 |

SUBTOTAL – Subtract Line 34 from Line 33. This amount of overpayment is available for credit or refund. |

35 |

|

|

|

|

|

36 |

AMOUNT OF LINE 35 TO BE CREDITED TO 2023 INCOME TAX |

CREDIT |

36 |

AMOUNT TO BE REFUNDED – Subtract Line 36 from Line 35. If mailing to LDR, use Address 2 on the next page.

37 Enter a “2” in box if you want to receive your refund by paper check. |

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Enter a “3” in box if you want to receive your refund by direct deposit. Complete |

REFUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

information below. If information is unreadable, you are filing for the first time, or if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

you do not make a refund selection, you will receive your refund by paper check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECT DEPOSIT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Type: |

Checking |

|

|

|

|

Savings |

|

|

Will this refund be forwarded to a financial |

|

Yes |

|

|

|

|

No |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

institution located outside the United States? |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Routing |

|

|

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Number |

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the first 4 letters of your last name in these boxes.

COMPLETE AND SIGN RETURN ON NEXT PAGE.

WEB 62332

2022 Form

Enter your Social Security Number.

|

38 |

AMOUNT YOU OWE – If Line 23 is greater than Line 30, subtract Line 30 from Line 23. |

||||||

|

|

|

|

|

|

|

|

|

|

39 |

ADDITIONAL DONATION TO THE MILITARY FAMILY ASSISTANCE FUND |

|

|

|

|

|

|

LOUISIANA |

|

|

|

|

||||

40 |

ADDITIONAL DONATION TO THE COASTAL PROTECTION AND RESTORATION FUND |

|||||||

|

|

|

|

|

|

|

||

41 |

ADDITIONAL DONATION TO LOUISIANA FOOD BANK ASSOCIATION |

|

|

|

|

|

||

|

|

|

|

|

|

|

||

42 |

INTEREST – From the Interest Calculation Worksheet, Line 5. |

|

|

|

|

|

||

DUE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

43 |

DELINQUENT FILING PENALTY – From the Delinquent Filing Penalty Calculation Worksheet, Line 3. |

|||||||

AMOUNTS |

||||||||

|

|

|

|

|||||

44 |

DELINQUENT PAYMENT PENALTY – From Delinquent Payment Penalty Calculation Worksheet, Line 7. |

|||||||

|

|

|

|

|

|

|||

45 |

UNDERPAYMENT PENALTY – See the instructions for Underpayment Penalty and Form |

|

|

|||||

|

|

|||||||

|

If you are a farmer, check the box. |

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

BALANCE DUE LOUISIANA – Add Lines 38 through 45. |

PAY THIS AMOUNT. |

|||||

|

46 |

If mailing to LDR, use address 1 below. For electronic payment |

||||||

|

|

options, see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT!

All four (4) pages of this return

MUST be mailed in together along

with your

Do not staple.

38

39

40

41

42

43

44

45

46

DO NOT SEND CASH.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. If I made a contribution to a START Savings Program, I consent that my Social Security Number may be given to the Louisiana Office of Student Financial Assistance to properly identify the START Savings Program account holder. If married filing jointly, both Social Security Numbers may be submitted. I understand that by submitting this form I authorize the disbursement of individual income tax refunds through the method as described on Line 37.

Your Signature

Date (mm/dd/yyyy)

Spouse’s Signature (If filing jointly, both must sign.)

Date (mm/dd/yyyy)

PAID

PREPARER USE ONLY

Print/Type Preparer’s Name |

Preparer’s Signature |

Date (mm/dd/yyyy) |

Check if |

|

|

|

|

|

|

Firm’s Name ➤ |

|

|

Firm’s FEIN ➤ |

|

|

|

|

|

|

Firm’s Address ➤ |

|

|

Telephone ➤ |

|

|

|

|

|

|

Enter the first 4 letters of your last name in these boxes.

{ A d d r e s s }

|

Individual Income Tax Return |

|

Calendar year return due 5/15/2023 |

|

|

1 |

Mail Balance Due Return with Payment |

TO: Department of Revenue |

|

P. O. Box 3550 |

|

|

Baton Rouge, LA |

2 |

Mail All Other Individual Income Tax Returns |

TO: Department of Revenue |

|

P. O. Box 3440 |

|

|

Baton Rouge, LA |

PTIN, FEIN, or LDR Account Number

of Paid Preparer

WEB

For Office |

|

Use Only. |

62333 |

|

ATTACH TO RETURN IF COMPLETED.

Enter your Social Security Number.

SCHEDULE C – 2022 NONREFUNDABLE PRIORITY 1 CREDITS

1CREDIT FOR TAX LIABILITIES PAID TO OTHER STATES – A copy of the return filed with the other states and Form

|

1A |

Enter the total of Net Tax Liability Paid to Other States from Form |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

1B |

Enter the Credit for Taxes Paid to Other States from Form |

|

|

||

|

|

|

|

|

|

|

1A

1B

Additional Nonrefundable Priority 1 Credits

Enter credit description and associated code, along with the dollar amount of credit claimed. See the instructions.

Credit Description |

Credit Code |

Amount of Credit Claimed |

2

3

4

5

6TOTAL NONREFUNDABLE PRIORITY 1 CREDITS – Add Lines 1B, and 2 through 5. Also, enter this amount on Form

2

3

4

5

6

Description |

Code |

Premium Tax |

100 |

|

|

Bone Marrow |

120 |

|

|

Description |

Code |

Qualified Playgrounds |

150 |

|

|

Debt Issuance |

155 |

|

|

Description |

Code |

Other |

199 |

|

|

File

electronically!

www.revenue.louisiana.gov/fileonline

WEB 62334

ATTACH TO RETURN IF COMPLETED.

Enter your Social Security Number.

SCHEDULE D – 2022 DONATION SCHEDULE

Individuals who file an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 33 of Form

1

Adjusted Overpayment – From

1

DONATIONS OF LINE 1

2The Military Family Assistance Fund

3Coastal Protection and Restoration Fund

4The START Program

5Wildlife Habitat and Natural Heritage Trust Fund

6Louisiana Cancer Trust Fund

7Louisiana Pet Overpopulation Advisory Council

8Louisiana Food Bank Association

9

10Louisiana Association of United Ways/LA

11American Red Cross

2

3

4

5

6

7

8

9

10

11

DONATIONS OF LINE 1

12Louisiana National Guard Honor Guard for Military Funerals

13Louisiana State Troopers Charities, Inc.

14Louisiana Horse Rescue Association

15Louisiana Coalition Against Domestic Violence

16Dreams Come True, Inc.

17Sexual Trauma Awareness and Response (STAR)

Louisiana State University Agricultural

18Center Grant Walker Educational Center

19Maddie’s Footprints

20University of New Orleans Foundation

21Southeastern Louisiana University Foundation

12

13

14

15

16

17

18

19

20

21

22 |

TOTAL DONATIONS – Add Lines 2 through 21. This amount cannot be more than Line 1. Also, enter this amount |

22 |

|

on Form |

|||

|

|

||

|

|

|

WEB 62335

|

|

|

|

ATTACH TO RETURN IF COMPLETED. |

|

|

|

|

|

|

|

|

|

|

Enter your Social Security Number. |

||

SCHEDULE E – 2022 ADJUSTMENTS TO INCOME |

||||||||

|

|

|||||||

|

|

|

|

|

|

|

|

|

1FEDERAL ADJUSTED GROSS INCOME – Enter the amount from your Federal Form 1040 or

2A |

INTEREST AND DIVIDEND INCOME FROM OTHER STATES AND THEIR POLITICAL |

|||

SUBDIVISIONS |

||||

|

||||

|

|

|

|

|

|

|

|||

2B |

RECAPTURE OF START CONTRIBUTIONS |

|

|

|

|

|

|

|

|

2C |

RECAPTURE OF START K12 CONTRIBUTIONS |

|||

|

|

|

|

|

2D |

ADD BACK OF PASS – THROUGH ENTITY LOSS |

|||

|

|

|

|

|

3 |

TOTAL – Add Lines 1, 2A, 2B, 2C, and 2D. |

|||

EXEMPT INCOME – Enter on Lines 4A through 4G the amount of exempted income included in Line 1 above. Enter the description and associated code, along with the dollar amount. See the instructions.

|

Exempt Income Description |

|

Code |

|||

4A |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4B |

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4C |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4D |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4E |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4F |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4G |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4H |

EXEMPT INCOME – Add Lines 4A through 4G. |

|

|

|

|

|

LOUISIANA ADJUSTED GROSS INCOME – Subtract Line 4H from Line 3. Also, enter this

5amount on Form

1

2A

2B

2C

2D

3

Amount

4A

4B

4C

4D

4E

4F

4G

4H

5

Description - See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

Code |

|||

Interest and Dividends on U.S. Government Obligations |

|

|

|

|

|

|

|

01E |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana State Employees’ Retirement Benefits |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02E |

Taxpayer date retired: |

M |

M |

Y |

Y |

Y |

|

Y |

Spouse date retired: |

M |

M |

Y |

Y |

Y |

Y |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana State Teachers’ Retirement Benefits |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03E |

|

M |

M |

Y |

Y |

Y |

|

Y |

|

M |

M |

Y |

Y |

Y |

Y |

|

|

Taxpayer date retired: |

|

Spouse date retired: |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Retirement Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04E |

|

M |

M |

Y |

Y |

Y |

|

Y |

|

M |

M |

Y |

Y |

Y |

Y |

|

|

Taxpayer date retired: |

|

Spouse date retired: |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Retirement Benefits – Provide name or statute: _______________________________________________ |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

05E |

|

M |

M |

Y |

Y |

Y |

|

Y |

|

M |

M |

Y |

Y |

Y |

Y |

|

|

Taxpayer date retired: |

|

Spouse date retired: |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Retirement Income Exemption for Taxpayers 65 or over |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06E |

Provide name of pension or annuity: _______________________________________________________________ |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description - See instructions. |

Code |

|

|

|

|

Taxable Amount of Social Security |

07E |

|

Native American Income |

08E |

|

START Savings Program Contribution |

09E |

|

Military Pay Exclusion |

10E |

|

Road Home |

11E |

|

Recreation Volunteer |

13E |

|

Volunteer Firefighter |

14E |

|

Voluntary Retrofit Residential Structure |

16E |

|

Elementary and Secondary School Tuition |

17E |

|

Educational Expenses for |

18E |

|

Educational Expenses for Quality Public Education |

19E |

|

Capital Gain from Sale of Louisiana Business |

20E |

|

Employment of Certain Qualified Disabled Individuals |

21E |

|

S Bank Shareholder Income Exclusion |

22E |

|

Entity Level Taxes Paid to Other States |

23E |

|

Pass - Through Entity Exclusion |

24E |

|

IRC 280C Expense Adjustment |

25E |

|

27E |

||

START K12 Savings Program Contributions |

28E |

|

Digital Nomads |

29E |

|

Certain Adoptions |

30E |

|

Other, see instructions. |

49E |

|

Identify: ____________________________________________ |

||

|

||

|

|

File

electronically!

www.revenue.louisiana.gov/fileonline

WEB 62336

ATTACH TO RETURN IF COMPLETED.

2022 Louisiana School Expense Deduction Worksheet

Your Name

Your Social Security Number

I.This worksheet should be used to calculate the three School Expense Deductions listed below. Refer to Revenue Information Bulletins

1.Elementary and Secondary School Tuition – R.S. 47:297.10 provides a deduction for amounts paid during the tax year for tuition and fees required for your dependent child’s enrollment in a nonpublic elementary or secondary school that complies with the criteria set forth in Brumfield v. Dodd and Section 501(c)(3) of the Internal Revenue Code or to any public elementary or secondary laboratory school that is operated by a public college or university. The school can verify that it complies with the criteria. The deduction is equal to the actual amount of tuition and fees paid per dependent, limited to $5,000. The tuition and fees that can be deducted include amounts paid for tuition, fees, uniforms, textbooks and other supplies required by the school.

2.Educational Expenses for

3.Educational Expenses for a Quality Public Education – R.S. 47:297.12 provides a deduction for the fees or other amounts paid during the tax year for a quality education of a dependent child enrolled in a public elementary or secondary school, including Louisiana Department of Education approved charter schools. The deduction is equal to 50 percent of the amounts paid per dependent, limited to $5,000. The amounts that can be deducted include amounts paid for uniforms, textbooks and other supplies required by the school.

II.On the chart below, list the name of each qualifying dependent and the name of the school the student attends. If the student is

|

|

|

Deduction as described |

||

Student |

Name of Qualifying Dependent |

Name of School |

above in Section I |

||

|

|

|

1 |

2 |

3 |

A |

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

III.Using the letters that correspond to each qualifying dependent listed in Section II, list the amount paid per student for each qualifying expense. For students attending a qualifying school, the expense must be for an item required by the school. Refer to the information in Section I to determine which expenses qualify for the deduction. Retain copies of canceled checks, receipts and other documentation in order to support the amount of qualifying expenses. If you checked column 1 in Section II, skip the 50% calculation below; however, the deduction is still limited to $5,000.

Qualifying Expense |

|

List the amount paid for each student as listed in Section II. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

A |

B |

C |

|

D |

|

|

E |

|

F |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Tuition and Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School Uniforms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textbooks or Other Instructional Materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (add amounts in each column) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If column 2 or 3 in Section II was checked, |

50% |

50% |

50% |

|

50% |

|

50% |

|

50% |

|

multiply by: |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduction per Student – Enter the result |

|

|

|

|

|

|

|

|

|

|

or $5,000, whichever is less. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV. Total the Deduction per Student in Section III, based on the deduction for which the students qualified |

as marked in |

boxes 1, |

2, or 3 in Section II. |

|||||||

|

|

|

|

|

||||||

Enter the Elementary and Secondary School Tuition Deduction here and on |

|

$ |

|

|

||||||

|

|

|

|

|

||||||

Enter the Educational Expenses for |

|

$ |

|

|

||||||

|

|

|

|

|

||||||

Enter the Educational Expenses for a Quality Public Education Deduction here and on |

|

$ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

WEB 62308

ATTACH TO RETURN IF COMPLETED.

Enter your Social Security Number.

SCHEDULE F – 2022 REFUNDABLE PRIORITY 2 CREDITS

Enter credit description and associated code, along with the dollar amount of credit claimed. See the instructions.

Credit Description

1

2

3

4

5

5A |

School Readiness Child Care Directors and Staff Credit - Facility License Number |

Credit Code |

|

Amount of Credit Claimed |

||||||||

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transferable, Refundable Priority 2 Credits

Enter the State Certification Number from Form

Credit Description

6.Musical and Theatrical Production

6A.

7.Musical and Theatrical Production

Credit Code |

Amount of Credit Claimed |

||||

|

|

|

|

|

|

|

6 |

2 |

F |

|

6 |

|

|

|

|

|

|

6 2 F |

7 |

|

7A.

8. Musical and Theatrical Production

6

2

F

8A.

9.OTHER REFUNDABLE PRIORITY 2 CREDITS – Add Lines 1 through 8. Also, enter this amount on Form

8

9

Description |

Code |

|

Description |

Code |

|

Description |

Code |

|

Description |

Code |

|

|

|

|

|

|

|

|

|

|

|

Ad Valorem Offshore Vessels |

52F |

|

Technology Commercialization |

59F |

|

School Readiness Business – |

67F |

|

Stillborn Child |

76F |

|

|

Supported Child Care |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Telephone Company Property |

54F |

|

Historic Residential |

60F |

|

School Readiness Fees and Grants to |

68F |

|

Funeral and Burial Expense for a |

77F |

|

|

Resource and Referral Agencies |

|

|||||||

|

|

|

|

|

|

|

|

|

||

Prison Industry Enhancement |

55F |

|

School Readiness Child Care |

65F |

|

Retention and Modernization |

70F |

|

Other Refundable Credit |

80F |

|

Provider |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Milk Producers |

58F |

|

School Readiness Child Care |

66F |

|

Digital Interactive Media & Software |

73F |

|

|

|

|

Directors and Staff |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

WEB 62337

Document Breakdown

| Fact | Detail |

|---|---|

| Form Title | IT-540-2D Louisiana Resident Income Tax Return |

| Tax Year | 2013 |

| Page Length | 4 Pages |

| Main Purpose | For Louisiana Residents to report income, calculate taxes due, and claim refunds or report overpayments. |

| Special Features | Includes sections for Name Change, Decedent Filing, Amended Returns, and NOL Carryback. |

| Key Sections | Filing Status, Exemptions, Income, Deductions, Tax Computation, Credits, Payments, Donations |

| Governing Law(s) | Louisiana State Income Tax Law |

Instructions on Filling in It 540 2D Louisiana

Filing a tax return is an annual obligation for residents in Louisiana, requiring careful attention to detail to ensure all information is accurate and complete. The IT-540-2D form is a key document for Louisiana residents that serves this purpose. Understanding and filling out this form correctly is essential for compliance with state tax laws and to potentially receive returns on overpaid taxes. Here's how to approach filling out the form, laid out step by step to make the process more manageable.

- Begin with your personal information. Enter your full legal name, Social Security Number (SSN), and date of birth (DOB) in the designated areas at the top of the form. If you are filing with a spouse, also include their name, SSN, and DOB.

- Choose your Filing Status. Check the appropriate box that matches your filing status: single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This should align with the status on your federal return.

- Under the Exemptions section, calculate exemptions for yourself, your spouse if applicable, and any dependents. You'll need each dependent's full name, SSN, relationship to you, and birth date. Start with section 6a for yourself and spouse details, then move to 6c for dependents, summing up the total in 6d.

- Proceed to report your income information. This starts with entering your Federal Adjusted Gross Income from your federal tax return into the designated line. If not filing a federal return, indicate wages directly on the form.

- Capture deductions. Depending on whether you itemize deductions or take the standard deduction on your federal return, enter the respective amounts in sections 8A and 8B. Calculate your excess federal itemized deductions, if any, and subtract that from your federal adjusted gross income to find your Louisiana income tax.

- Enter your applicable nonrefundable tax credits from Sections 12A through 14, including federal childcare credits, school readiness credits, and other state-specific nonrefundable credits, summing these in section 16 after calculations.

- Calculate and report any refundable tax credits in the sections provided, ranging from the Louisiana refundable childcare credit to others like the earned income credit or school readiness credits. Each will have specific instructions on the form for calculation.

- Determine your total payments, including Louisiana tax withheld, any estimated payments made, and payments made with extension requests. These are totaled up to determine if you've overpaid or underpaid.

- If applicable, calculate your Consumer Use Tax and enter the amount.

- Review the sections on refundable tax credits and total payments, calculate your total income tax, and consumer use tax. Compare this to the total payment to determine if you have an overpayment or owe additional taxes.

- Choose your refund method, if applicable. Indicate by selecting the option for the MyRefund Card, paper check, or direct deposit. Fill in the banking details for direct deposit accurately to avoid delays.

- If you owe additional taxes, calculate the total amount due, including any penalties for underpayment or late filing/payment. Ensure all figures are accurate to avoid further penalties.

- Consider if you would like to make additional donations to Louisiana's charitable organizations or funds listed on the donation schedule. If so, allocate the desired amount from your refund to each and include these in your form calculations.

- Sign and date the form. If filing jointly, ensure your spouse also signs. Provide the telephone number where you can be reached.

- Review the entire form to ensure accuracy and completeness. Attach all required documentation, such with W-2 and 1099 forms, before mailing to the address provided on the form instructions.

By carefully following these steps, individuals can accurately complete and submit their IT-540-2D forms to meet their tax obligations in Louisiana. Should there be any doubts or complexities, consulting with a tax professional is advisable to avoid errors that could lead to penalties or missed refund opportunities.

Listed Questions and Answers

What is the IT-540-2D form used for in Louisiana?

The IT-540-2D form is a document utilized by residents of Louisiana to file their yearly individual income tax returns. It collects information about one's income, deductions, tax credits, and calculates the amount of state tax owed or the refund due. It's especially designed to capture details like filing status, exemptions including those for dependents, income, and deductions, as well as to report any nonrefundable and refundable tax credits.

How do I know if I need to file the IT-540-2D form?

You need to file the IT-540-2D form if you are a resident of Louisiana and are required to file a federal income tax return. Your filing status and income level, similar to federal tax requirements, determine your obligation to file a state tax return. If you have Louisiana income tax withheld or if you qualify for certain Louisiana tax credits, you may also need to file this form to claim a refund or credit.

Can I claim tax credits on the IT-540-2D form?

Yes, the IT-540-2D form allows you to claim both nonrefundable and refundable tax credits. Nonrefundable tax credits include the Federal Child Care Credit and the Louisiana Nonrefundable Child Care Credit, among others. The form also provides sections for refundable credits, such as the Louisiana Refundable Child Care Credit and School Readiness Credit. These tax credits can reduce your overall tax liability, and in the case of refundable credits, they can amount to a refund if they exceed your tax liability.

What should I do if I don't have to file a federal return but have Louisiana income?

If you are not required to file a federal return but have Louisiana income, you still need to report this income on the IT-540-2D form. There's a section on the form where you can indicate wages and other income even if a federal return isn't filed. It's important to report all sources of Louisiana income to ensure your tax calculation is accurate and to comply with state tax laws.

How do I submit donations or additional payments for state programs through the IT-540-2D form?

On the IT-540-2D form, there's an opportunity to contribute to various state programs through donations or additional payments. This can be done using the 'Donation Schedule' section, where you can specify amounts you want to donate to programs like the Military Family Assistance Fund, the Coastal Protection and Restoration Fund, among others. These contributions can be deducted from your overpayment (if applicable) or added to your payment due to the state. To donate, simply enter the amount you wish to contribute next to the appropriate program name on the form.

Common mistakes

When filling out the IT-540-2D Louisiana form, individuals often encounter a few common mistakes that can lead to delays and inaccuracies in processing their tax returns. Highlighting these mistakes can help ensure smoother submissions and more accurate filings.

One prevalent mistake is incorrectly entering filing status. Taxpayers must ensure the number entered in the filing status box matches their federal return status. For instance, mistakenly choosing "single" when "married filing jointly" applies can significantly affect the taxation calculations and deductions eligibility.

Another common error is omitting or inaccurately reporting exemptions, particularly in sections 6A and 6B for age and blindness and 6C for dependents. Taxpayers sometimes forget to claim all their qualified exemptions, which could result in paying more tax than necessary or, conversely, claiming exemptions not applicable to them, leading to discrepancies and potential audits.

Many also struggle with the income and deductions sections, particularly in accurately transferring amounts from the federal return. This includes reporting federal adjusted gross income, itemized or standard deductions inaccurately, which forms the basis for calculating Louisiana income and can hence affect the overall tax liability.

Incorrectly calculating nonrefundable and refundable tax credits, as outlined from lines 12 through 23, is another frequent oversight. Errors in these sections, including misunderstanding eligibility for certain credits like the Louisiana School Readiness Credit or the Federal Child Care Credit, can either result in underestimating tax owed or overstating refund entitlements.

Lastly, many individuals make mistakes in the payment and refund section, particularly around the details for direct deposit (lines 33 through 35). Providing incorrect banking information or failing to accurately report amounts withheld can delay refunds or result in errors in tax due calculations.

Avoiding such mistakes requires careful reading of form instructions, double-checking entries against federal returns, and verifying personal information like Social Security Numbers (SSNs) and bank details. Ensuring accuracy in these areas not only helps in timely processing but also in maximizing potential refunds and minimizing liability.

Documents used along the form

When filing the IT-540-2D Louisiana form, individuals often need to accompany their submission with various other forms and documents to provide a comprehensive view of their financial status and comply with tax regulations. These documents can range from verification of income to proof of eligibility for credits or deductions, each playing a crucial role in the processing and final determination of an individual's state tax liabilities and potential refunds.

- W-2 Forms: These are issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. This form is critical for accurately reporting one's income.

- 1099 Forms: Various 1099 forms report income from sources other than wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and government payments like refunds or unemployment compensation (1099-G).

- Schedule E: This schedule is used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It's especially relevant for taxpayers with rental property or investments in partnerships.

- Schedule H: For claiming a credit for taxes paid to other states by Louisiana residents. If you’ve paid income tax to another state, this form is necessary to avoid dual taxation on the same income.

- Schedule G: Used to report other nonrefundable tax credits. It encompasses various tax incentives not directly related to child care or education credits.

- Schedule D: This schedule is for reporting donations made from one's tax refund. It details the different funds or organizations to which a taxpayer has chosen to contribute part or all of their refund.

- Schedule F: Utilized for reporting refundable tax credits outside of the standard child care and educational credits, including unique state-specific incentives.

- Consumer Use Tax Worksheet: For calculating use tax owed on purchases made without sales tax. This is essential for taxpayers who’ve bought items online or out-of-state without paying Louisiana sales tax.

- Extension Request Form: If additional time to file a tax return is needed, this form is used to request an extension, ensuring taxpayers avoid penalties for late filing.

The process of compiling and submitting these documents alongside the IT-540-2D form is integral for achieving a precise and lawful tax return. Each document serves to substantiate the financial disclosures made within the main form, ensuring taxpayers meet their obligations while maximizing potential benefits under the law.

Similar forms

The IT-540 2D Louisiana form is similar to other tax forms used both at the federal and state levels. These forms often share common elements such as the need to report income, calculate tax liability, and determine eligibility for deductions and credits. Understanding the similarities can help taxpayers navigate their filing obligations with greater ease.

One similar document is the Federal Form 1040, the U.S. Individual Income Tax Return. Like the IT-540 2D, the Federal Form 1040 includes sections for reporting income, deductions, and tax credits. Both forms require the taxpayer's identification information, including Social Security Numbers for the taxpayer and spouse, if applicable. Additionally, they each have provisions for declaring dependents, with the IT-540 2D mirroring the Federal Form 1040’s approach to exemptions and dependent information. The key differences lie in the specific deductions and credits available, which are tailored to either federal or Louisiana state tax regulations.

Another document with similarities is the State Form W-2, Wage and Tax Statement. While not a direct return form like the IT-540 2D, the W-2 is essential for completing it accurately. Both the IT-540 2D form and W-2 include information regarding the taxpayer's income and tax withheld by employers. Taxpayers use the information from their W-2 forms to fill out the income and tax sections of the IT-540 2D, ensuring that their reported earnings and tax payments align with their employer’s records. This correlation is crucial for calculating the correct tax liability and any refund or payment due.

Finally, the IT-540 2D bears resemblance to the Schedule E form used for reporting income from rental property, royalties, partnerships, S corporations, estates, and trusts. Both the IT-540 2D and Schedule E deal with adjustments to income but serve different roles in the tax filing process. Schedule E is specifically for supplementary income sources, which may be reported on the IT-540 2D as part of the taxpayer's total income. The interplay between these forms highlights the intricacies of tax law and the necessity of comprehensive reporting.

Dos and Don'ts

When it comes to filling out the IT-540-2D form for Louisiana residents, there are some important dos and don'ts you should keep in mind to ensure the process goes smoothly and accurately. Here's a breakdown to help guide you through it:

Things You Should Do:

Double-check your filing status and make sure it matches your federal return. This helps avoid inconsistencies that could delay processing.

Accurately report all exemptions, including age, blindness, and dependent information, to ensure you receive the rightful deductions.

Include your Social Security Number (SSN) and that of your spouse if married filing jointly. This is crucial for identity verification and processing.

Attach Forms W-2 and 1099 if you have Louisiana tax withheld for 2013. These documents are essential for verifying your tax payments.

Review the entire form before submitting it to ensure all information is accurate and complete. Mistakes can lead to processing delays or incorrect tax calculations.

Things You Shouldn't Do:

Don't leave any required fields blank. If a section doesn't apply to you, mark it with a zero “0” instead of leaving it empty.

Avoid rounding numbers. Enter exact amounts as they appear on your documentation to maintain accuracy in your tax calculation.

Don't forget to sign and date the form. An unsigned form is considered invalid and will not be processed.

Do not send cash if you owe money. Instead, opt for a check, money order, or electronic payment to ensure the safety of your payment.

Avoid waiting until the last minute to submit your form. Filing early helps avoid the stress of rushing and allows time to correct potential errors ahead of the deadline.

Misconceptions

Many taxpayers grapple with the complexities of tax forms, and the Louisiana IT-540-2D form is no exception, surrounded by a fair share of misconceptions. Let's demystify some common misunderstandings.

Only Louisiana residents with straightforward finances can use the IT-540-2D form. In reality, this form is designed for all Louisiana residents to report income, regardless of the complexity of their financial situation. It accommodates various income types, deductions, and credits.

Filing status must match the federal return. Though the form instructs to match the filing status with the federal return, some assume this limits their ability to file effectively under different circumstances. However, the requirement ensures consistency and simplicity in tax reporting.

The form doesn't allow for name changes. Contrary to this belief, the IT-540-2D does provide options for taxpayers who have changed their name, such as in the case of marriage or divorce, ensuring that their return accurately reflects their current legal name.

Decedents or their spouses cannot use this form. The form includes specific sections for filing on behalf of a deceased taxpayer (decedent) or by their surviving spouse, accommodating various filing needs.

Amended returns are not permitted. This misunderstanding might discourage correcting errors. However, the IT-540-2D form does have provisions for filing amended returns, providing taxpayers a way to correct previously filed returns.

No options exist for NOL (Net Operating Loss) carrybacks. Although NOL carrybacks can be complex, the form allows taxpayers to address this aspect of their financial history, offering a way to manage losses over multiple tax years.

The section for dependents has a cap. While the form visibly accommodates up to six dependents directly, it allows taxpayers to attach additional sheets if needed, ensuring no dependent is left unclaimed due to space constraints.

There's no provision for non-required federal filers. This assumption overlooks the form's flexibility. It includes a mechanism for those not required to file a federal return to indicate their wages directly on the form, ensuring that all residents can report their income accurately.

Refund selections are limited to checks or direct deposits. The form actually provides more flexibility, including an option for a MyRefund Card, which is a convenient alternative for those without traditional bank accounts or those who prefer not to use direct deposit.

Understanding these aspects of the IT-540-2D form can alleviate filing anxiety, ensuring that Louisiana residents can file their taxes accurately and take advantage of the provisions designed to accommodate a wide range of personal and financial situations.

Key takeaways

When it comes to understanding and completing the IT 540 2D form for Louisiana residents, several key takeaways will ensure a smooth process:

- Ensure the accuracy of personal information such as your Social Security Number (SSN), date of birth (DOB), and contact details to prevent processing delays.

- Choose your filing status carefully, as it must match the status on your federal return. The options available reflect different living or marital situations, such as single, married filing jointly, or head of household.

- Report exemptions accurately, including those for yourself, your spouse if applicable, and dependents. Remember to include considerations for age or visual impairment.

- Understand that if you do not have to file a federal return, you must indicate your wages directly on the form and mark a specific box to note this.

- For those with itemized or standard federal deductions, it's vital to accurately transfer these amounts to the Louisiana form, as they impact your adjusted gross income.

- Be aware of nonrefundable and refundable tax credits, such as those for childcare or education, and understand how they affect your total tax liability or refund.

- If expecting a refund, decide on the method of disbursement beforehand. You have options such as a MyRefund Card, paper check, or direct deposit.

- For those who owe money, calculate interest, penalties for late filing or payment, and underpayment, if applicable, to know the exact balance due.

- Contributions to various funds or causes can be made directly from your refund, offering a convenient way to support initiatives important to you.

- Always verify your form before submission, ensuring that all information is complete and accurate to avoid unnecessary delays or issues with your return.

By understanding these key points, taxpayers can navigate the intricacies of the IT 540 2D form more effectively, leading to a more straightforward and error-free filing experience.

Popular PDF Templates

Louisiana Up 1 - Inclusive of necessary fields to ensure accurate reporting of unclaimed property, like holder’s details, property amounts due, and a declaration of the completeness of the report.

Louisiana Ucc Filing - Integral for maintaining an orderly and predictable commercial environment in Louisiana.

Louisiana Attorney Disciplinary Board - Disclosure of criminal convictions is required, except for minor, non-alcohol-related traffic violations, highlighting the thorough vetting process for temporary practice in Louisiana.